Like from a script of a Hollywood movie: The resurrection of the tourism sector

Summer is here, the coronavirus pandemic is receding due to the successful vaccination and people are eager to travel. Shares of companies in the tourism sector are currently experiencing an unprecedented boom. In this article, we will analyse the most interesting ones and discuss how to potentially profit from them.

Venice, Bali, Santorini. Beautiful destinations well-known by many tourists for their paradise-like features. But during the coronavirus pandemic, these places have suddenly transformed from sun-lit paradise destinations into abandoned ghost towns. The tourism industry was among the most suffering ones during the pandemic, and most of the major tourist destinations became completely depopulated. Hotels, airlines, cruise operators, restaurants, casinos, and many others fell victim. However, as the coronavirus has receded and the population has become more vaccinated, the appetite for travel has grown considerably. Companies that were on the verge of bankruptcy are now struggling to satisfy the demand. What is the outlook for the sector in the coming months and how can we potentially profit from this?

Cruises in times of pandemics - from fairy tales to nightmare

It is probably unnecessary to analyze in detail the collapses of individual companies and industries during the coronavirus, as these constantly filled the headlines of virtually all media. However, one sector is worth highlighting - cruises. In the pre-2020 era, it was the epitome of the travel ideal. Huge cruise ships equipped with practically everything you could think of would take you to the most exotic destinations. Sounds great, doesn't it? But there's a little catch. Few people probably expected that these luxury ships would turn into a traveler's nightmare. Instead of luxury, passengers found themselves locked in a kind of floating prison where the covid-19 contagion was spreading uncontrollably. Shares of cruise operators thus started sinking quickly, in some cases even meeting their historic lows.

Chart 1: Shares of Disney in the MT4 platform on the W1 timeframe along with the 50 and 100 day moving averages

But there is light at the end of the tunnel here too. After two utterly tragic years, cruise lines are also coming back from the dead, as evidenced by rising revenues - for example, Royal Caribbean Cruises achieved higher revenues for the first half of 2022 than for 2020 and 2021 combined. And revenues for the best months of the year are yet to come. In addition, the company launched a new cruise ship a few months ago, similar to Disney Cruise Lines (operated by Disney, whose stock chart is above), which launched a ship called Wish in June and plans two more new ships by 2025. Such a move would have been highly unexpected just 2 years ago; probably everyone still has memories of cruise ships waiting to be scrapped instead of loaded with tourists.

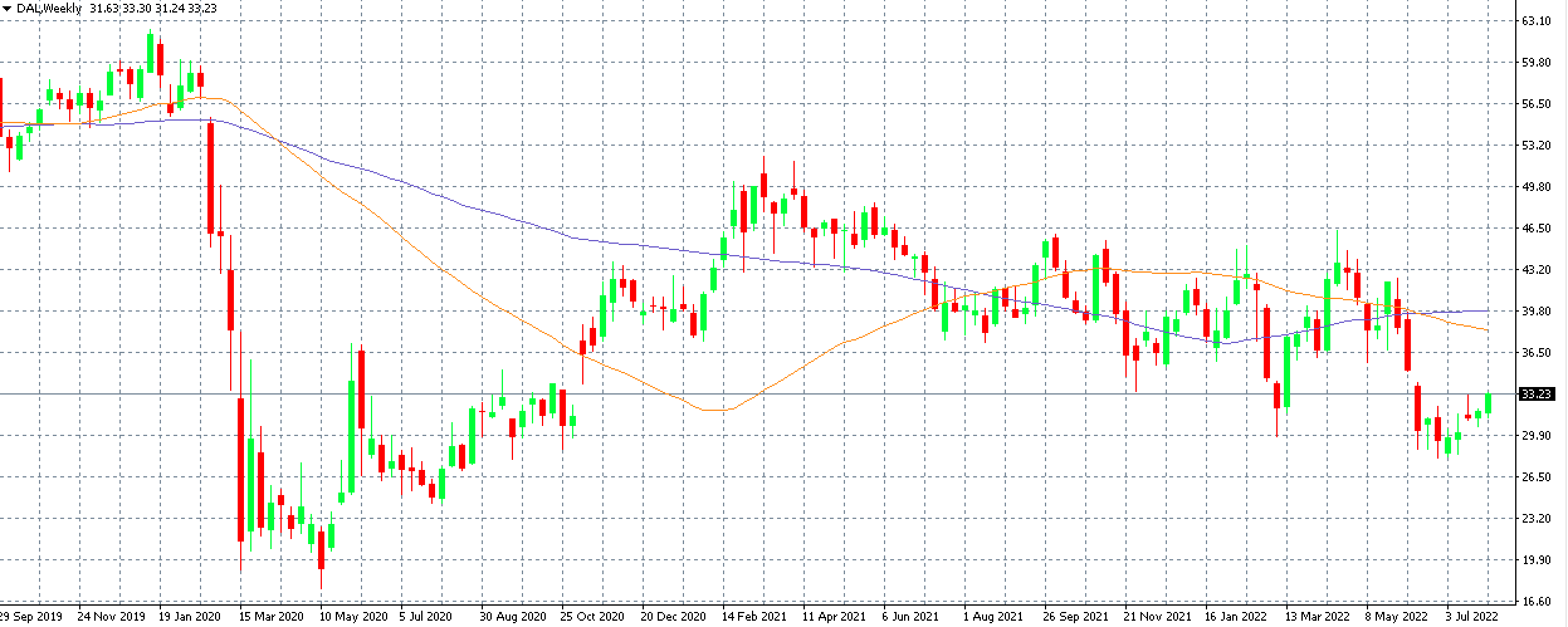

Chart 2: Shares of Delta Airlines on the MT4 platform on the W1 timeframe along with the 50 and 100 day moving averages

Chart 2: Shares of Delta Airlines on the MT4 platform on the W1 timeframe along with the 50 and 100 day moving averages

Busy times for Airlines

We could find several similar stories outside of cruises. Another example would be airlines, some of which would probably not have survived without state aid. For example, US airlines have received over USD 50 billion from the government to help them survive this difficult period. More than half of that amount then went to pay staff salaries. Even so, airlines are facing staff shortages and meeting passenger demand is virtually impossible.

At the moment, we are experiencing a 'revenge travel' phenomenon on the market - a situation where people who have been cooped up at home for the past two years want to go on holiday at any cost. Tens of thousands of flights are being cancelled and postponed. So if you have had a trouble-free holiday, you can consider yourselves to be very lucky.

The resurgence of tourism-related companies now looks like a Hollywood movie, but the question is which one. Will it be a movie with a good ending in which these companies are fully resurrected, or will we see a horror movie in which a revived subject teeters on the edge of life and death like some kind of zombie?

Despite the big positives looking at the economic results and bookings for the coming months (and 2023), there are growing headwinds in the global economy that could significantly slow the resurgence of tourism stocks.

Big waves on the horizon? And how to potentially profit from them?

In probably every sector related to tourism, we can find companies whose

shares have appreciated by tens or even hundreds of percent since their bottom in 2020. However, the tourism industry still has a lot of catching up to do to reach 2019 numbers, and much of the stock is still well below pre-Coronavirus prices despite the growth of the last two years. However, despite the positives mentioned above, it begs the question,

are investors being overly optimistic? Does the current state of the market favour speculators or value-seeking investors?

All the sectors mentioned above seem to have a common enemy in the coming months - a possible

global recession. Inflation in most developed economies is slowly but surely hitting double digits and global geopolitical instability is driving fuel prices to astronomical heights.

This is also reflected in the price of airline tickets and travel may become a luxury in the coming months as the recession sets in. People's current appetite for travel is undoubted, but can quickly turn sour as the need to save money might settle in soon. And it is companies in the travel industry that may pay the price.

Don't forget about cyclicity

It should be noted here that

travel is traditionally a cyclical industry. In times when you need to tighten your belt, this is one of the first cost-cutting measures. Moreover, the coronavirus, which is

currently confining China in particular, is still a major threat. All

investors in casinos and cruise lines, where the Chinese are one of the biggest consumers, should take heed. All of these factors may further pressure the stocks of tourism-related companies, which in many cases have fallen significantly more than the overall market (as measured by the S&P 500 index) since the beginning of the year.

Chart 3: Shares of AirBnB in the MT4 platform on the D1 timeframe along with the 50 and 100 day moving averages

Chart 3: Shares of AirBnB in the MT4 platform on the D1 timeframe along with the 50 and 100 day moving averages

Where can use an advantage of the high volatility at the moment?

So one thing seems very likely -

big waves are on the horizon that will cause further

volatility in already quite volatile stocks. However, we may not see a tsunami similar to the one caused by the coronavirus pandemic. A look at the charts of stocks like

Boeing, Booking Holdings, American Airlines, AirBnB and Marriott International shows that they have suffered from very high volatility since the coronavirus began.

Thus,

share price movements of tens of percent in a single day, for example after the announcement of earnings, are no exception.

Volatility is welcomed by intraday and swing traders and, when combined with leverage, can yield interesting gains (but of course also losses). All indications are that speculators who take advantage of CFD opportunities might thus reap the rewards in the coming months.