Macroeconomic context of the Japanese Yen

At its June 2022 meeting, the Bank of Japan (BoJ) decided to continue its ultra-lose policy settings and underlined its position to maintain borrowing rates at "current or lower" levels. The Japanese central bank also pledged to pursue a 10-year government bond rate of about 0%.

The governor of the Bank of Japan, Haruhiko Kuroda, also emphasized that they will not hesitate to ease monetary policy further if required. The central bank, he said, does not pursue a certain level of currency.

The BoJ claimed that by stepping up bond purchases and conducting fixed-rate operations, yield curve control could be maintained even in the face of rising foreign yields.

As of autumn 2022, there is a massive divergence between the Fed (currently raising rates and doing quantitative tightening) and the BoJ (negative rates and doing quantitative easing), and the USDJPY pair remains in a long-term uptrend.

Performance history of USDJPY

USDJPY has remained steady since 2013, despite the massive rally in 2014 and an even sharper plunge in 2015. The following years saw the pair remain stuck near 105 in a low volatility regime. However, the massive divergence between the USD and JPY started in 2021, when the Fed began telegraphing monetary policy tightening. However, the BoJ has remained pat, being faithful to neverending money printing and negative rates. That has led to a massive rally, pushing the USDJPY pair to 135, the highest level in 30 years.

Source: Purple Trading Metatrader 4

USDJPY - quotes and trading

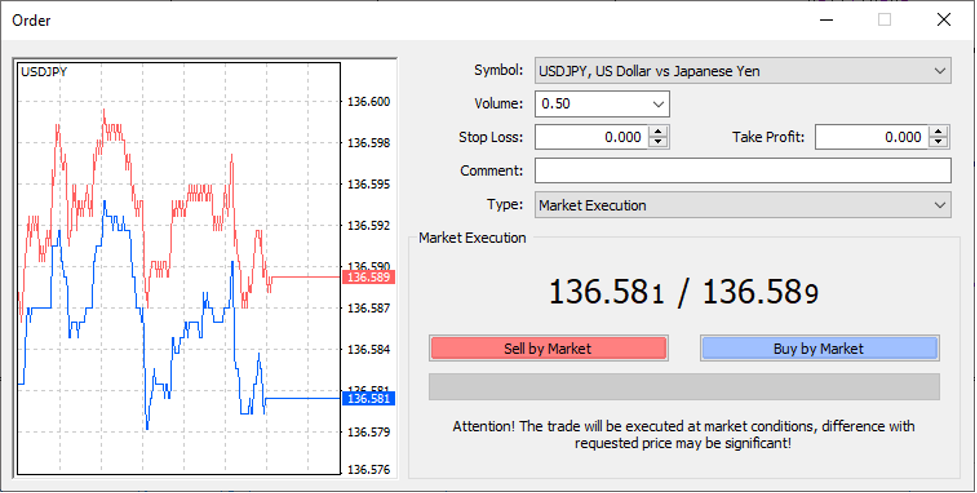

You can trade the USDJPY currency pair in our Purple Trading Metatrader 4 platform. First, find the ticker USDJPY in the Metatrader 4 platform and press the new order button. The following window will pop up.

Source: Purple Trading Metatrader 4

Lot value calculation

When you open our Metatrader 4 platform and click on the USDJPY ticker, you'll see that there is often a 1 pip spread between the Ask and the Bid price during periods of high liquidity (usually when London and New York are open for trading).

One micro lot is the minimum volume for trading USDJPY (0.01). If you trade a mini lot (0.1), you will gain or lose 7 USD for each 10 pips USDJPY makes. Every 10 pips of USDJPY movement will yield 35 USD profit/loss when trading half a lot. For example, you buy half a lot at 136.60, and USDJPY goes to 137.00. Your total profit will be 140 USD (calculated as 40 pips movement * 35 USD profit per 10 pips of the move). When entering a short position, the same principle determines your profit or loss.

The USDJPY is priced in Japanese Yen, so keep that in mind. Therefore, whether your account is in EUR or another currency, your profit or loss must be converted to EUR at the current exchange rate.

You have the option of trading at market price (market execution) or using pending orders (limit and stop orders). In addition, you can start trading without the stop-loss and take-profit orders and add them later.