Tesla - a new product on the horizon?

Another darling of Purple Trading's clients is the Californian car company Tesla. The latter also deserved attention last month because of a 3:1 stock split. Tesla has been doing relatively well since then, as evidenced by the fact that its stock has added 4%. Meanwhile, the S&P 500 has written off almost 7% over the same period. Tesla's capitalisation is still just under USD 1 trillion, making it the fifth largest company in the US market. With a P/E ratio in excess of 100, this is a rare feat.

What is the secret of Tesla's success? Tesla and Elon Musk's army of car lovers have practically created a cult around the automaker, making Tesla stock a fanatical buy. All they need is news that next week Tesla will unveil a prototype robot called Optimus, whose name will amuse fans of Transformers franchise in particular. The robot was supposed to make factory work easier and eventually find its way into our homes.

However, Tesla also has a large number of opponents, not for nothing it is one of the most shorted stocks in the US market. In fact, for a long time, Tesla was the most shorted stock ever. However, it was stripped of that "primacy" by Apple last week. Skeptics are calling for Tesla to focus more on developing the cars themselves, rather than the expensive robots that Tesla would deliver as another product to homes. In any case, we'll know more next Friday, which many investors are waiting for. However, robot production could be the next big thing and could bring in interesting revenues in the future. After all, Elon Musk has proven several times that he can do almost anything.

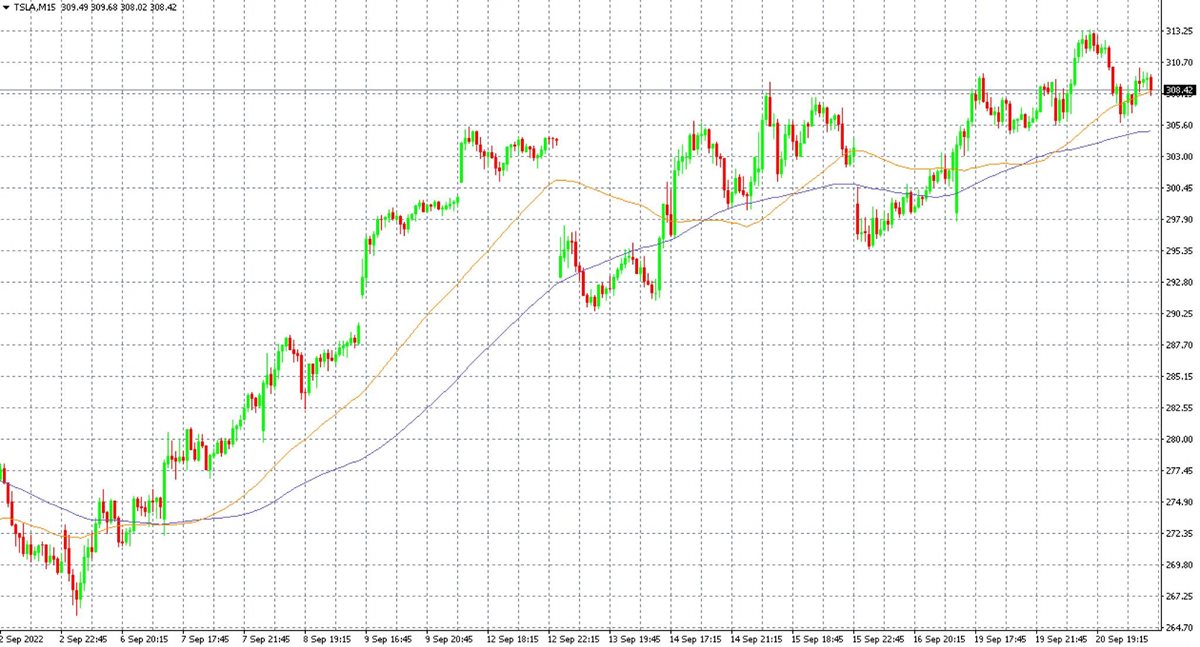

Chart 2: Tesla shares in the MT4 platform on the M15 timeframe along with the 50 and 100 day moving averages

Chart 2: Tesla shares in the MT4 platform on the M15 timeframe along with the 50 and 100 day moving averages

Positive news are coming about car production, especially from Germany, where the giga-factory is already in full operation. Tesla has announced its intention to double its sales in Germany compared to 2021. Last year, Tesla sold 40,000 cars in Germany and plans to double that this year. If it succeeds, it would overtake Toyota in the ranking of the best-selling automakers in Europe's most important market. On the positive side, demand for the cheaper Model 3 and Y remains very strong, so Tesla is not necessarily pushing to introduce new models.

However, it’s not all just unicorns and rainbows. Aside from the uncertainty caused by inflation, there is one big question mark hanging over Tesla - Elon Musk's legal battle with Twitter. Over the past few years, we've been able to track Tesla stock rising and falling with Elon Musk's performance and excesses. The battle with Twitter may take a lot of power and financial resources away from him, which may then significantly affect Tesla itself. The trial is expected to begin in mid-October. One thing is certain - Tesla will continue to be one of the most sought-after companies.