Practical demonstration of using order block in trading

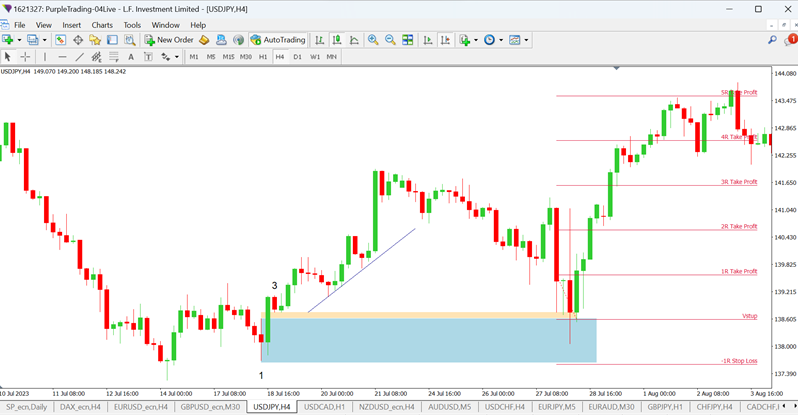

We will demonstrate the use of OB on the currency pair USDJPY, which is shown in the following picture:

Bullish OB on the USDJPY pair on the H4 chart

There is a bullish OB at point 1. It is the last bearish candle before the next upward move, which marks the rising trend line. A Price Value Gap has formed between candle number 1 and number 3. The OB is therefore valid. Then we wait for the price to return to this OB. After that, the entry is in the long direction.

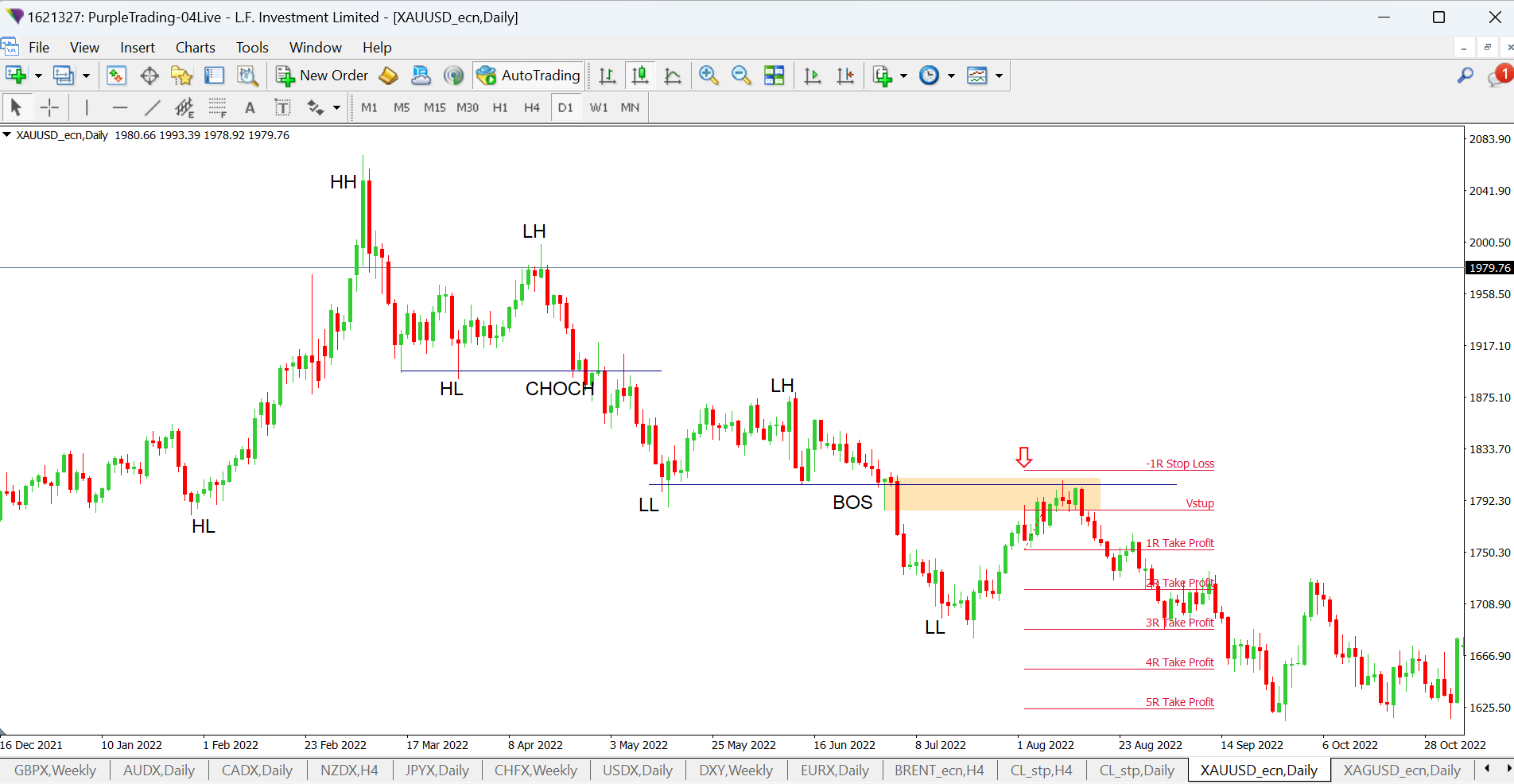

In the next picture we have an example of a bearish OB in a downtrend situation:

Gold on D1 chart (HH-higher high, LL- lower low, HL- higher low, LH - lower high)

Gold has formed a lower low (LL) and a lower high (LH). There was a break of the lower low (BOS) and a bearish order block (last bullish candle before the breakout) was formed at this point. This break was also accompanied by a Price Value Gap. Price later returned to the order block and would have offered a trade with 3R potential if we had speculated to the previous LL.

Note on entry

The figure shows that the entry was virtually the moment price touched the OB boundary. However, since the Price Value Gap was not completely filled, this is a disadvantageous and even risky entry because the Price Value Gap represents a gap that tends to fill.

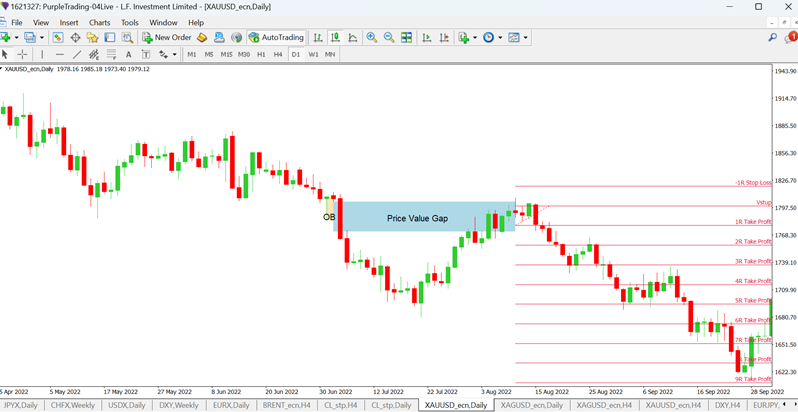

To take advantage of the signal using OB, it will be more appropriate to wait for the Price Value Gap to be filled, which is close to OB. This will happen if the OB is not part of the Price Value Gap (i.e. its first candle). Once the Price Value Gap is filled, you will move to a lower timeframe, on which you will then look for some confirming candle formation to indicate a move in the expected direction.

Entry after filling the Price Value Gap

In this case, the trade would offer patient traders a profit of almost 6R if the entry was made after the Price Value Gap was filled.