Amazon - a giant on sale?

Amazon shares have been trading at a 20:1 split for over two months. Since then, their development has been a roller coaster ride. Even so, Amazon shares have gained more than 10% since the split. However, they are still down some $50 compared to their yearly high. So is now the right time to buy the giant's stock? Earnings results from the end of July would suggest that Amazon is in great shape. Sales beat expectations and the Amazon Web Services section is still performing above expectations. The outlook for the third quarter is also positive, with Amazon now seeing sales between $125 billion and $130 billion, which would be a 13-17% increase compared to the third quarter a year earlier.

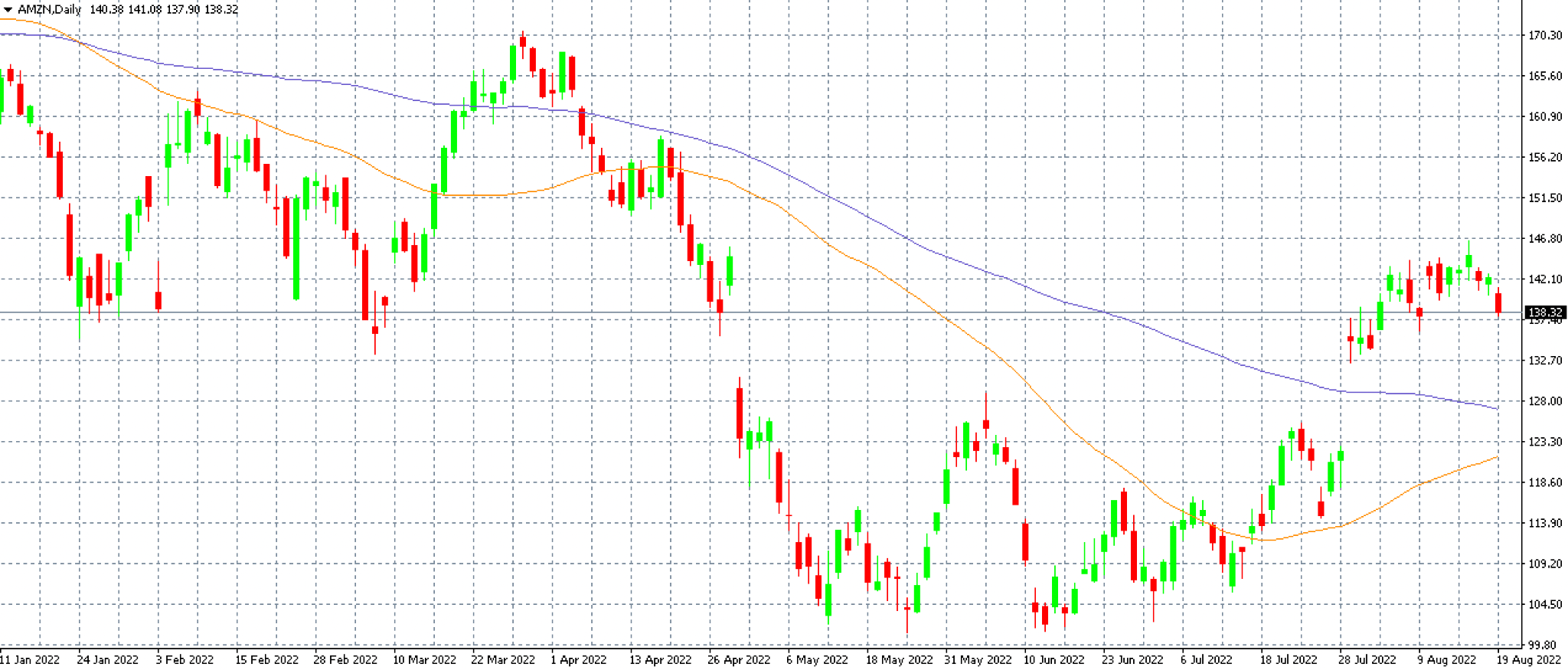

Chart 2: Shares of Amazon in the MT4 platform on the D1 timeframe along with the 50 and 100 day moving averages

Chart 2: Shares of Amazon in the MT4 platform on the D1 timeframe along with the 50 and 100 day moving averages

But it wasn’t all just rainbows and unicorns for Amazon either. Due to inflation, the company's costs are rising significantly and, like other technology companies, Amazon has decided to lay off employees. During the second quarter, it laid off almost 100,000 employees. In addition, Amazon wrote off a large loss due to its investment in the car company Rivian, whose shares fell by half during the second quarter. Amazon has already written off more than USD 11 billion on that investment this year (Still feeling bad due to some of your poor investment choices?). But back to the positives. Unlike rivals Meta Platforms and Alphabet, Amazon has managed to increase its ad revenue. So is now the perfect time to buy?

Like Walmart, Amazon is a reflection of the overall mood of US consumers. Sales for both companies have been a pleasant surprise and the outlook also looks interesting. However, the clouds are still gathering over the markets and the recent bear market rally could be near, if not past, its peak. Thus, there may be even better opportunities for stock purchase if nervousness in the markets increases further. The current period thus favours speculators more.

Alibaba - a paradise for speculators

Among the biggest companies, Alibaba may have suffered the most in recent years. The company has been under pressure due to constant speculation about delisting in the US and also because of problems with Chinese regulators. It all culminated in the failure of Ant Group's IPO and Alibaba founder Jack Ma even disappeared completely for a few weeks. In addition, the coronavirus is still raging in China, significantly affecting the economy there, which is gradually slowing down. Moreover, since the beginning of the year, the already battered Alibaba shares have written down almost a quarter of their capitalisation. A look at the chart below suggests that Alibaba stock is a haven for traders seeking volatility.

Chart 3: Alibaba shares on the MT4 platform on the D1 timeframe along with the 50 and 100 day moving averages

Chart 3: Alibaba shares on the MT4 platform on the D1 timeframe along with the 50 and 100 day moving averages

Alibaba shares are definitely one of the most polarizing in the market. Some traders see them as a great (and now cheap) opportunity to invest in the world's largest e-commerce company in the world's largest market. Others, on the other hand, see the risk associated with investing in the Chinese market as too great. Rising geopolitical tensions between China and the US would tend to favour the latter group. Moreover, big investors are leaving Alibaba, which again attracted the attention of speculators last week.

A large part of its stake was sold to SoftBank, an investment group led by Masayoshi Son. Who practically built his name on the investment in Alibaba, and his exit is thus a distinctly bearish signal, even though SoftBank is now known to be struggling financially. However, it’s legendary investor Ray Dalio, who has been a big supporter of Chinese companies, amd who should be getting even more attention now. That’s because even his company, Bridgewater Associates, sold its stake in Alibaba last week. So it seems that big investors are abandoning the sinking ship. By all accounts, Alibaba shares will remain a haven for speculators.