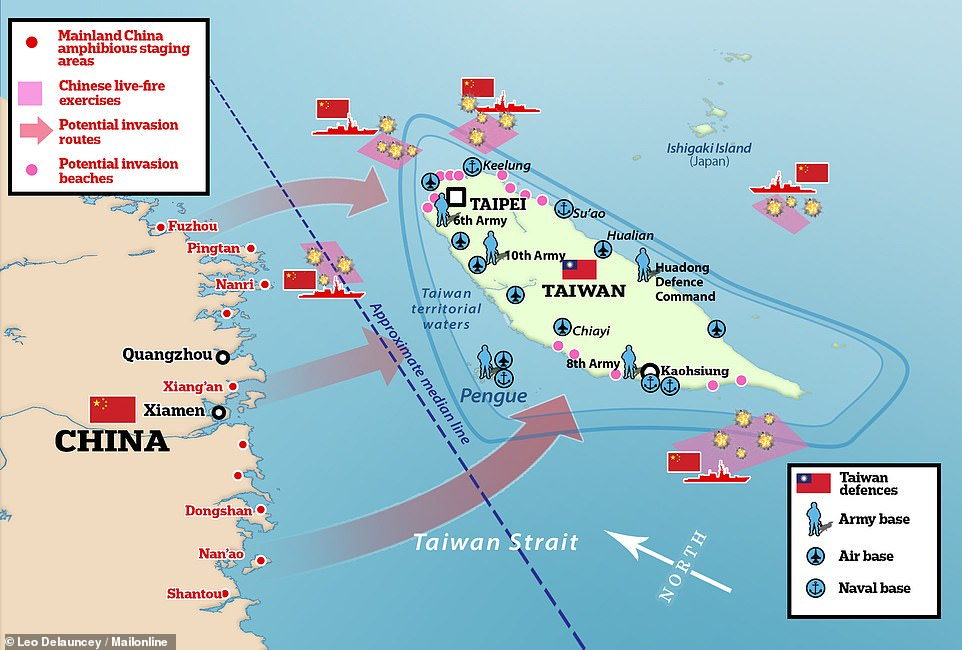

Possible routes of attack on Taiwan are shown in the image below. China could reportedly try to starve Taiwan. The island nation produces only 35% of its food domestically and relies on imports for the rest.

Possible routes of attack on Taiwan by China. Source: dailymail.com

Possible consequence of Escalation 1: Chip shortage and threat to oil production

In the global context, Taiwan is extremely important because of the production of semiconductor chips. These are used virtually everywhere today. According to statistics, more than half of all chips are manufactured in Taiwan, and the figure for the most powerful ones is even higher - around 90%. The biggest player on the market is the Taiwanese company TSMC. The modern world simply cannot do without advanced chips. That is why Taiwan is a frequent target of political battles between China and the West. The outbreak of a military conflict would of course have huge implications for the entire market, but in this article we focus on oil.

The oil industry has also undergone a major modernisation in recent decades. As a result, the oil industry's dependence on modern chips is considerable. In the event of conflict and chip supply constraints, we could expect a major threat to global oil production, which could drive oil prices significantly higher. We must not forget the potential problems in the supply chain that such a conflict would cause. It is not so long ago that the world suffered from a severe shortage of modern chips. Moreover, the South China Sea is an important area for the international transport of oil, and any disruption to the routes could prolong supplies and also increase the price of oil.

Possible consequence of Escalation 2: World War or Global Recession?

A separate chapter of our hypothetical scenarios is the possible involvement of the US in a war and its possible escalation into a world conflict. Although we prefer not to imagine the impact of this scenario, we need to be prepared for anything

In the event that the US were to become involved in our entirely hypothetical conflict, two potential scenarios loom on the horizon:

-

Increased demand for oil for war purposes and the associated rise in oil prices, and a major geopolitical risk.

-

The outbreak of a global economic crisis and a significant drop in oil prices.

Scenario 1: Oil above USD 200

For the first case, it is very difficult to find suitable comparisons when looking at history; fortunately, the last world wars were more than 70 and 100 years ago. In the meantime, the world has undergone a huge transformation and oil consumption has grown enormously. The exponential increase in the world's dependence on oil is shown in the chart below.

However, both world wars led to a significant rise in oil prices due to higher demand. During 1914-1918, the price of oil more than doubled to $1.98 per barrel. During the Depression of the 1930s, the price of oil again fell below one dollar. By 1948, however, thanks to higher demand during World War II, it had risen again to $2 per barrel.

The oil market does not thrive in tension, especially when it concerns major producers. For example, we can look at the year 2022, when Russian oil became toxic to much of the market. It is also interesting to look back to 1973 when the first oil shock occurred. At that time, OPEC cut production and embargoed oil imports to countries that supported Israel. The price of oil then rose from USD 3 to USD 12 per barrel, causing massive inflation and an economic crisis in the US. If oil prices were to double again, oil would potentially hit USD 200 per barrel. This could then cause a transition to the next phase - a global financial crisis.

Growth in world oil, coal, and gas consumption. Source: Václav Smil and BP