Is it already late? Are stocks overpriced?

At first glance, Novo Nordisk and Eli Lilly shares may appear overvalued. Eli Lilly's value has risen by almost 65% this year, while the main US stock index, the S&P 500, has risen by 'only' 15%. Novo Nordisk is up 50% so far this year, while the broader European stock index, the Euro Stoxx 600, is up just under 8%. Both companies have had a great year thanks to the development of obesity drugs, and the current rally is in some ways reminiscent of the frenzy around artificial intelligence.

A slight overvaluation is indicated by the P/E ratio, i.e. share price to earnings per share. While there is no ideal value here, a number around 20 is seen as good by investors. However, there are also companies that have been operating at a significantly higher P/E for a long time, especially in the technology sector - Tesla and Nvidia, for example. For pharmaceutical companies, the P/E ratio should be somewhere around 20 to 40. Novo Nordisk currently has a P/E ratio of almost 42, and Eli Lilly is even over 100. From this perspective, both companies may be overvalued. On the other hand, a too-low P/E does not inspire much confidence, for example, Pfizer's was below 10 before last quarter's results.

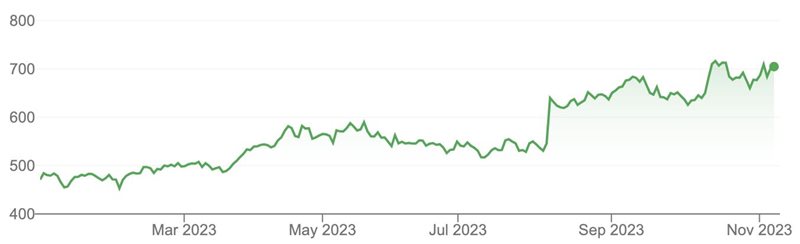

Novo Nordisk shares, source: Google

However, looking only at the P/E is not enough; investors like growth and can price it appropriately. It is precisely the earnings and revenue growth that both companies now offer. Moreover, the cure for obesity is literally the investors' dream - it solves a pressing problem for humanity.

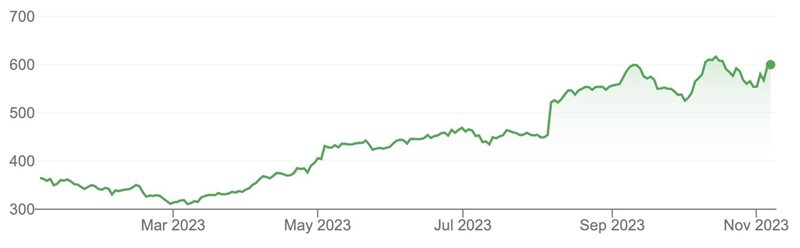

Eli Lilly shares, source: Google