Figure 1: The US 10-year bond yields and The USD index on H4 chart

The reason for these unexpected moves is the dynamics of competing forces. Accentuating higher inflation is accompanied by concern about how this will affect future economic growth. Adding to the concern about economic growth is the impact of the Omicron virus variant.

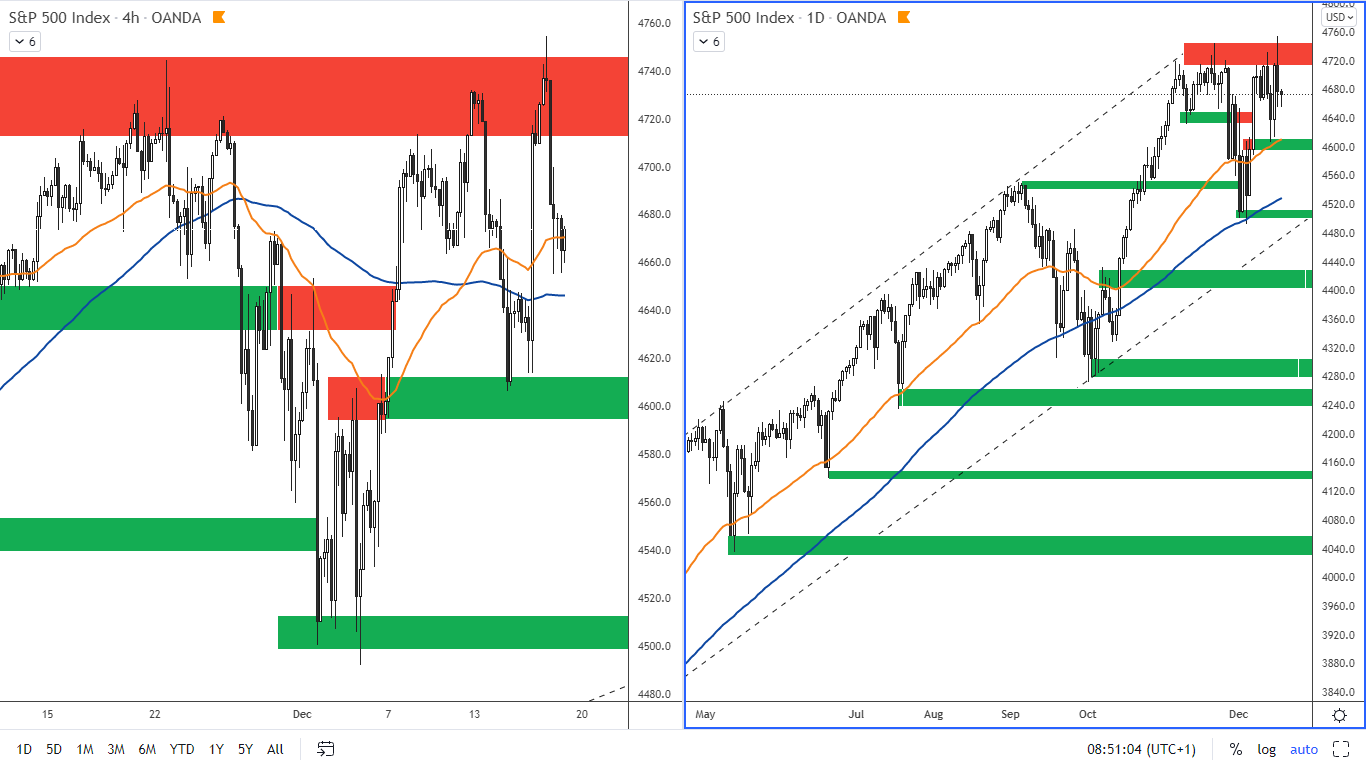

The SP500 still in bullish mood

After Wednesday's Fed announcement, many would have expected the stock indices to weaken. However, this did not happen and instead there was a rise in US equities, reaching a new all-time high at 4,753 on the SP 500 index.

All the major news has been absorbed by the market and so the current market uncertainty is only the impact of the Omicron virus variant and some tensions between the US and China. The US government blacklisted more Chinese companies on Thursday in response to China's oppression of its Uyghur minority. In response, the SP 500 index made a slight correction on Thursday. Overall, however, the SP 500 index is still in an uptrend. Given these tensions, it would not be surprising if the index held in consolidation.

Figure 2: The US SP 500 index on 4H and D1 chart

The uptrend on the SP 500 index is still in place and the support at SMA 100 on the daily chart has shown its strength. The price of the SP 500 has returned to the previous historical peak where the resistance is around 4,713 - 4,753. The nearest support is at 4,594 and 4,610.

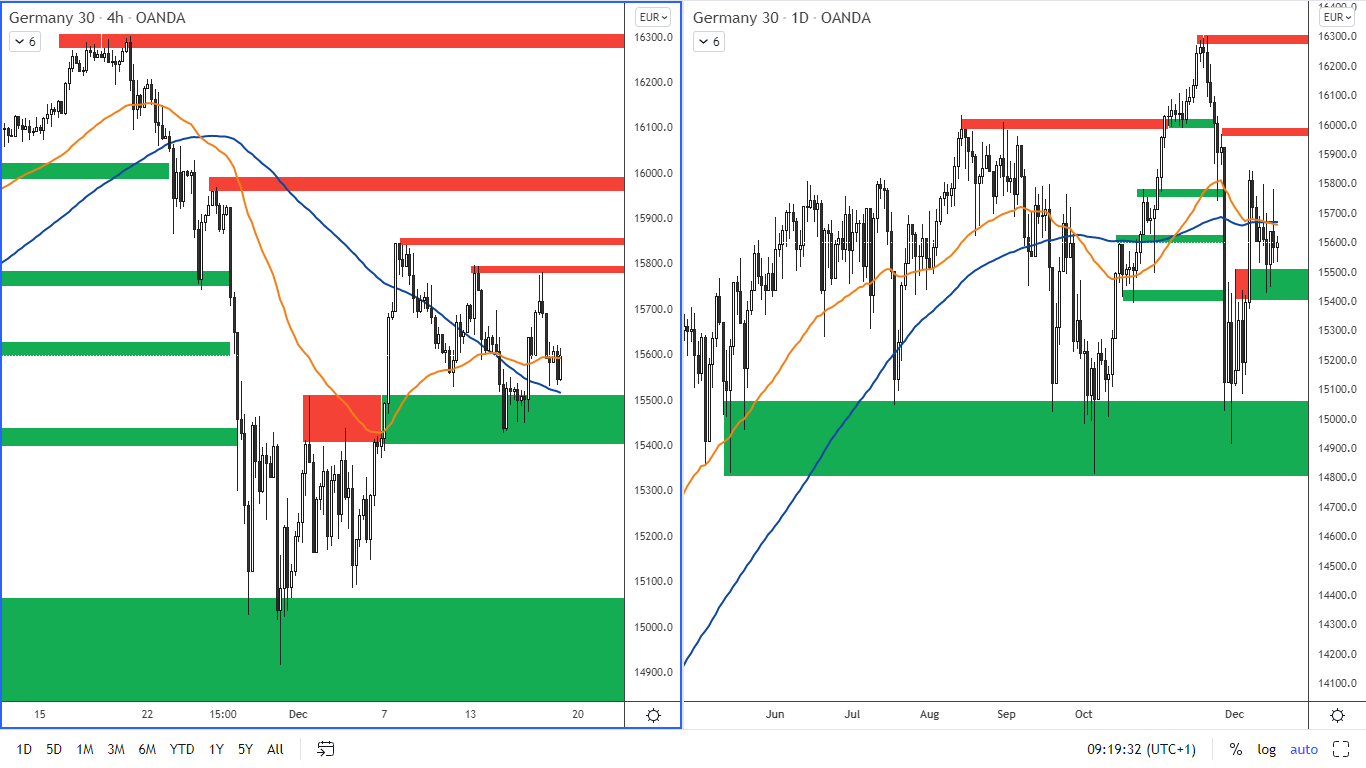

German DAX index

In terms of more significant economic data, the manufacturing PMI was reported last week and came in at 57.9, better than the previous reading of 57.4. Thus, optimism about economic developments in Germany continues. The current dovish rhetoric of the ECB should also have a positive effect on the index growth as well. Also, the correlation between the DAX and the SP 500 could push the DAX up to an all-time high.

Figure 3: DAX on H4 and daily chart

From a technical perspective, the Dax has established a new support at 15,400 - 15,500. Resistance on the H4 chart is at 15,790 and then 15,850. The moving averages EMA 50 and SMA 100 on the H4 chart indicate a bullish mood.

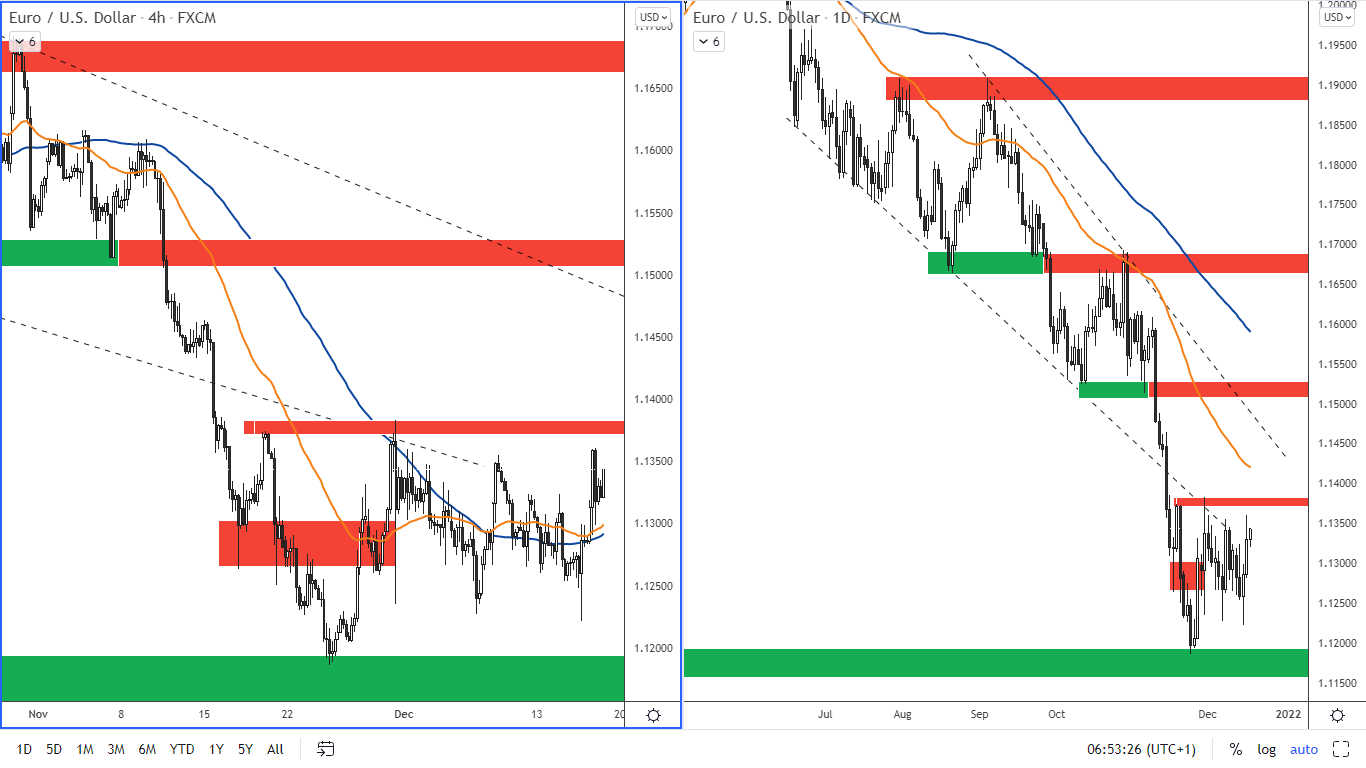

The EUR/USD surprisingly strengthened

The ECB kept rates at current levels and confirmed that no rate hikes are likely in 2022. The ECB still sees the currently higher inflation as a transitory phenomenon where rates will be slightly above its target. This dovish bias would normally be bearish for the euro, especially given the hawkish Fed. However, a profit taking before the end of the year was what propelled the EURUSD to the top of its two-week trading range. Neverthless, the EURUSD is still in a bearish trend.

Figure 4: The EURUSD on H4 and daily chart

The nearest resistance is at 1.1380. The ideal entry in the short direction appears to be around 1.15, where there is strong resistance. A support is in the area around 1.1160 – 1.1200

The Bank of England raised rates

The British strengthened sharply after the Bank of England surprised the market with its first interest rate hike in three years. Given the latest COVID-19 restrictions and rising cases of the Omicron variant, it was a surprise move that analysts did not anticipate. But the central bank had to act as inflation hit a ten-year high (CPI for November was 5.1%).

The central bank therefore raised the base rate from 0.1% to 0.25%.

Figure 5: The GBPJPY on H4 and daily chart

On the GBPJPY pair, we can see that the pound's rise has stopped at the resistance seen on the daily chart, which is at 152.3. The nearest support on the H4 chart is 151. The growth of this pair should be supported by the fact that the Bank of Japan is the most dovish of all major central banks.

The gold has entered a traditionally bullish period

The gold tends to strengthen between November and February as the statistics show (you can read more details on this in our gold e-book, which you can download here:

Ebooks - Purple Trading (purple-trading.com)

We can see on the gold chart in Figure 6 that gold touched a support at $1,753 per ounce last week after the Fed announcement and it has been rising continuously since then. Apart from a seasonal influence, another reason for the appreciation is probably the fact, that investors currently see gold as a hedging opportunity against the inflation. The weakening of the US dollar has also contributed to the rise in the yellow metal.

Figure 6: The gold on H4 and D1 chart

The gold has broken through the resistance from the H4 chart, which is in the area near 1792. This area is now the new support. The next resistances are then at 1810-1815 from the H4 chart. From the D1 chart, the resistance is then at $1,850 per ounce.