How to Trade the Fair Value Gap

Because these gaps represent an imbalance, Fair Value Gaps often fill up. We can use this knowledge to accurately determine the price level where we want to enter a trade.

Filling the gap

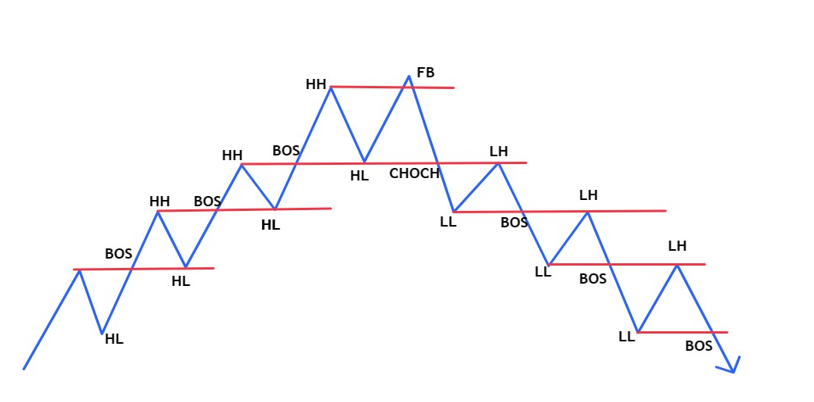

With this strategy, it is important to determine what the current trend is. This should be determined on a higher time frame, such as weekly, daily, or H4. A healthy uptrend produces a higher high (HH) and higher low (HL), while a downtrend produces a lower high (LH) and lower low (LL).

If the HH breaks in an uptrend or the LL breaks in a downtrend, a break of structure (BOS) is formed and the trend is likely to continue.

If a break of HL occurs in an uptrend to the downside, a change of character (CHOCH) occurs and the chance that the uptrend could reverse and start to decline increases. In a downtrend, the analogy is then reversed, i.e. when a break of the lower high (LH) to the upside increases the chance that the market decline could stop and the market could start to rise. An example is shown in Figure 2.

Sometimes, however, false breaks can also occur. These are then used to lure you into a trap in order to collect liquidity. Read the article about Smart Money and liquidity withdrawal.

Diagram of increasing and decreasing trend

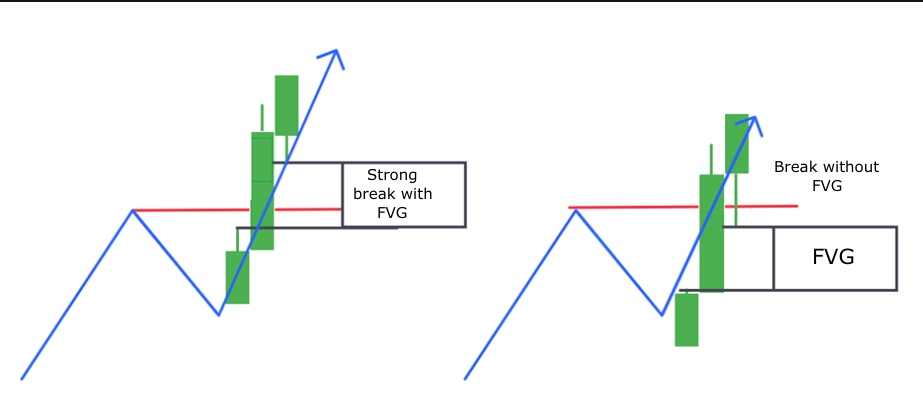

It is important to note the points where the BOS or CHOCH break occurs. If the break is accompanied by the formation of a FVG, then a strong impulsive move has occurred and the price is likely to continue in the direction of the FVG that formed the break. In such a case, a patient trader will wait for the moment when the broken line is returned (and therefore the gap that was formed on it is filled), and then consider entering in the direction of the filled gap.

If the break occurs such that the break line is not inside the gap, the situation is less reliable for the gap to act as support (uptrend) or resistance (downtrend). An example of a strong break with FVG and a less reliable break without FVG in a bullish trend is shown in the next figure.

Representation of a strong break with a bullish FVG

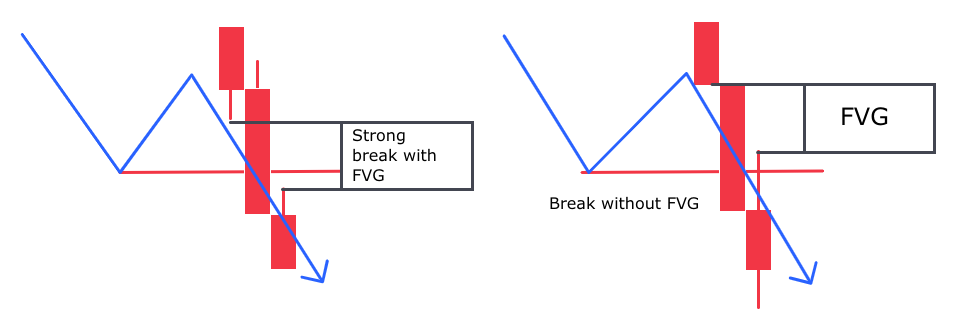

In the case of a bearish trend, this is analogous:

Strong break with bearish FVG

The idea is that the break of support or resistance should be inside the FVG, which has a visibly longer middle candle than the surrounding candles. These breaks indicate that they were made with impulsive force and tend to be more reliable. Therefore, it is preferable to focus on these situations.

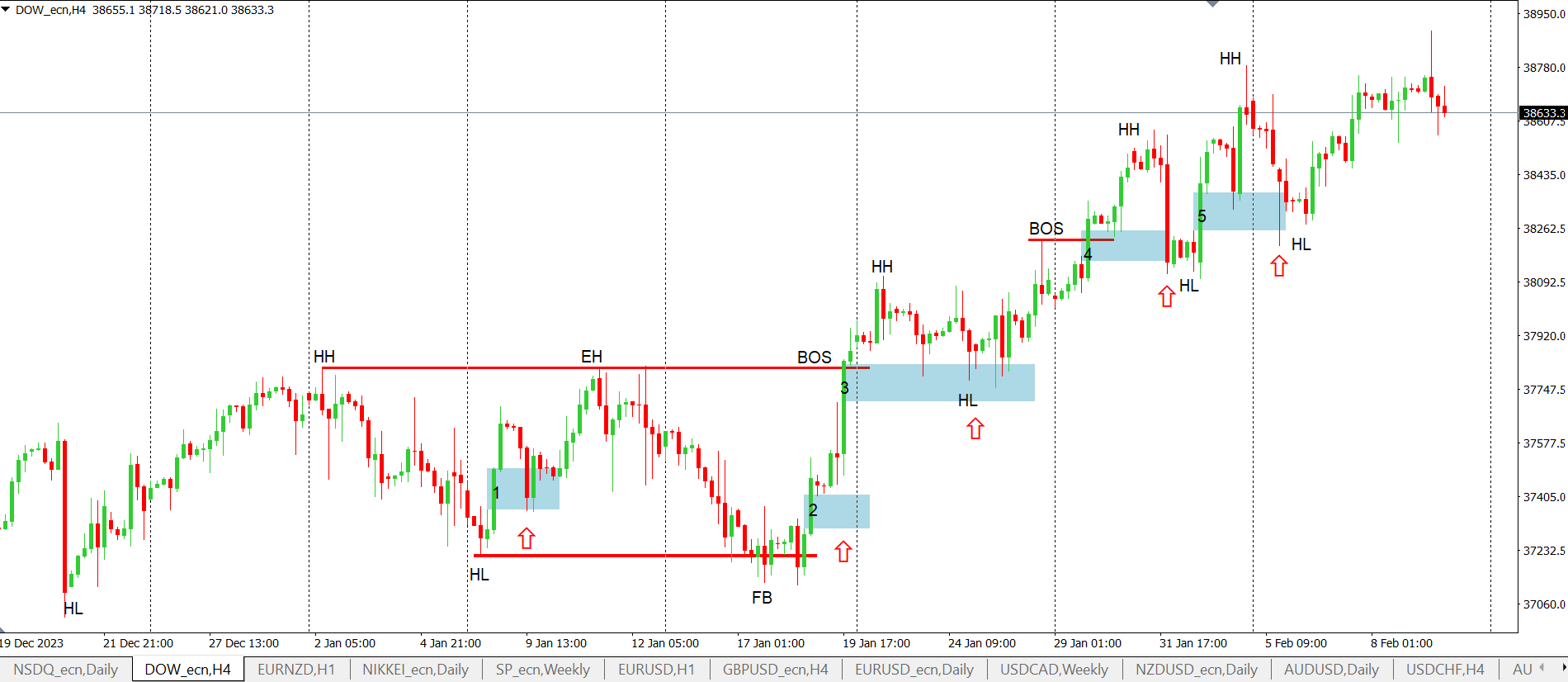

We will show this practically in the following example, where we have the DJ30 instrument on the H4 chart.

Dow Jones index on H4 chart

We have identified a growing trend in which several FVGs have been formed. In situation 3 and 4, an FVG has been formed with the formation of a BOS structure break in an uptrend. These are situations where it would be possible to enter a long trade in accordance with the previous theory. Then in situations 1, 2 and 5 the FVG was formed inside the uptrend structure.

We can also see that the gap was not always completely filled, so in this case the trade would not have occurred. Gaps 1, 4 and 5 were later filled (see arrow). Then in situation 3 there was a partial filling. In the case of the gap created in point 2, there was no gap filling at all.

You may also notice that when a gap is filled, it may also be 'overshot'. This is because gaps serve as indicators where liquidity is collected in the form of pending stop losses. Liquidity collection theory teaches that smart money will first collect this liquidity and only then will the market turn.

In the next chart we have examples with bullish and bearish FVG, a change in market character (CHOCH) and a BOS with a downtrend.

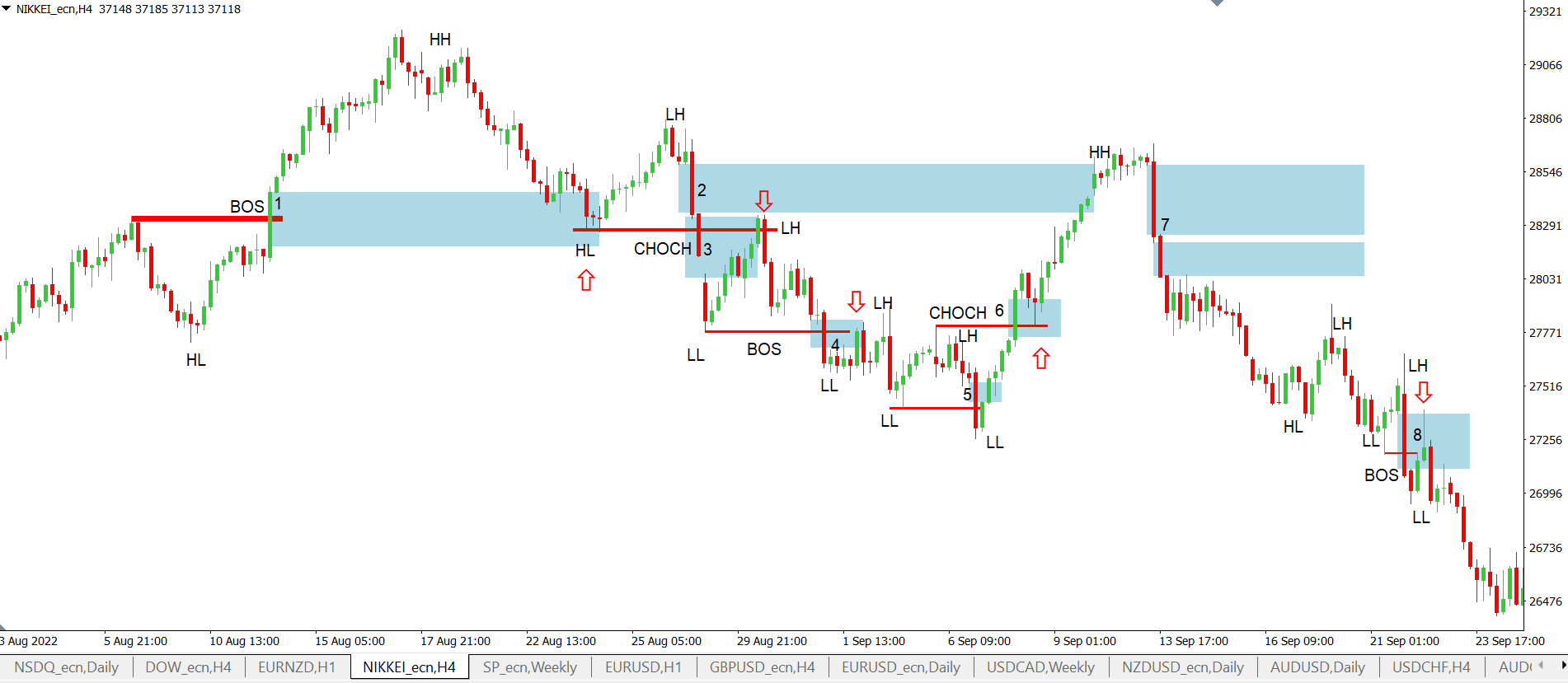

Index NIKKEI na H4 grafu

At FVG 1, the BOS is an uptrend, which was later tested and the price bounced up. At FVG 3, the previous higher low (HL) was broken, so there was a change in market character (CHOCH) which was confirmed by the bearish FVG, which is a strong confirmation. This was later filled and a short could be entered. Candle 4 offered a BOS (break of the lower low, LL) again with an FVG which was later retested and it would be possible to enter short again.

And what about candle 5? This candle did produce an FVG, but this FVG did not break the previous low. The low was indeed broken by a long candle, but the following candle closed above it. So, there was a breakout here, but no FVG (recall Figure 4). Thus, there was no BOS with a valid FVG, but a false break.

Then at point 6, there is again a breakout with a change in market character (CHOCH) as the previous lower high was broken to the upside. It would therefore be a possible long entry. Then the gap from candle 2 was filled and price then reversed down.

The gaps on candle 7 were not filled. Then at 8, the downtrend was confirmed by a lower high and lower low, and since there was a BOS of the lower low with the help of FVG, on retest, a short entry would be valid.