Brace yourselves, inflation is coming

Following the outbreak of the pandemic, liquidity in circulation has risen sharply and will most likely have to grow further as the economy waits for a few more difficult months. However, gradual vaccination will boost prices, which are now under pressure from weak economic activity, low consumption and cheap energy. Someone is already preparing for the digital gold market, while bond traders should buckle up.

Pushing liquidity limits

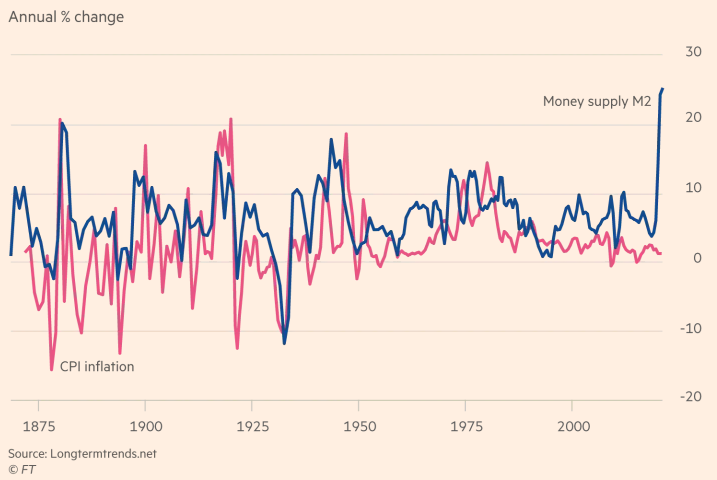

When the price of oil fell to negative values last year, few people were thinking about inflation at the time. But with the slump in oil came the unprecedented response of monetary policy to the proliferating lockdowns. In the modern world, central banks do not have many tools to combat declining economic activity. However, monetary policy can most effectively help the economy by pumping additional liquidity. And that is precisely what it did, as from March to November the US money supply in the US increased by 24%. Not surprisingly, liquidity growth in 2020 was the largest in recent history.

Graph: Comparison of M2 money supply growth (blue) and inflation (red) (Source: FT.com)

Graph: Comparison of M2 money supply growth (blue) and inflation (red) (Source: FT.com)

Money ends up in a private sector

Monetary expansion was evident in other world economies as well, but nowhere as pronounced as in the United States. According to economic publications, the price level is determined by the supply and demand for money in the system. The rate of inflation is then equal to the rate of growth of money in circulation over real income. Sometimes other variables are taken into account, such as interest rates and inflation expectations. However, we hear everywhere that the money that the Fed pumped into the system ended up in the stock market. The form of quantitative easing that the Fed had already applied in the last crisis did not have such a negative impact on post-crisis inflation and prices were falling, as is so far due to weak economic activity and delayed consumption now.

However, there is one fundamental difference between the current situation and the last crisis in 2009. The money generated by the Fed after the mortgage crisis went mainly to excess reserves in the banking system and only a small part went to the private sector. This is because the banks did not hold any excess reserves, because they did not receive any interest from them and the management advocated holding the minimum necessary reserves to satisfy the regulators. The banks tried to get the rest of the money on the market in the form of mortgages or loans.

After the financial crisis, a change came and the Fed began paying interest to banks on the reserves held, and regulators introduced minimum liquidity requirements. Banks simply absorbed extra reserves from the Fed, and quantitative easing led to modest growth in lending. Now, however, the Fed and the Treasury have produced a slightly different outcome. The money does not only go to bank reserves but goes directly to the bank accounts of individual companies through PPP programs, stimulus checks, and grants. The money simply ends up in the private sector, and the Fed's actions are suddenly much stronger than simply increasing liquidity in the interbank sector.

Inflation economy

The huge increase in stocks should thus be followed by an inflationary economy in 2021. Inflation is most likely to exceed the 2% target and will not fall for many years to come. At the same time, rising consumer prices will reduce the purchasing power of traders in the bond market, and their yield will grow much faster than the Fed expects. Hedging against collapses on risky assets will thus be more expensive. It is difficult to expect that monetary and fiscal incentives will be paid by citizens with higher taxes. As always, it will pay for rising inflation, and we should prepare for that.