The Swing Overview - Week 46

Last week was marked by important data from the US labor market and data on US inflation, which continues to accelerate. After that, the US dollar strengthened and the US stock indices made a slight correction. Gold, which some investors consider as a hedge against rising inflation, was also strengthened. The EURUSD currency pair broke below the key support at 1.15 for the first time since July 2020.

The US economic data

Friday's NFP data beat analysts' expectations and pointed to a strongly improving US labor market. In October, the US economy created 531k new jobs and the unemployment rate fell to 4.6%. The number of initial jobless claims also continued to fall, with 267k claims filed last week.

At the same time, inflation was reported in the US and it continues to accelerate. The CPI for October came in at 6.2% year-on-year. This is the highest value of inflation since 1991.

While the Fed said at its last meeting that it had not been considering raising the key interest rates yet, this figure on higher inflation could persuade central bankers to reconsider their stance. The U.S. dollar index responded to higher inflation with a strong strengthening, and rates on the U.S. 10-year Treasury note also rose.

Figure 1: The US 10-year bond yield and USD index on the H4 chart

Figure 1: The US 10-year bond yield and USD index on the H4 chart

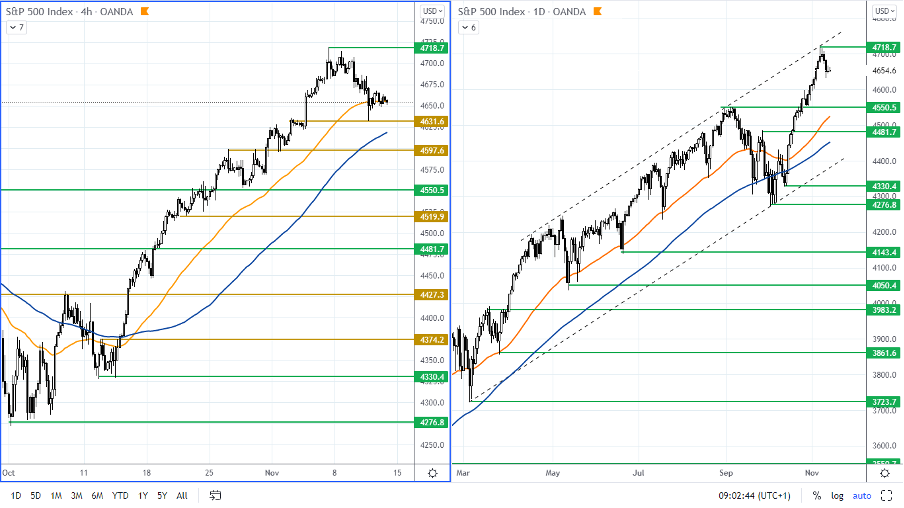

The US stocks have made a correction

Higher inflation also sent US stock indices down. However, they are still in an uptrend, so the current decline can be considered as a mild correction. In uptrends, the corrections are opportunities to buy.

The SP 500 index has reached a new all-time high, which is at 4,718. For possible downside speculation, in such strong uptrends, we need to wait for some resistance to form. On the SP 500, such resistance is the upper boundary of the rising channel on the daily chart. We can see that price reacted here last week.

Figure 2: US SP 500 index on 4H and D1 chart

Supports, on the other hand, can be found on the H4 and daily charts. The closest support then remains the consolidation at around 4,630, which the price already reached last week. Very strong support is then around 4,550, which has formed on the daily chart.

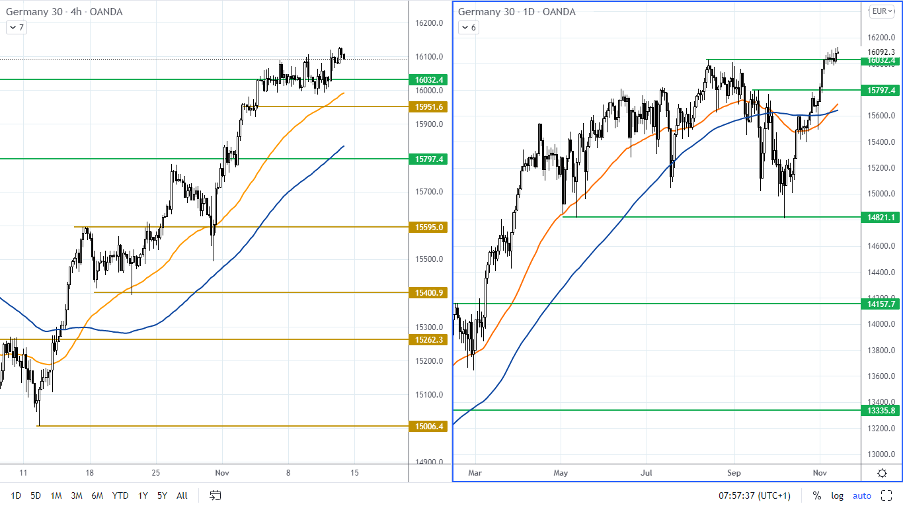

German DAX index

The DAX is also in an uptrend and is currently above support at 16,030, which was formed by breaking the previous peak. The new all-time-high for the DAX index that formed last week is 16,124. This gives the index room to rise further. The good mood among investors was supported by the ZEW index, which reached 31.7, which is the highest since August 2021.

Figure 3: DAX on H4 and daily chart

The closest support, apart from 16,030, is at the consolidation around 15,950. The next significant support is at the area around 15,800 where the previous resistance has become the current support.

The euro is at its lowest value since July 2020

The downtrend on EURUSD was manifested by the break of the strong support at 1.15. On the daily chart, we can see trend lines that point to a descending wedge formation. The price is approaching the lower trend line, which can be taken as support.

Figure 4: EURUSD on H4 and daily chart

The nearest resistance is therefore at 1.15 and then in the area around 1.1520. The nearest support, apart from the lower trend line, is at 1.14-1.1420, which was formed in June 2020. Very strong support is then at 1.1170, as we can see in the next picture.

Figure 5: The EURUSD on the daily chart

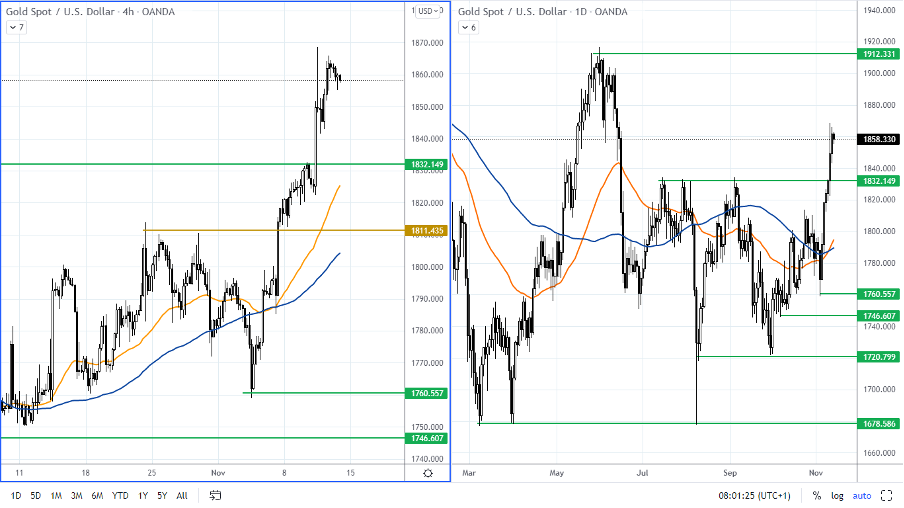

Gold is strengthening strongly

Gold is often in a strong inverse correlation with the value of the US dollar. Therefore, the strong rise in the gold price last week was a bit surprising because gold, unlike US bonds, does not carry any yield. Traditionally, however, gold served as a hedge against inflation. This could then be an explanation for the current appreciation of the yellow metal.

Figure 6: Gold on H4 and daily chart

The daily chart shows that gold has broken the strong resistance at $1,832 and is heading further up. The next strong resistance is in the band around $1,912 per troy ounce. Support is in the band around USD 1,832 per ounce.