Tesla is splitting its stock (again). Here are 5 things you need to know

Tesla shares will undergo a 3:1 stock split this Wednesday, Aug. 24, after the U.S. markets close. This will be the second Tesla stock split in two years. Below are 5 things you need to know.

1) Technical details

This

Wednesday, August 24, Tesla shares (CFD symbol TSLA in MetaTrader 4) will undergo a 3:1 split after the close of the US stock markets. The following day, 25.8., there will be

3 times more shares and they will trade at one third of their value. This means that if you own 10 Tesla shares now, you will have 30 at one-third the value on Thursday.

2) How did the stock split decision reflect on the chart?

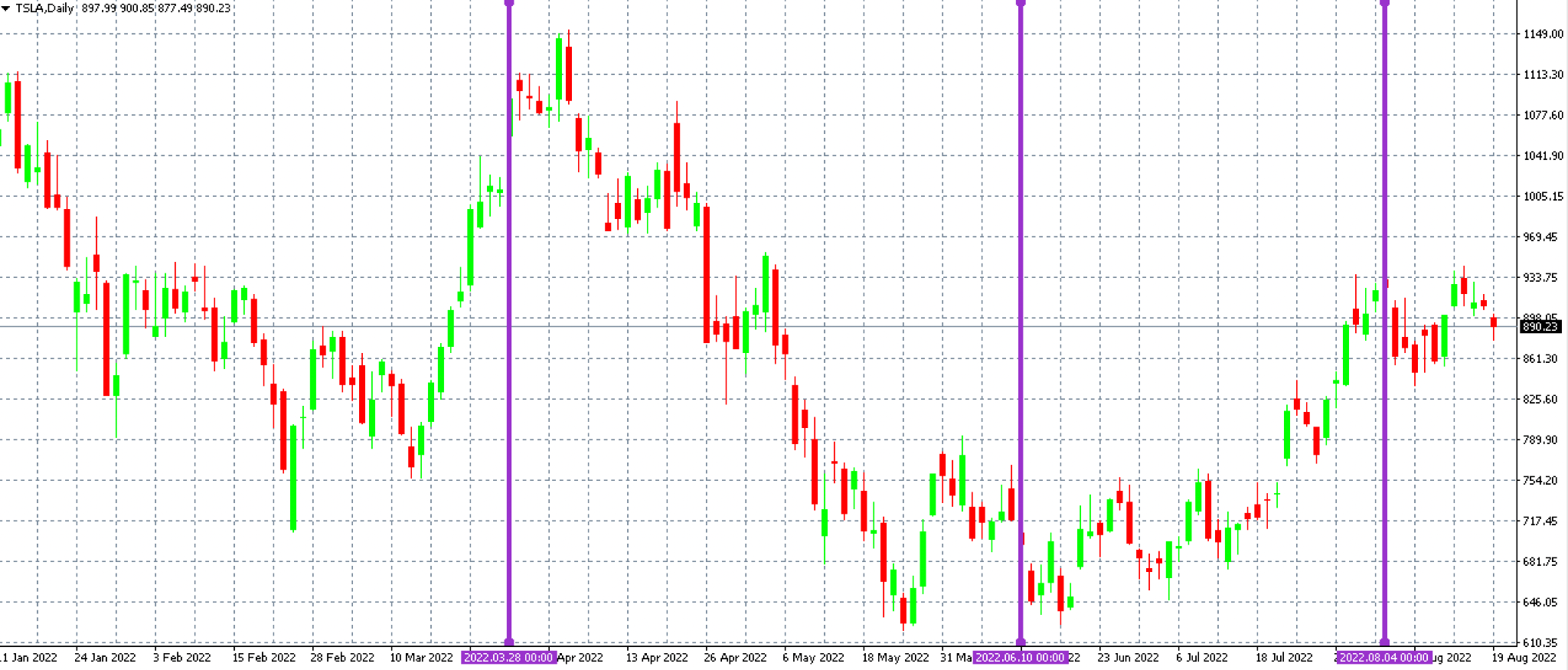

Below is a

chart of Tesla stock on the D1 time frame. Three

important data points are shown using the purple vertical lines.

Line 1 (March 28) - Tesla informed the SEC of its intention to split its stock. It also announced it on Twitter on the same day.

Line 2 (June 10) - Tesla officially filed with the SEC to split its stock 3:1. Four days prior, Tesla also sent invitations to a shareholder meeting.

Line 3 (August 4) - Shareholders approved a stock split effective Aug. 25, 2022.

Chart 1: Tesla shares in the MT4 platform on the D1 timeframe

Chart 1: Tesla shares in the MT4 platform on the D1 timeframe

3) Why are the shares split?

Stock splits are not uncommon in the market. Recently,

Amazon, Shopify and Alphabet have made such a move. For automaker Tesla, this will be the second split within two years. The stock split does not affect the intrinsic value of the company in any way, it is purely to increase the accessibility of the company in question and to

lure retail investors.

4) Is the stock split positive?

A stock split is usually good news for a company's shareholders, as the shares in question may be in greater

demand among smaller investors. However, share price growth following the announcement of a split is not guaranteed and so investors should not speculate on growth alone. Many different factors are involved in the markets and a

stock split alone does not guarantee growth.

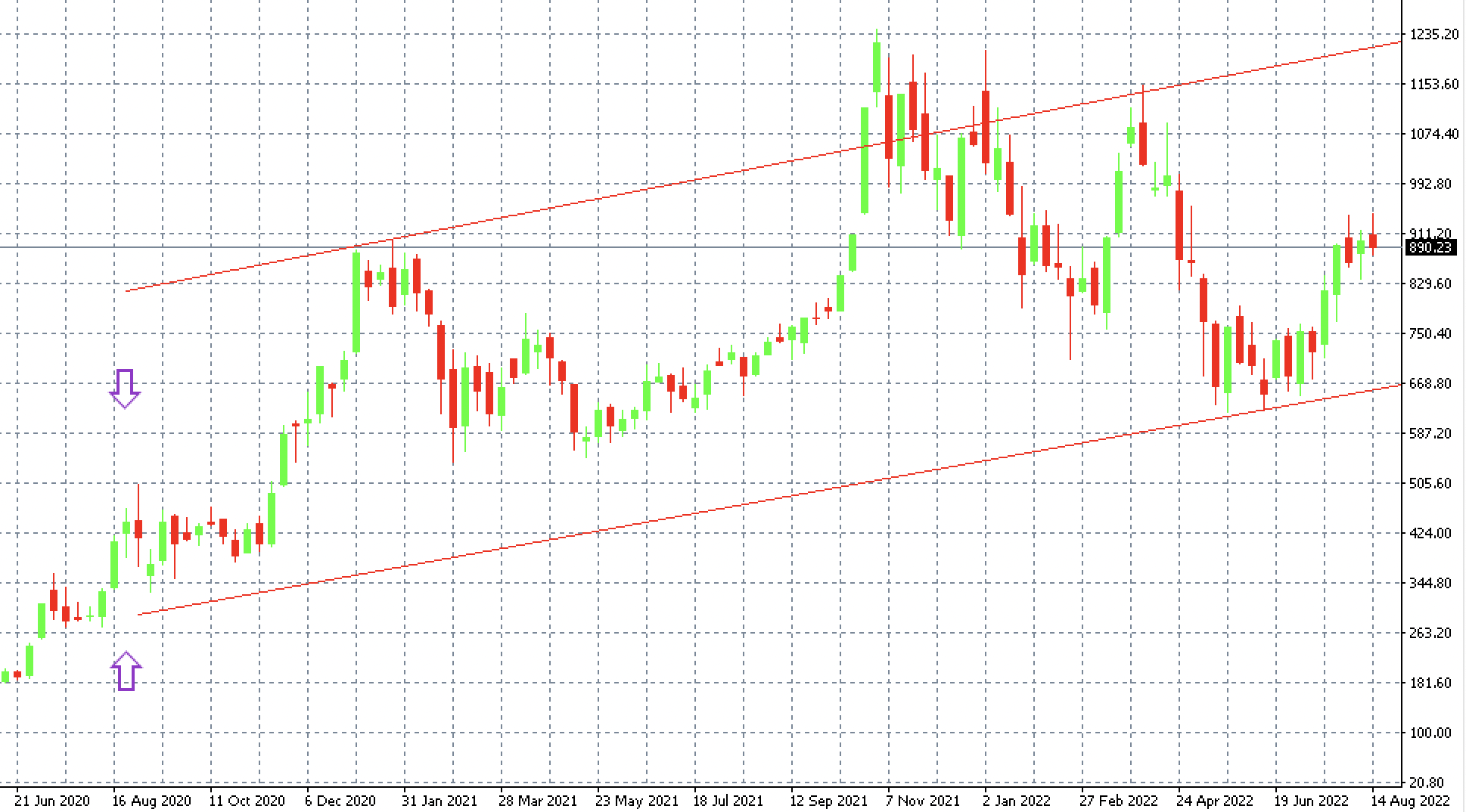

Chart 2: Tesla shares in the MT4 platform on the W1 timeframe

Chart 2: Tesla shares in the MT4 platform on the W1 timeframe

5) How has Tesla stock performed since the last split?

The last Tesla stock split occurred in

August 2020, and it was a

5:1 split. From the announcement of the split itself to the execution of the split, Tesla

shares rose 60%. Since the last split (shown by the purple arrows in the chart above), the stock is up

nearly 150%.

The share price performance after the announcement of the

upcoming split went quite the opposite way, with the stock

falling by more than 10%. However, this is more to do with the general mood of the stock markets. In case the mood on the market improves, Tesla's more affordable shares may be tempting investors again.