The Swing Overview - Week 19

Stock indices continued to weaken strongly last week, while the US dollar has already surpassed the mark 104 and is at 20-year highs. However, a set of important data is behind us, which could bring some temporary relief to the equity markets. The Czech koruna weakened sharply after the appointment of the new CNB Governor Ales Michl, who is a proponent of a dovish approach. Thus, the rise in interest rates in the Czech Republic appears to be close to its peak.

Macroeconomic data

The US consumer inflation for April was reported on Wednesday, which came in at 8.3% on year-on-year basis. Analysts were expecting inflation to be 8.1%. Although the figure achieved was higher than expectations, it was still lower than the 8.5% inflation figure achieved in March. On a month-on-month basis, the price increase in April was 0.3%, significantly lower than in March when prices rose by 1.5%.

On Thursday, industrial inflation was reported at 8.8% year-on-year and 0.4% month-on-month for April.

The positive thing about this data is that inflation declined from previous readings. However, it is important to note that the year-on-year comparison is based on data where inflation was also higher in the previous year due to the recovery from the Covid-19 pandemic.

The Fed chief reiterated that he expects another 0.50% point rise in interest rates at the next two Fed meetings. He also mentioned that a higher rate hike cannot be ruled out if necessary.

The US 10-year bond yields came down from their peak and made a slight correction. However, the US dollar continued to strengthen and broke the resistance at 104. The dollar is thus at 20-year highs.

Figure 1: US 10-year bond yields and USD index on the daily chart

Equity indices heavily oversold

The strong dollar, rising US bond yields, the war in Ukraine and the effects of the lockdown in China were the main reasons for the decline in equity indices. The SP 500 index hit 3,860, the lowest level since March 2021. This is also where long-term support is. However, the important macro data is behind us and the market has processed all the available fundamental information. This could bring temporary relief to the markets and the index could make an upward correction. The fall in 10-year bond yields, gives this move some boost as well.

Figure 2: The SP 500 on H4 and D1 chart

Figure 2: The SP 500 on H4 and D1 chart

However, from a technical analysis perspective, the US SP 500 index remains in a current downtrend as the markets have formed lower low and is also below both the SMA 100 and EMA 50 moving averages on the H4 and daily charts. The nearest resistance is 4040 - 4070. The next resistance is at 4,140 and especially 4,293 - 4,300. The support is at 3,860 - 3,900.

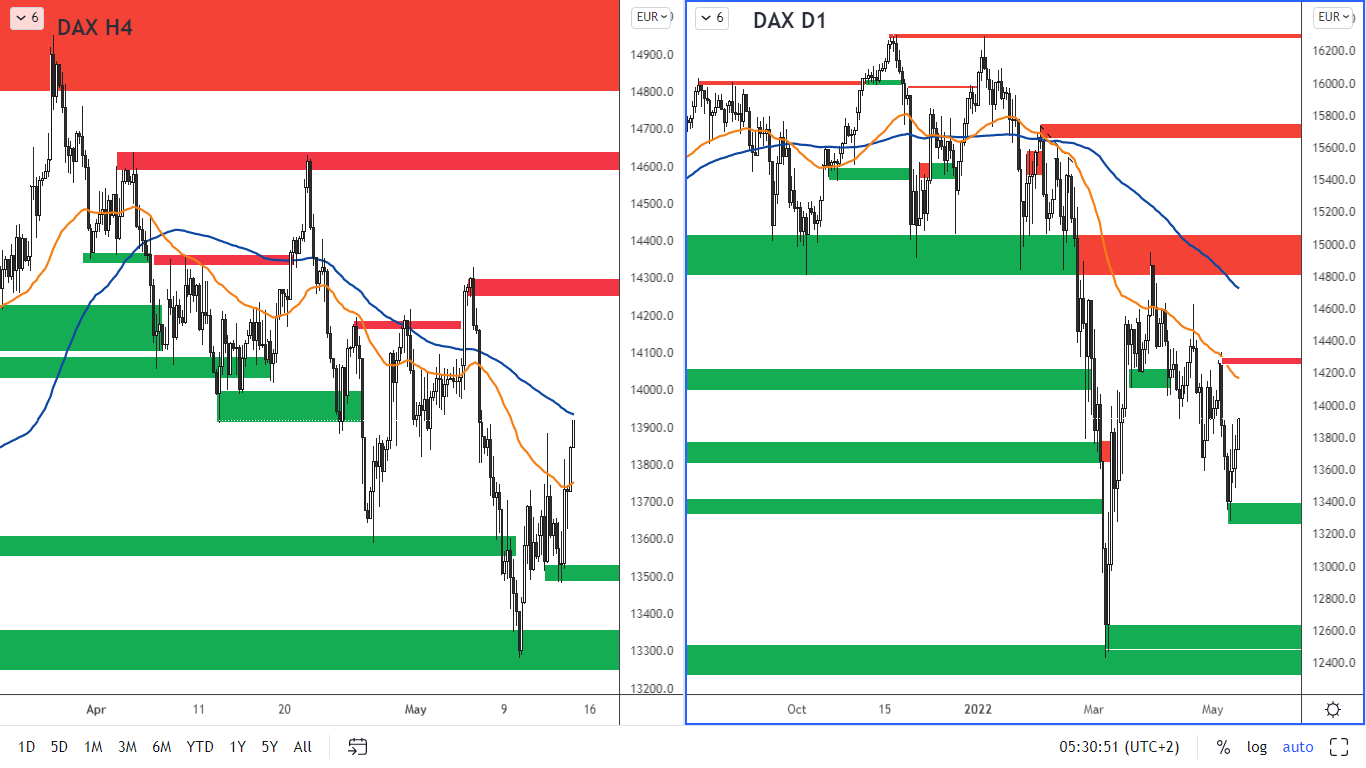

German DAX index

In macroeconomic data, the German ZEW Economic Sentiment for May was reported last week and showed a reading of -34.3, an improvement from the previous month's reading of -41.0. Inflation in Germany for April is at 7.4% on year-on-year basis and up 0.8% from March (the previous month's increase was 2.5%).

Figure 3: German DAX index on H4 and daily chart

Figure 3: German DAX index on H4 and daily chart

The index continues to move in a downtrend along with the major world indices. The price has reached the SMA 100 moving average on the H4 chart, which tends to signal resistance in a downtrend. The price is moving below the SMA 100 on both the daily chart and the H4 chart, confirming the bearish sentiment. The nearest support according to the H4 is 13,600 - 13,650. The resistance is 14,300 - 14,330. The next resistance is 14,592 - 14,632.

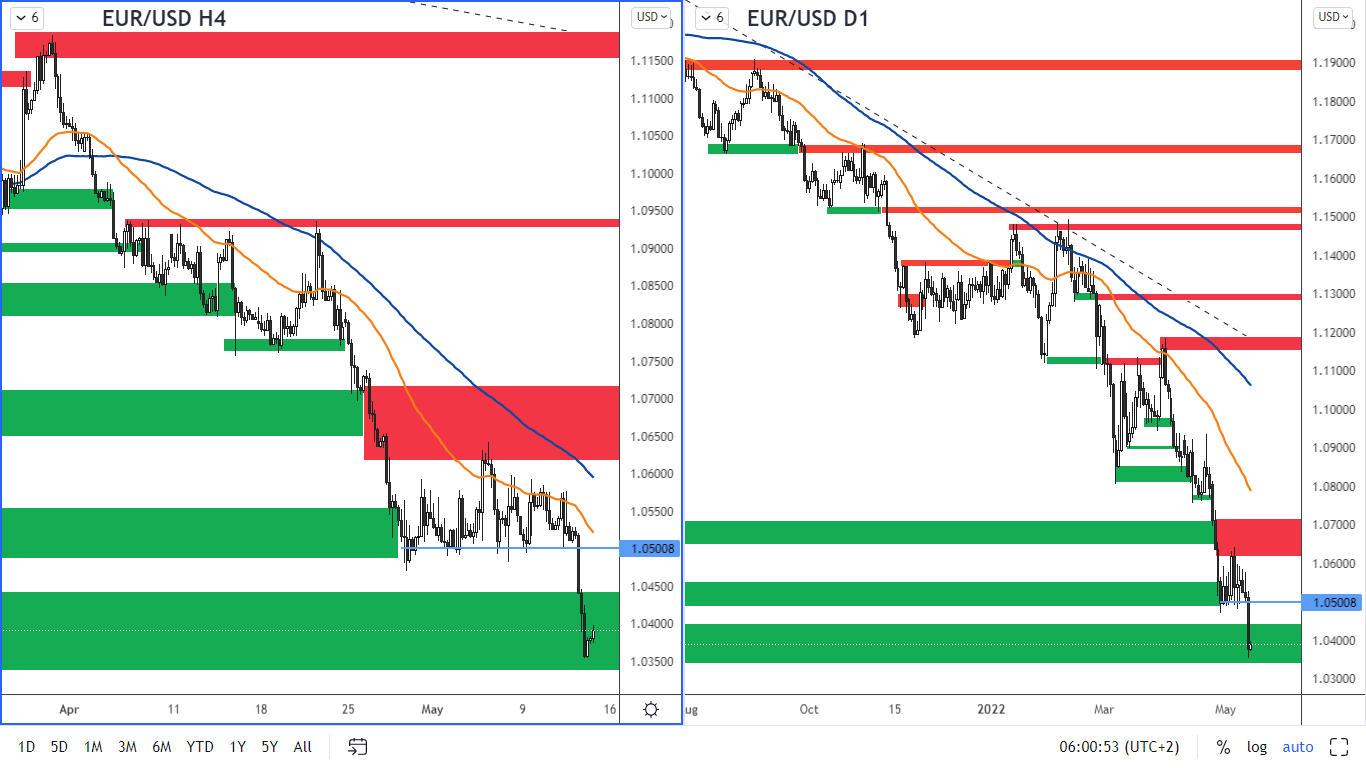

The big sell-off in the euro continues

The euro fell to 1.0356 against the dollar, the lowest value since January 2017. This value is also an area of significant support where price could stall.

Fundamentally, the euro's depreciation is due to the strong dollar and the Fed's hawkish policy, which contrasts with the ECB's policy of not raising rates yet.

Figure 4: The EURUSD on H4 and daily chart

Figure 4: The EURUSD on H4 and daily chart

Eurozone inflation data will be reported next week, which could be an important catalyst for further movement. The significant support is priced around 1.0350 - 1.040. The current resistance is at 1.05.

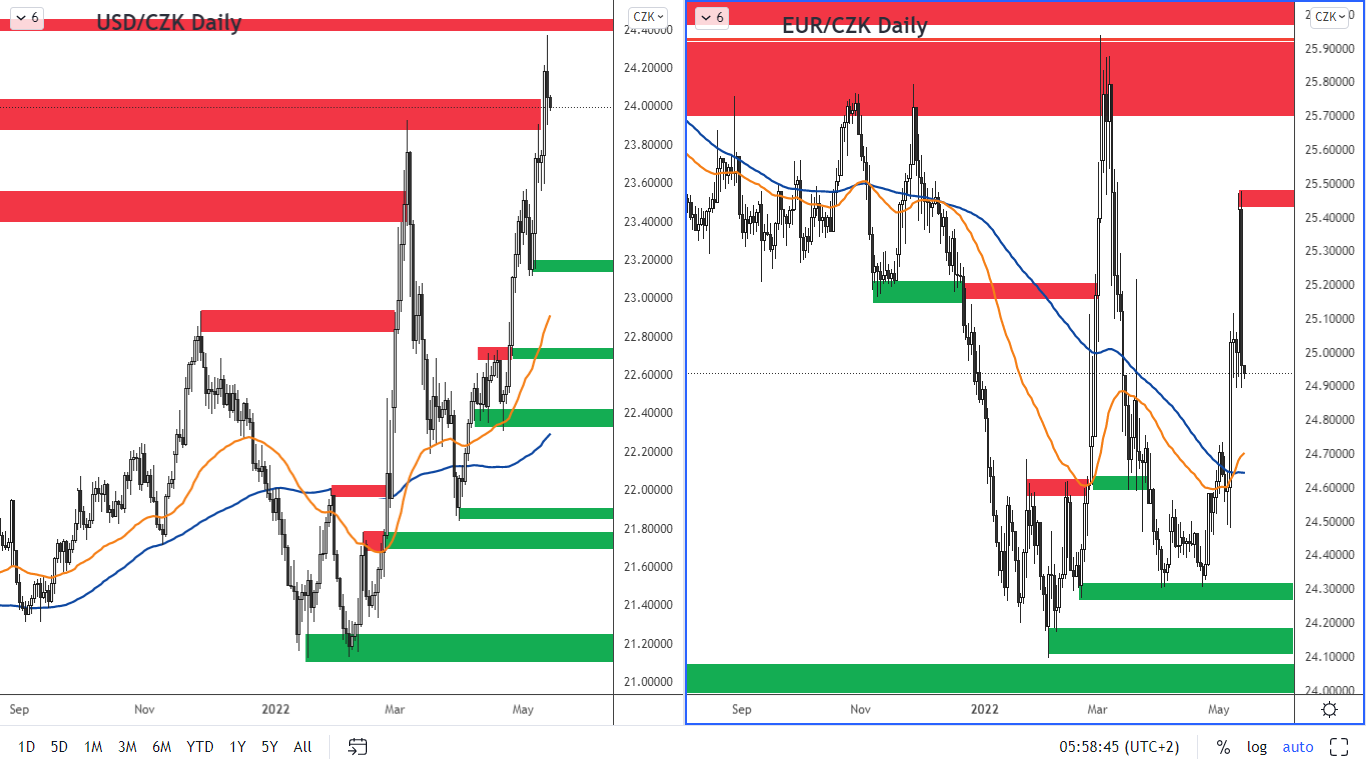

Czech koruna weakened strongly on the new governor appointment

The President Miloš Zeman surprised with the appointment of Ales Michl for the governor of the CNB. Michl is known for his dovish views, having spoken out against raising interest rates at recent meetings. His appointment was welcomed in the markets by a strong depreciation of the Czech koruna.

However, the bank later intervened in the markets by selling part of its foreign exchange reserves to prevent further depreciation of the Czech koruna.

It is important to know that the Bank's monetary policy is decided by the seven-member Bank Board. So far, the proportion for voting on rate hikes has been 5:2. But by the end of June, the president must appoint 3 new board members. This could significantly change the voting ratio on the board and set a new course for the bank's policy, which would mean a halt to the rise in interest rates. However, it is likely that at the June board meeting the board, still with the old composition, will decide on further interest rate increases.

Figure 5: The USD/CZK and the EUR/CZK on the daily chart

Figure 5: The USD/CZK and the EUR/CZK on the daily chart

The Czech koruna has reached 24.36 against the dollar and 25.47 against the euro, from which it started to descend after the CNB interventions.