Examples of rollover adjustment calculation

Example 1: Contango and BUY position - example of rollover adjustment calculation

In this example, consider the market structure located in the contango (the contract to be rolled over to has a higher price than the current contract) and the open BUY position in the coffee market represented by the symbol COFFEE.fut.

Other input parameters for the calculation are as follows:

-

Position size: 2 lots

-

Currency symbol: USD

-

Account currency: CZK

-

USD / CZK exchange rate: 21.5

-

BID / ASK price of the current contract (expiring in September): 193.18 / 193.22

-

BID / ASK price of the new contract (expiring in December): 195.63 / 195.67

-

Tick size on COFFEE.fut symbol: 0.01

- Tick value on the COFFEE.fut symbol: 0.1 USD

-

Rollover fee: 20%

Calculation

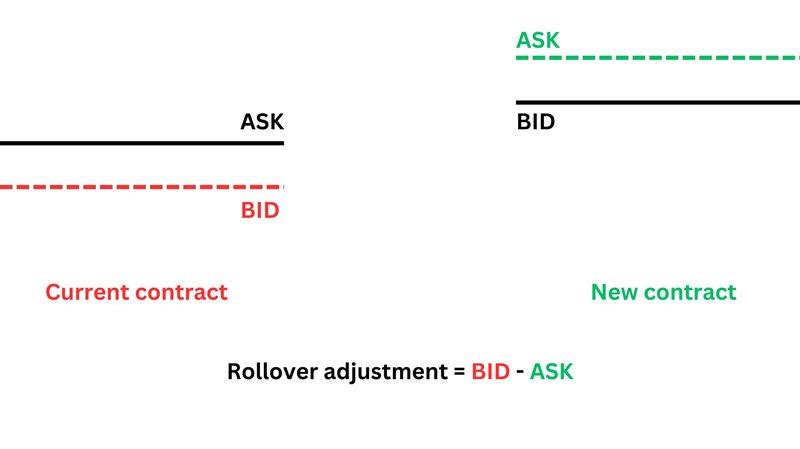

First, it is necessary to determine which prices will be used to calculate the rollover adjustment. Since the trader has an open buy position, it is necessary to consider the BID price of the current contract (193.18) during its hypothetical closure and the ASK price on the new contract (195.67) during its hypothetical reopening. After deducting these two prices, we get the price difference (-2.49), which we will use when calculating the rollover adjustment.

Because the market is in contango, an “artificial” profit is being made on the trader’s account after the rollover. We, therefore, subtract the higher price (new ASK) from the lower one (current BID) to get the resulting fee as a negative number, as it needs to be deducted:

193.18 – 195.67 = -2.49

Figure 3: Prices used when scrolling the purchase position in the contango

Now divide the calculated price difference by the size of the tick (0.01) and multiply it by the value of the tick (0.1) to obtain its face value:

-2.49 / 0.01 * 0.1 = -24.9 USD

We then multiply the calculated face value by the traded volume (2) in lots:

-24.9 * 2 = -49.8 USD

The 20% rollover fee charged by the broker must now be deducted from the adjustment calculated in this way:

-49.8 - (|-49.8| * 0.2) = -59.76 USD

We will convert the resulting rollover adjustment into the account currency (CZK) from the symbol currency (USD) according to the USD / CZK exchange rate (21.5):

-59.76 * 21.5 = -1284.84 CZK

Result

The result is a rollover adjustment of size -1284.84 CZK. This amount will be deducted from the trader’s account through the balance operation.

Example 2: Contango and SELL position - example of rollover adjustment calculation

In this example, consider again the market structure located in the contango and the open SELL position in the coffee market represented by the symbol COFFEE.fut.

Other input parameters for the calculation are the same as in the previous example:

-

Position size: 2 lots

-

Currency symbol: USD

-

Account currency: CZK

-

USD / CZK exchange rate: 21.5

-

BID / ASK price of the current contract (expiring in September): 193.18 / 193.22

-

BID / ASK price of the new contract (expiring in December): 195.63 / 195.67

-

Tick size on COFFEE.fut symbol: 0.01

-

Tick value on the COFFEE.fut symbol: 0.1 USD

-

Rollover fee: 20%

Calculation

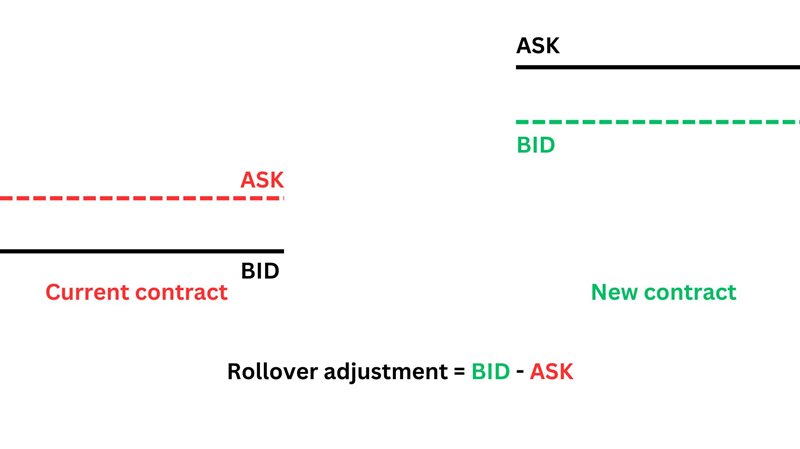

First, it is again necessary to determine which prices will be used to calculate the rollover adjustment. Since the trader has an open SELL position, it is necessary to consider the ASK price of the current contract (193.22) during its hypothetical closure and the BID price on the new contract (195.63) during its theoretical reopening. After deducting these two prices, we get the price difference (2.41), which we will use when calculating the rollover adjustment.

Because the market is in contango and the trader incurs an "artificial" loss on the account after the rollover, we subtract the lower price (current ASK) from the higher one (new BID) to get the resulting fee in positive values as it is added to the account::

195.63 – 193.22 = 2.41

Figure 4: Prices used when rolling the sell position in the account

Now divide the calculated price difference by the size of the tick (0.01) and multiply it by the value of the tick (0.1) to obtain its face value:

2.41 / 0.01 * 0.1 = 24.1 USD

We then multiply the calculated face value by the traded volume (2) in lots:

24.1 * 2 = 48.2 USD

The 20% rollover fee charged by the broker must now be deducted from the adjustment calculated in this way:

48.2 - (48.2 * 0.2) = 38.56 USD

We will convert the resulting rollover adjustment into the account currency (CZK) from the symbol currency (USD) according to the USD / CZK exchange rate (21.5):

38.56 * 21.5 = 829.04 CZK

Result

The result is a rollover adjustment with a size of 829.04 CZK. This amount will be credited to the trader’s account through the balance operation.