Brexit in a week from 27/1 - 2/2/2020

Day D has come and the UK ceased to be a member of the EU on Friday January 31, 2020. The central bank BoE left interest rates unchanged and the GBPUSD appreciated to 1.320. Will GBPUSD re-attack level 1.35 soon? And what awaits us in the post brexite era? Follow our opinion in this article.

Fundamental analysis

Half of the British had reason to celebrate on Friday as the United Kingdom ceased to be formally a member of the EU after 47 years. It has entered the next phase of Brexit, namely a transitional period that will last at least until December 31, 2020. This means that the UK will continue to follow EU rules and contribute to its budget over this period. It must also negotiate a trade agreement with the EU during this period.

The most important macro economic news was the meeting of BoE central bank on interest rates on Thursday last week. The Bank of England decided to keep rates unchanged at 0.75%. The pound sterling responded to this report by a sharp increase and on Thursday and Friday strengthened by 200 pips to 1.3200.

As a justification for the keeping of rates, the BoE stated that there were signs of global growth stabilization, reflecting the reduction of tensions in the trade war and also the result of economic stimulus that many central banks applied in the past. Global confidence indicators in the economy have improved, and production indicators values have also improved. In Britain, investor sentiment is recovering, domestic real estate market indicators are improving, and overall business activity shows signs of recovery as well.

Technical analysis as at February 2, 2020

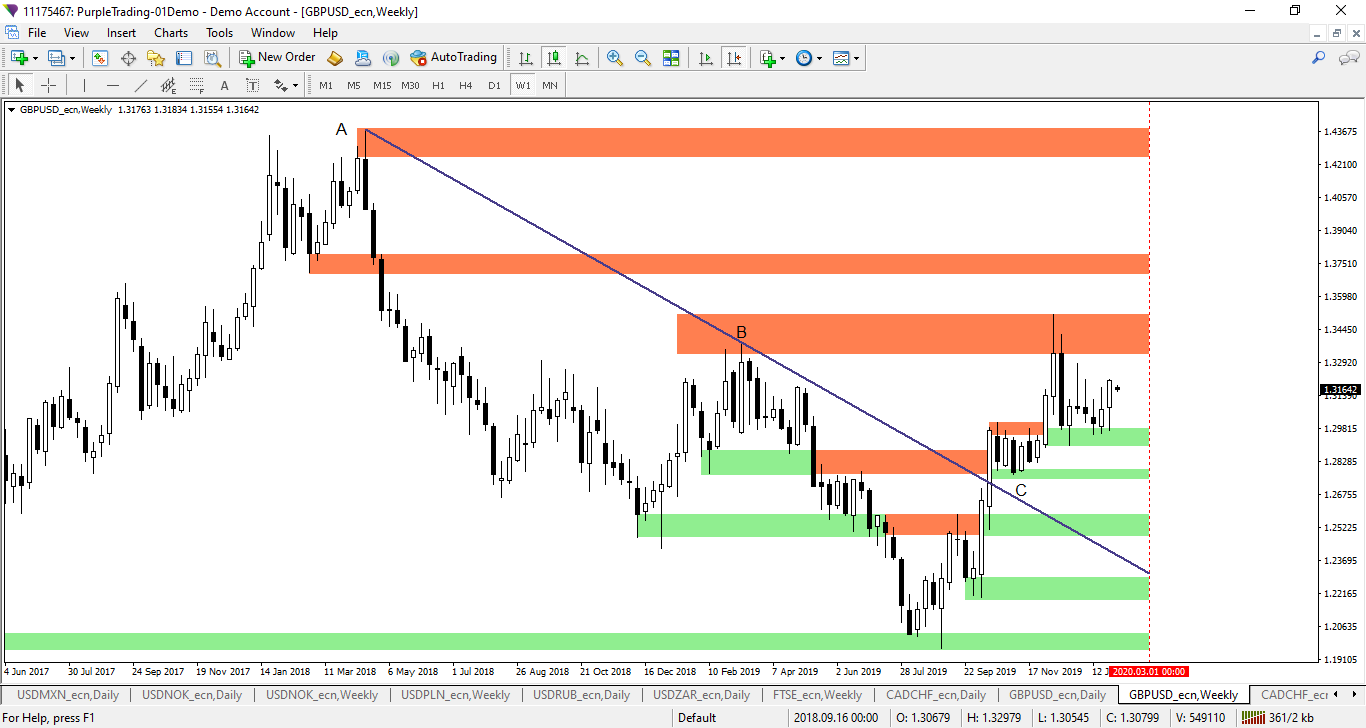

From the weekly chart, see Figure 1, we can see that the GBPUSD pair is still in the range between 1.35 and 1.29. Last week, a strong bullish candle developed on the weekly chart, responding in line with our opinion of the previous week. Last week the price moved in a range around 230 pips and it closed on the level 1.3205.

Figure 1: The GBPUSD on weekly chart

Figure 1: The GBPUSD on weekly chart

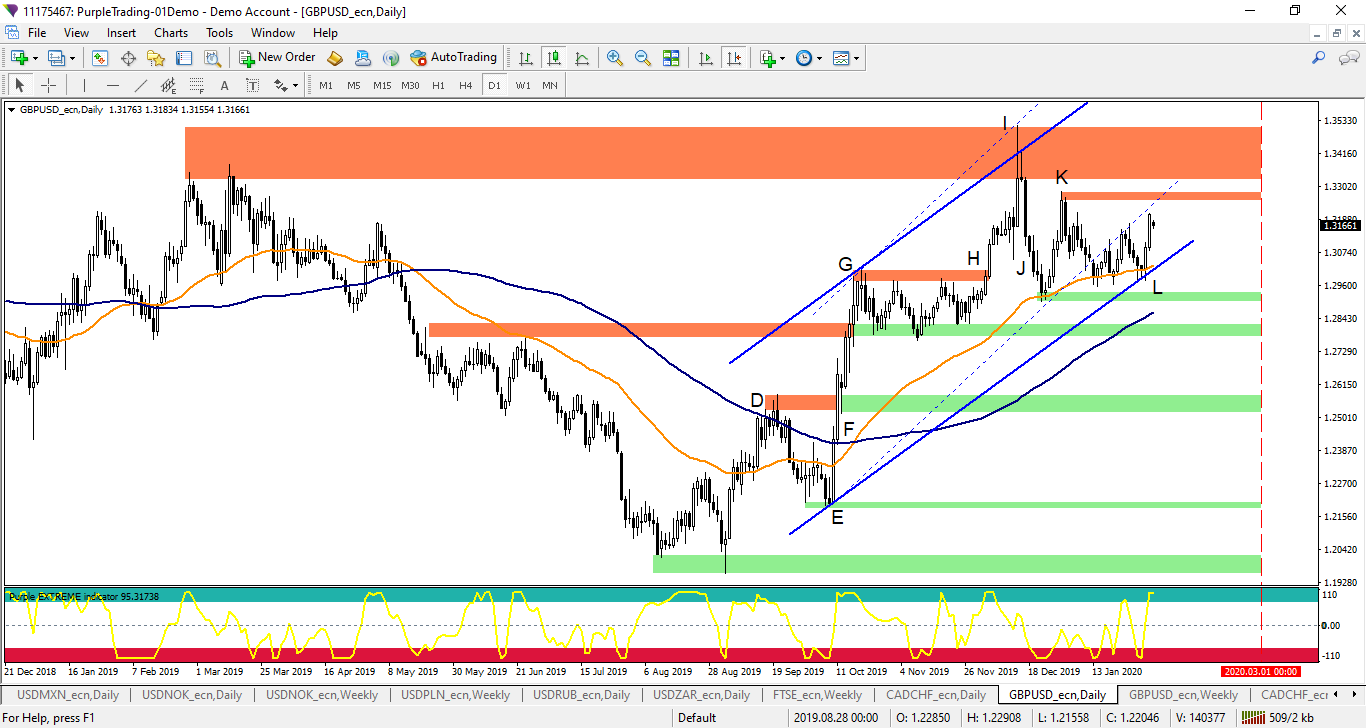

On the daily chart, see Figure 2, we can see that the price continues to move in an upward trend, which is confirmed by the growing channel, as well as the bullish pattern golden cross, when EMA 50 crossed above SMA 100 at point F and formed higher highs and higher lows. The GBPUSD last week tested the level of support on the moving average of EMA 50, which was also the level of support for the growing channel at the point L.

Figure 2: The GBPUSD on daily chart

Figure 2: The GBPUSD on daily chart

From the point of view of this technical analysis, trades in the long direction would continue to be preferred. The negation of this business idea will occur in the case of a clear break through the growing channel and the price closing below the level of 1.29. If this happens, then for other inputs in the long direction, it would be necessary to wait for a confirmation signal to be generated at some support level.

Resistance 1 is at a level around 1.3260 - 1.3280.

Resistance 2 is in a broad band 1.3330 - 1.3510. The level was tested and then the price bounced back down.

Resistance 3 is between 1.3700 - 1.3750.

Support 1 is now in a zone 1.2940 - 1.2900.

Support 2 is located in the band 1.2780 - 1.2820.

Support 3 is in the range around 1.2520 - 1.2570. This level is breaking through previous resistance.

Moving averages are also important support and resistances to follow.

In addition, we present the overall market sentiment, which according to the COT (Commitment of Traders) report, which is presented every Friday, shows that last week large speculators slightly reduced their long positions as the number of contracts decreased from the previous 24,900 to 17700. Total sentiment, however, still remains bullish as the number of long contracts is higher than the number of short contracts.

In terms of further development, it is possible that the GBPUSD will soon reach 1.35, where it will test the previous peak. Gradually, however, uncertainty may arise as to the final form of the EU-UK trade agreement that needs to be negotiated in the interim period. Therefore, the pound could stay in the side trend for some time or even drop to some significant level of support.

What awaits us next week?

From a macroeconomic perspective, PMI data in the manufacturing, construction and service sectors will be reported in the first half of the week. Improvements in these indicators could temporarily support the GBPUSD.

As for Brexit itself, from February 1, 2020 the UK entered the transition period and the UK will prepare for negotiations with the EU. The EU needs a mandate for official negotiations with Britain, which should be approved by all EU countries in last February week. Official negotiations will therefore take place from March. So if there are any comments of the negotiations on the trade agreement this week, they will be only unofficial opinions. However, they may also have the potential to cause short-term fluctuations in the pound sterling.