Brexit in a week from 14/10 – 20/10/2019

So the "super" week is over. And what has happened? First, the British Pound strengthened significantly and got close to 1.30. It broke through another level of resistance. All this was due to reports of a "divorce" agreement between the EU and the UK. However, on the weekend, Boris Johnson suffered another defeat when the British Parliament did not vote on the agreement,

so it is possible that Brexit will not happen on October 31, 2019. Further details are given below.

Fundamental analysis

Last week, it followed up on the activities of the previous week and Boris Johnson frantically negotiated the details of the agreement on the UK's departure from the EU with the European Commission. The agreement was finally concluded at the last minute and could be submitted to the European Summit for approval on Thursday. Here, the agreement was accepted as expected.

But the hardest thing was waiting for Boris Johnson. On Saturday, the House of Commons of the British Parliament met extraordinarily to approve the agreement. However, just as the previous agreement negotiated by Theresa May was not approved, there was resistance also now. This time, however, it was not even voted on the agreement. Instead, the Parliament agreed that the content of the agreement must be first implemented into the legislation before it is approved.

Consequently, Boris Johnson was legally obliged to ask the EU to postpone the Brexit deadline. He did it, but by a letter he did not sign, according to the BBC. He also sent another letter, which he had already signed, in which he stated that it would be mistake to postpone Brexit and that the UK would be able to take all legislative measures for Britain's departure from the EU by October 31, 2019. Boris Johnson remains convinced that he will be able to take Britain out of the EU by the end of October 2019.

From the UK macroeconomic point of view, employment data was first reported on Tuesday last week. In particular, it was the Unemployment Index, which reached the level of 3.9% (in the previous period it was 3.8%). Furthermore, data on the change in the number of unemployed (Claimant Count Change), which increased by 21 thousand of unemployed people (an increase of 16 thousand in the previous period) and a change in average earnings, which reached 3.8% (compared to 3.9% in the previous period).

Inflation data, the so-called CPI index, was reported on Wednesday, reaching 1.7% year on year basis (1.7% in the previous year), and on Thursday, data on retail sales changes, which were 0% on a month-on-month basis previous period -0.3%).

The impact of the GBPUSD currency pair is also affected by the US data. Last week, data on retail sales change of -0.3% (0.6% in the previous period) was presented on Wednesday and U.S. Building Permits, which reached the value of 1 387 ths. of new permits (in the previous period 1,435 thousand).

Technical analysis as at October 20, 2019

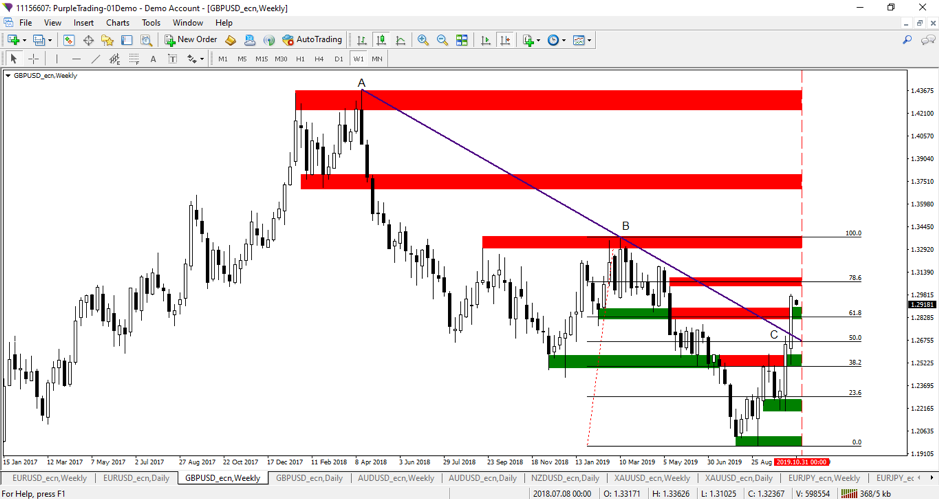

The GBPUSD offered us another significant movement over the past week. The price opened at 1.2620 and closed at 1.2972. It reached even 1.2989. On the weekly chart, see Figure 1, we can see that another strong bullish candlestick was formed that broke through the resistance zone. Even the downward trend line connected by points A and B was broken (see point C).

Figure 1: The GBPUSD on weekly chart

Figure 1: The GBPUSD on weekly chart

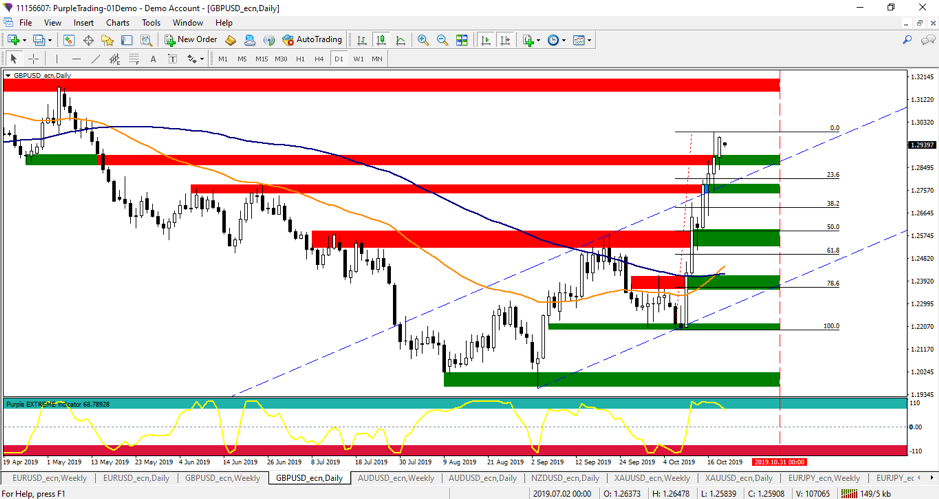

The daily chart, see Figure 2, shows that the price closed every day at higher prices and broke resistance in the band 1.27-1.2770 and also another resistance in the band 1.2850-1.2900 in the past week. These resistances are now supports. Friday's candlestick, however, did not beat the high of the previous candlestick.

Furthermore, we can see that the EMA 50 crossed the SMA 100 upwards,

so that a so-called golden cross was formed, which is a bullish signal. The price also broke the top of the growing channel we identified last week.

Higher highs and higher lows in terms of price action means that the previous downward trend has reversed. We also drew the current Fibonacci levels on the chart between last swing high and low.

Figure 2: The GBPUSD on daily chart

Figure 2: The GBPUSD on daily chart

For potential long speculation, it would be appropriate now to wait for the correction, ideally for the price to fall to some significant level of support. For this purpose, the level of 1.2550 - 1.2600 seems to be ideal. First, it is 50% Fibonacci retracement, and at this level the previous significant resistance was broken as well. The correction is now supported by the fact that the agreement has not yet been approved in Parliament.

Resistance 1 is at a level of about 1.3000 - 1.3050. From Figure 1, it is about 78.6% of Fibonacci retracement and it is the area from which the previous significant decrease was triggered.

Resistance 2 is at a level around 1.3150 - 1.3200.

Resistance 3 is approximately 1.3300 - 1.3370.

Support 1 is now in a zone 1.2740-1.2780.

Support 2 is in the range around 1.2550 - 1.2600. This level is a confluence of the Fibonacci level 50.0 in Figure 2 and the break of previous resistance. Reactions may also occur at 1.2500, where there is 61.8% is Fibonacci retracement.

Support 3 is at 1.2350-1.2400, where the 78.6% Fibonacci level is.

Support 4 is at 1.2200-1.2250, where the last higher low is created. If the price falls below this level, then the 1.20 level may be tested.

Should it be announced that the British Parliament would eventually approve the agreement, including the implementation into legislation, it could be expected that the currency pair would strengthen further.

What awaits us this week?

The EU will consider a letter on the extension of the Brexit deadline sent by the Prime Minister. All 27 countries must agree to the extension. Should at least one country refuse the extension, the deadline for Brexit October 31, 2019 shall continue to apply.

On the other side of the channel it will be very busy. According to current reports, the British Government is preparing to submit for approval legislative measures to ensure the implementation of the negotiated agreement into British legislation.

Furthermore, there is likely to be an attempt to push the negotiated agreement through the British Parliament. According to some sources, such an attempt may already take place on Monday. If the vote were taken and the agreement was not approved, the pound could be expected to weaken. If it were approved, still it would not exclude the risk of hard Brexit, since the content of the Brexit Agreement must be first implemented in British legislation.

All plans of Boris Johnson, however, can be completely ruined by the British Parliament if it starts debate why the letter announcing the Brexit delay sent to the EU has not been signed by the Prime Minister and whether such a letter is legally binding at all. It is possible that Parliament will approve an amendment to the law requiring the prime minister to sign the letter if there is any doubt that the request for extension of the Brexit deadline has not been clearly communicated.

There is still a possibility that the British Parliament could vote on no confidence in the government of Boris Johnson to prevent a disaster in the form of an hard Brexit if the situation were to be feared.

In the context of the current Brexit agreement, it should be noted that, according to Reuters, the new Brexit agreement is far more harmful than the one put forward by Theresa May. For example, analysis estimates that the Johnson’s Agreement will cause a long-term growth of less than 1.5% per year. In the case of an agreement negotiated with May, the growth would be 1.7%, while staying in the EU 1.9%. These could be factors that could lead to a rejection of the agreement.

From the UK's macroeconomic data, the CBI Industrial Trend Orders will be reported on Tuesday, identifying economic expectations in the manufacturing sector. On Thursday, data on the number of approved mortgages (the so-called U.K. Gross Mortgage Approval) will be presented.

The impact on the GBPUSD currency pair may also be affected by the US data. Next week, U.S. Property Sales data will be reported on Tuesday. On Thursday, the U.S. Durable Goods Orders as well as PMI data for the manufacturing and service sectors will be reported.