Coca-Cola Company - USD 26 billion

If you've seen at least one documentary about Warren Buffett, you've probably seen that he can't get enough of Coca Cola and McDonald. This brings us to another prominent position in Berkshire Hathaway's portfolio. In fact, Coca-Cola Company shares represent

approximately 7.3% of the portfolio and it is also the oldest of the current investments. In fact, Warren Buffett began investing in Coca-Cola stock as

early as 1988. But it's certainly not just the popularity of the famous brown beverage that's responsible for this; the Coca-Cola Company is one of the strongest brands in the world and one of the most stable dividend payers - and that's what Warren

Buffett loves most of all.

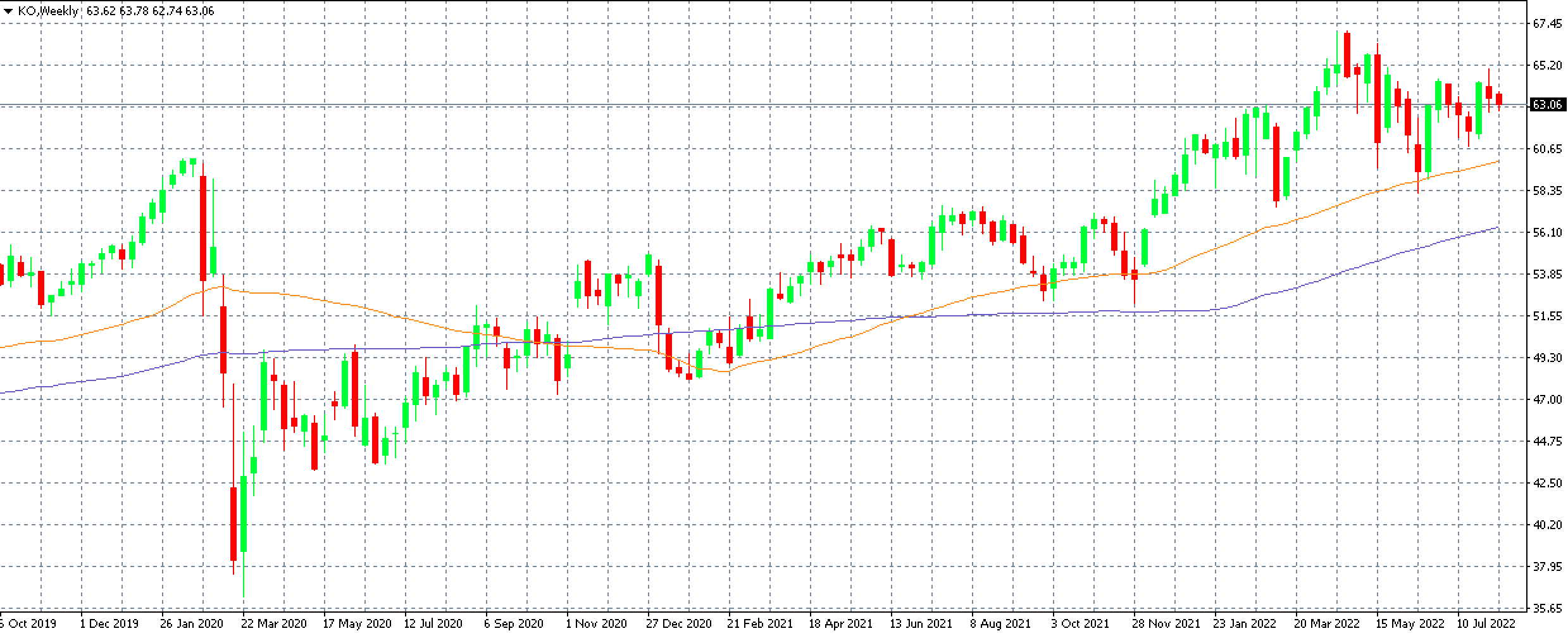

Chart 3: Shares of Coca-Cola Company on the MT4 platform on the W1 timeframe along with the 50 and 100 day moving averages

Chart 3: Shares of Coca-Cola Company on the MT4 platform on the W1 timeframe along with the 50 and 100 day moving averages

Which sector is Warren Buffett currently betting on?

In recent years, Warren Buffett's investments have primarily focused on one sector - energy. In recent months, his most significant investment was the purchase of a stake in

Occidental Petroleum. Buffett began buying its stock back in 2019, when the company was seeking funds to acquire Anadarko Petroleum. However, the volume of purchases has taken a steep upward turn,

particularly in 2022, pushing Berkshire Hathaway's stake in Occidental Petroleum past 20% in recent days. According to some opinions, Warren Buffett could try to control Occidental Petroleum completely and buy all the shares. This company is definitely

worth watching.

However, Occidental Petroleum is not the only energy company in Berkshire Hathaway's portfolio. Towards the end of 2020, Warren Buffett invested in another company from the energy sector -

Chevron Corporation. He has a stake of just over 8% in the company, which, thanks to skyrocketing stock prices of energy companies, amounted to over $25 billion. Some of the other companies that Warren Buffett has added to his

portfolio in 2022 are HP, Paramount Global, Citigroup, Activision Blizzard, Formula One Group and General Motors.

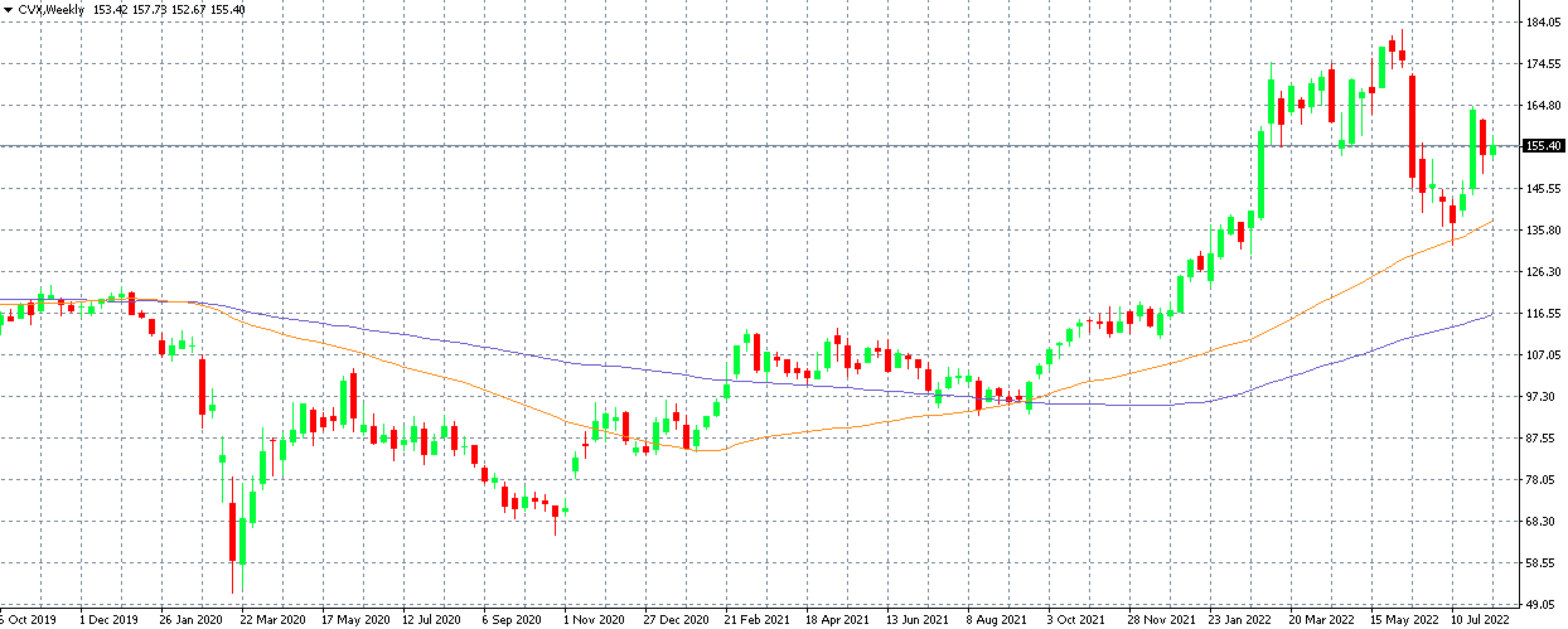

Chart 4: Shares of Chevron Corp in the MT4 platform on the W1 timeframe along with the 50 and 100 day moving averages

Chart 4: Shares of Chevron Corp in the MT4 platform on the W1 timeframe along with the 50 and 100 day moving averages

Why follow the "Oracle of Omaha"?

Watching Warren Buffett's portfolio is definitely worthwhile for investors and speculators. His Berkshire Hathaway is one of the biggest players in the stock markets and the announcement of any acquisition can cause

high volatility. But if you don't have time to follow the latest moves in Warren Buffett's portfolio, don't worry, his Berkshire Hathaway is itself listed on the New York Stock Exchange under the ticker

BRK-B. Moreover, since the beginning of the year, the company has done relatively well, with its shares down

just under 3%, while the S&P 500 index has corrected by more than 13%. Moreover, despite his advanced age, Warren Buffett is still one of the most important figures in capitalism, and every statement he makes

carries a lot of weight.

Does Warren Buffett foresee the coming crisis?

Last week, Berkshire Hathaway announced its financial results and it seems that its loss due to the fall of global stock markets

reached USD 44 billion during the second quarter. Moreover, there is another issue on the horizon that could make Warren Buffet lose a few hairs. A possible economic recession could significantly affect the number of zeros in his account. His company's actions during the second quarter seemed to confirm that Warren Buffett himself

expects a recession to be imminent. In fact, the company significantly reduced the amount of money invested compared to the first quarter and repurchased its own shares. So it is possible that the famous investor is preparing his "

ammunition" for discount purchases.