Positions of large speculators according to the COT report as at 7/1/2022

Total net speculator positions in the USD index rose by 100 contracts last week. This change is the result of a decrease in long positions by 5,100 contracts and a decrease in short positions by 5,200 contracts.

The decline in total net positions occurred in all other currencies tracked except the Japanese yen, which bounced off the bottom in an environment of risk-off sentiment.

Speculators' positions in the yen have been negative since March 2021, when contracts fell into negative territory. Bearish sentiment reached a short-term high just five weeks ago on November 2, when speculators' total net positions fell to a total of -107,600 contracts. Since that week, sentiment in the Japanese yen has improved by a total of +28,758 contracts.

The positions of speculators in individual currencies

The total net positions of large speculators are shown in Table 1: If the value is positive then the large speculators are net long. If the value is negative, the large speculators are net short.

|

|

7/1/2021 |

3/1/2022 |

24/12/2021 |

17/12/2021

|

10/12/2021

|

3/12/2021

|

|

USD index

|

39 100 |

36 800 |

35 100 |

31 200

|

34 900

|

35 900

|

|

EUR

|

-1 500 |

-6 600 |

-10 200 |

-11 900

|

-8 300

|

-23 200

|

|

GBP

|

-39 100 |

-50 700 |

-57 700 |

-50 700

|

-38 300

|

-38 900

|

|

AUD

|

-89 400 |

-81 700 |

-80 400 |

-78 900

|

-81 800

|

-80 200

|

|

NZD

|

-8 800 |

-8 400 |

-6 100 |

-5 900

|

10 700

|

10 600

|

|

CAD

|

-11 000 |

-10 300 |

-9 900 |

-13 100

|

-9 400

|

-14 100

|

|

CHF

|

-9 600 |

-10 700 |

-9 200 |

-8 300

|

-12 100

|

-14 200

|

|

JPY

|

-62 300 |

-53 100 |

-52 300 |

-53 500

|

-63 100

|

-78 900

|

Table 1: Total net positions of large speculators

Notes:

Large speculators are traders who trade large volumes of futures contracts, which, if the set limits are met, must be reported to the Commodity Futures Trading Commission. Typically, this includes traders such as funds or large banks. These traders mostly focus on trading long-term trends and their goal is to make money on speculation with the instrument.

The total net positions of large speculators are the difference between the number of long contracts and the number of short contracts of large speculators. Positive value shows that large speculators are net long. Negative value shows that large speculators are net short. The data is published every Friday and is delayed because it shows the status on Tuesday of the week.

The total net positions of large speculators show the sentiment this group has in the market. A positive value of the total net positions of speculators indicates bullish sentiment, a negative value of total net positions indicates bearish sentiment.

When interpreting charts and values, it is important to follow the overall trend of total net positions. The turning points are also very important, i.e. the moments when the total net positions go from a positive value to a negative one and vice versa. Important are also extreme values of total net positions as they often serve as signals of a trend reversal.

Sentiment according to the reported positions of large players in futures markets is not immediately reflected in the movement of currency pairs. Therefore, information on sentiment is more likely to be used by traders who take longer trades and are willing to hold their positions for several weeks or even months.

Detailed analysis of selected currencies

Explanations:

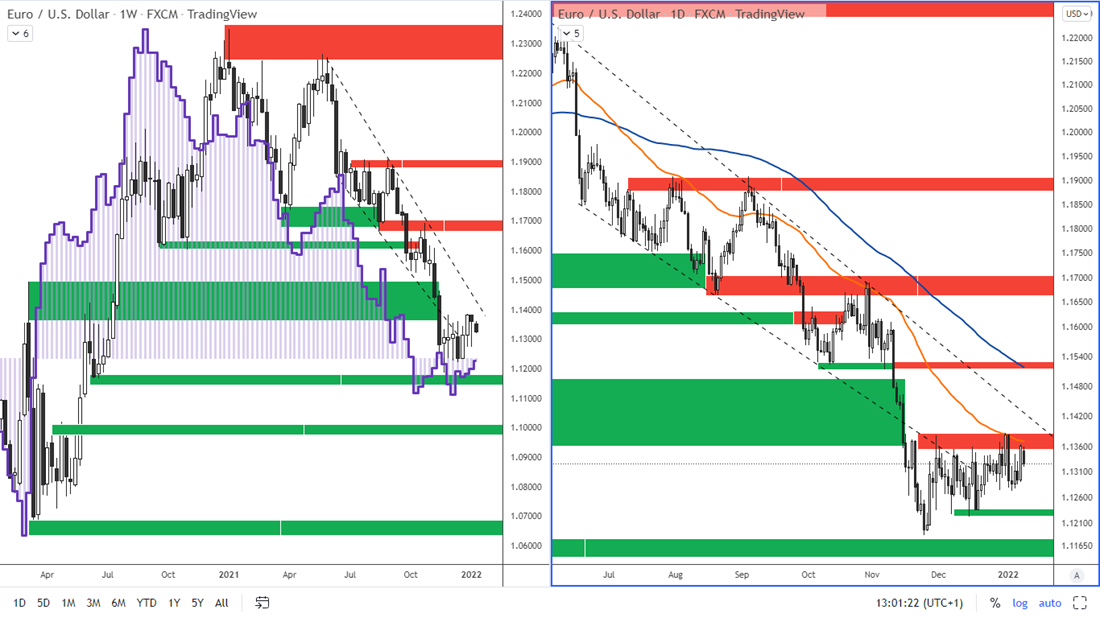

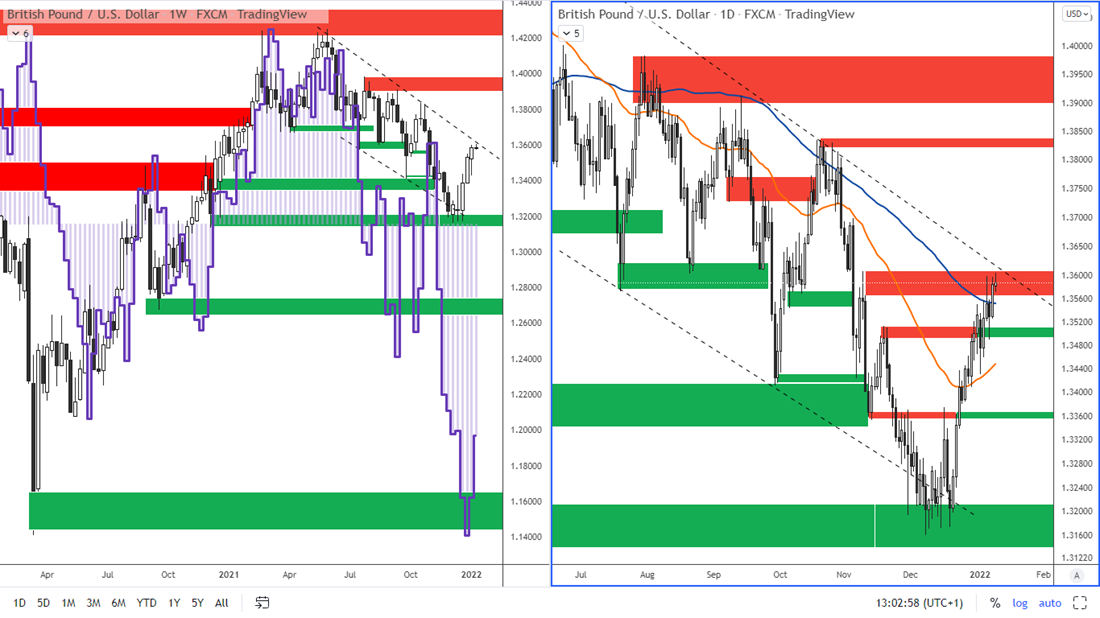

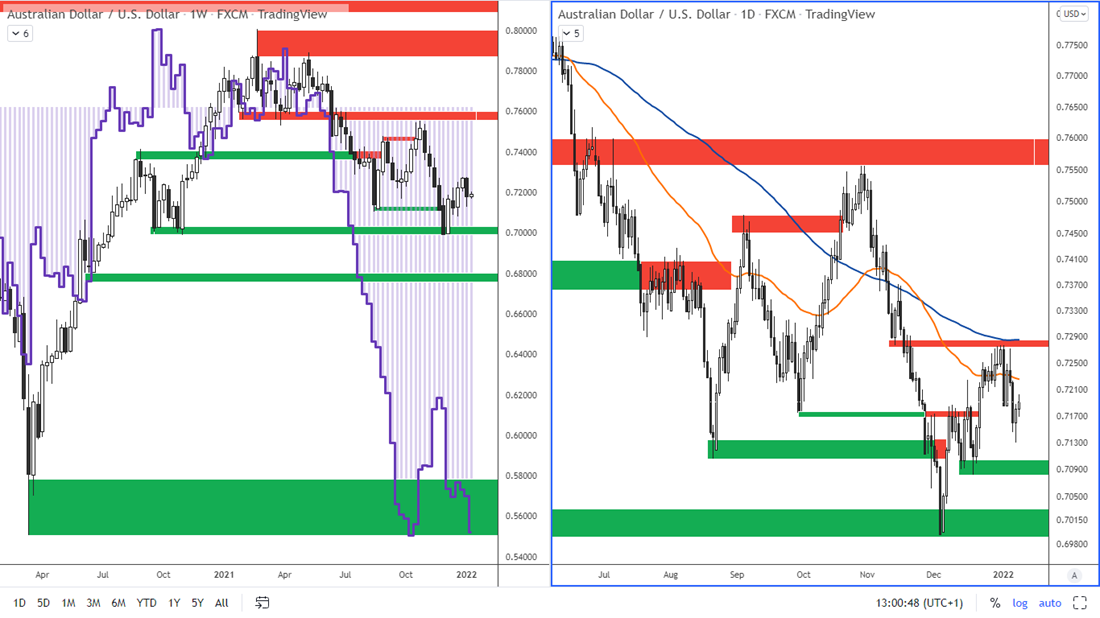

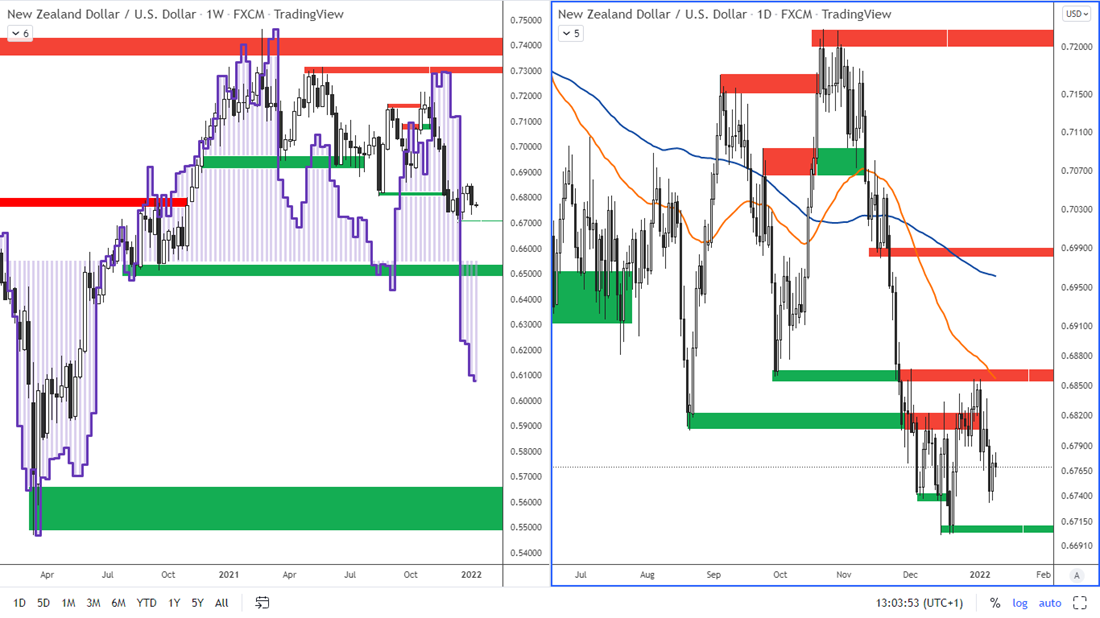

Purple line and histogram in the chart window: this is information on the total net position of large speculators. This information shows the strength and sentiment of an ongoing trend.

Green line in the indicator window: these are the bullish positions of large speculators.

Red line in the indicator window: indicates the bearish positions of large speculators.

If there is a green line above the red line in the indicator window, then it means that the overall net positions are positive, i.e. that bullish sentiment prevails. If, on the other hand, the green line is below the red line, then bearish sentiment prevails and the overall net positions of the big speculators are negative.

Information on the positions of so-called hedgers is not shown in the chart, due to the fact that their main goal is not speculation, but hedging. Therefore, this group usually takes the opposite positions than the large speculators. For this reason, the positions of hedgers are inversely correlated with the movement of the price of the underlying asset. However, this inverse correlation shows the ongoing trend less clearly than the position of large speculators.

Charts are made with the use of www.tradingview.com.

Euro

|

DATE

|

WEEKLY CHANGE IN OPEN INTEREST

|

WEEKLY CHANGE IN TOTAL NET POSITIONS OF SPECULATORS

|

WEEKLY CHANGE IN TOTAL LONG POSITIONS OF SPECULATORS

|

WEEKLY CHANGE IN TOTAL SHORT POSITIONS OF SPECULATORS

|

Sentiment

|

| 7. 1. 2022 |

4 900 |

5 100 |

500 |

-4 600 |

Weakening bearish

|

| 3. 1. 2022 |

1 000 |

3 600 |

2 000 |

-1 600 |

Weakening bearish

|

| 24. 12. 2022 |

10 500 |

7 100 |

7 100 |

5 400 |

Weakening bearish

|

Figure 1: The euro and COT positions of large speculators on a weekly chart and the EURUSD on D1

Total net speculator positions rose by 5,100 contracts last week. This change is due to an increase in long positions by 500 contracts and a decrease in short positions by 4,600 contracts.

The euro continues to move in a range between 1.12 - 1.1380. Overall, the pair is still in a downtrend.

Long-term resistance: 1.1350 - 1.1380

Long-term support: 1.1150 - 1.1180

Short-term support: 1.1220 -1.1240

The British pound

|

DATE

|

Weekly change in open interest

|

Weekly change in total net positions of speculators

|

Weekly change in long positions of speculators

|

Weekly change in short positions of speculators

|

Sentiment

|

| 7. 1. 2022 |

-5 371 |

11 600 |

2 900 |

-8 700 |

Weakening bearish

|

| 3. 1. 2022 |

-2 400 |

7 000 |

2 300 |

-4 700 |

Weakening bearish

|

| 24. 12. 2021 |

-5 500 |

-7 000 |

-8 700 |

-1 700 |

Bearish

|

Figure 2: The GBP and COT positions of large speculators on a weekly chart and the GBPUSD on D1

Figure 2: The GBP and COT positions of large speculators on a weekly chart and the GBPUSD on D1

Last week, the total net positions of speculators rose by 11,600 contracts. This increase in total net positions is the result of a 2,900 contracts increase in long positions and an 8,700 contracts decrease in short positions.

The pound has reached resistance around 1.3600. There is a confluence of a down trendline and the horizontal resistance. The pound is still in a downtrend as it can be seen on the daily chart.

Long-term resistance: 1.3580-1.3600

Long-term support: 1.3490-1.3510

Next support is at: 1.3350 – 1.3360

The Australlian Dollar

|

Date

|

Weekly change in open interest

|

Weekly change in total net positions of speculators

|

Weekly change in long positions of speculators

|

Weekly change in short positions of speculators

|

Sentiment

|

| 7. 1. 2022 |

-3 000 |

-7 700 |

-4 300 |

3 400 |

Bearish

|

| 3. 1. 2022 |

-8 200 |

-1 300 |

-6 100 |

-4 800 |

Bearish

|

| 24. 12. 2021 |

-6 100 |

-1 500 |

-6 300 |

-4 800 |

Bearish

|

Figure 3: The AUD and COT positions of large speculators on a weekly chart and the AUDUSD on D1

Last week, the total net positions of speculators fell by 7,700 contracts. This change is due to a decrease in long positions by 4,300 contracts and an increase in short positions by 3,400 contracts.

The price stopped at the 0.7280 resistance last week, from which the price bounced downwards.

Long-term resistance: 0.7270-0.7280

Long-term support: 0.7080-0.7100

The New Zealand Dollar

|

Date

|

Weekly change in open interest

|

Weekly change in total net positions of speculators

|

Weekly change in long positions of speculators

|

Weekly change in short positions of speculators

|

Sentiment

|

| 7. 1. 2022 |

-1 600 |

-400 |

-1 800 |

-1 400 |

Bearish

|

| 3. 1. 2022 |

500 |

-2 300 |

200 |

2 500 |

Bearish

|

| 24. 12. 2021 |

100 |

-200 |

-2 400 |

-2 200 |

Bearish

|

Figure 4: The NZD and the position of large speculators on a weekly chart and the NZDUSD on D1

Last week, total net positions fell by 400 contracts. The change in total net positions is the result of a decrease in long positions by 1,800 contracts and a decrease in short positions by 1,400 contracts.

The New Zealand dollar weakened last week and bounced downwards at the resistance at 0.685.

Long-term resistance: 0.6850-0.6870

Long-term support: 0.6700-0.6710