3 most famous examples of successful shorting in history

Now you know what shorting is and how to use it when speculating on falling share prices with CFD contracts. However, there is a big gap between theory and practice. So let's take a look at some of the most famous "shorts" that have made history. They might just inspire you to make similarly successful trades.

Jesse Livermore - the pioneer of day trading

One could write a very extensive article or even a book about Jesse Livermore's life (one such book, Reminiscences of a Stock Operator, has even been published). However, it is possible that you have never heard of this trader. Yet it is Jesse Livermore who is considered the

pioneer of intraday trading. Since he was active mainly in the early 20th century, he is not well known among the current generation of traders. However, some of his speculations have gone down in history. His ability to predict stock market crashes even earned him the nickname

"the bear of Wall Street".

His first known short came in 1906, when Livermore

successively shorted over 20,000 shares of the Union Pacific railroad company. A few months earlier, he had been riding a bull run, and his instincts told him that the bubble was about to burst. Let us just recall that in the early 20th century it was very difficult to trade using the fundamental analysis because the

information was scarce and often unavailable as large number of companies did not even publish their financial results. Moreover,

manipulating the markets was much easier back then than it is today, and many traders took advantage of that fact. Livermore had no choice but to rely on his instincts.

So he

looked for opportunities to speculate on the market downturn, and the choice fell on the Union Pacific railroads. He first shorted 5,000 shares, but then came the great tragedy that made Livermore rich. A

major earthquake on the west coast of the USA destroyed almost 80% of San Francisco and killed over 3 000 people. Livermore felt that the newspapers were not reporting the true extent of the tragedy and gradually shorted 20,000 shares of Union Pacific. This bet paid off handsomely, and Livermore

made over $250,000 on a single trade.

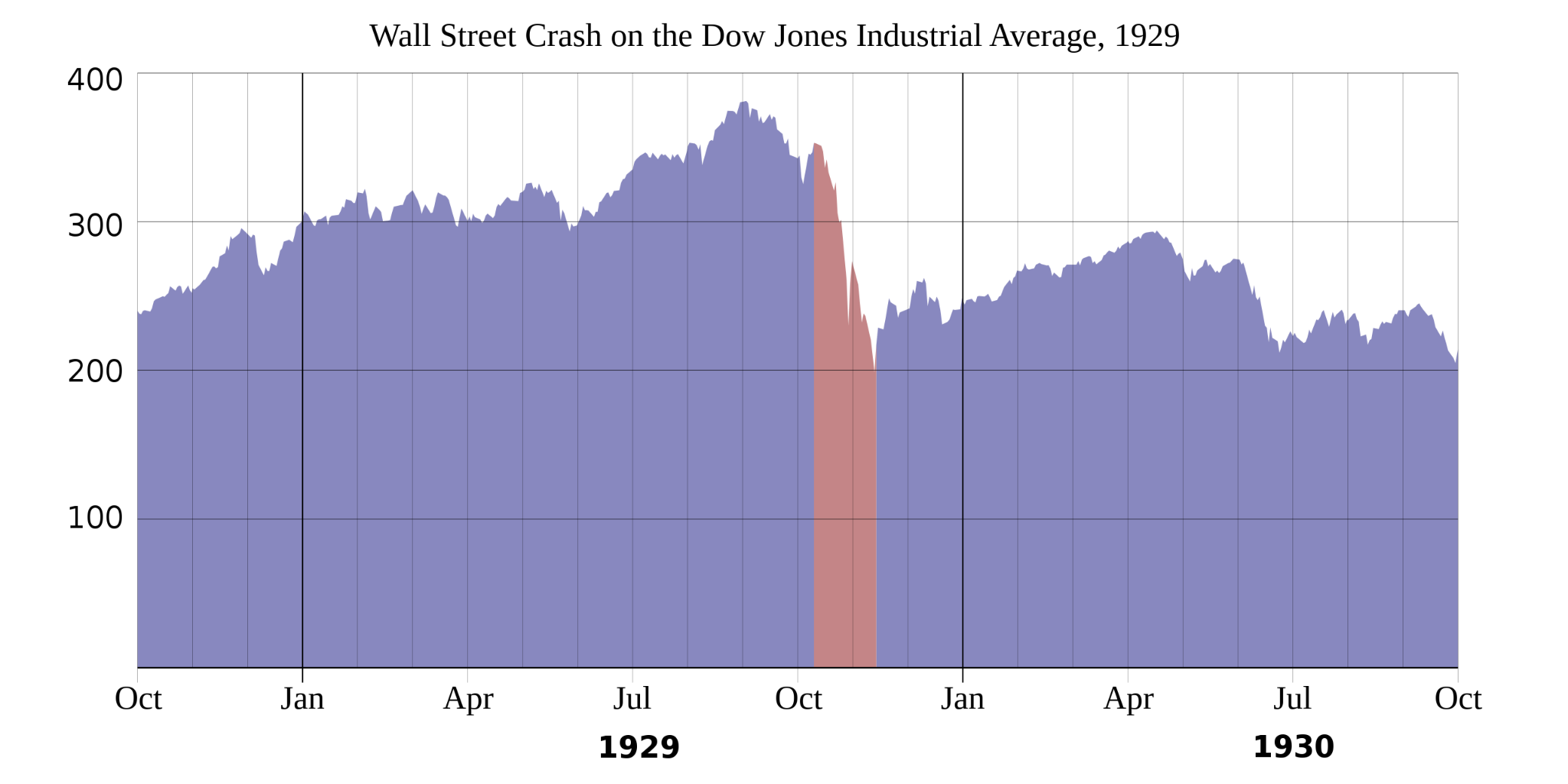

Chart 1: The evolution of the Dow Jones index from 1929 to 1930. Source.

His biggest victory, however, came more than 20 years later. Livermore once again showed great instincts and gradually sold off all his

long positions and in turn built a large short position in the stock markets before the Great Depression of 1929. On Black Friday, October 29, 1929, Livermore reportedly made as much as $100 million in the historic stock market crash. This drew the ire of many Americans, who

lost virtually everything in the Depression, to Livermore. His story does not have a happy ending though as he gradually lost his fortune and

depression drove him to suicide in 1940.

David Einhor - the man who predicted the collapse of Lehman Brothers

Fast forward almost 80 years into the future, markets are no longer overseen by the

SEC and manipulated as easily as they were in the early 20th century. Yet, relatively often, a great opportunity to speculate on falling stock prices appears.

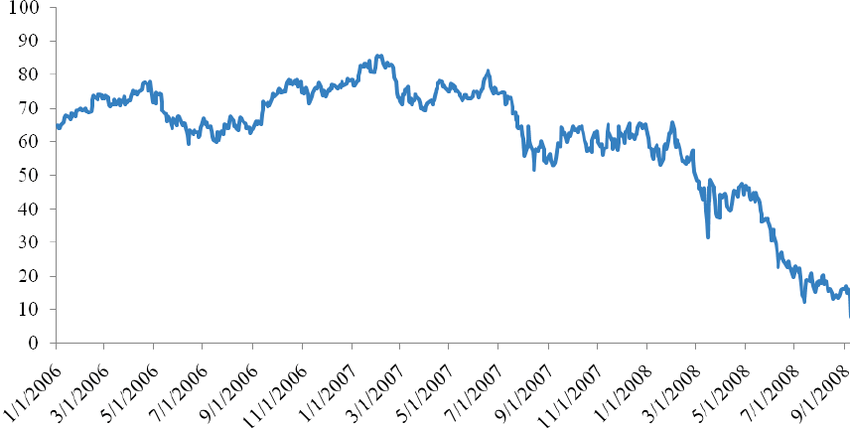

David Einhorn was already a well-known trader before the 2008 mortgage crisis. In 1996, he founded the hedge fund GreenLight Capital, which focused on long/short positions. However, he is most famous for his short

position on Lehman Brothers stock, which his fund entered in July 2007 - more than a year before the

bank's actual collapse.

What led David Einhorn to make such a risky bet? Einhorn believed that Lehman Brothers had high exposure to illiquid mortgage investments and that these investments were not properly recorded on the bank's books. Einhorn even went public and called Lehman Brothers' accounting methods questionable. The genius of this move began to show in March 2008, when investment bank Bear Stearns was bailed out by the US Federal Reserve. Lehman Brothers was considered to be even more at risk than Bear Stearns, as confirmed by the bank's subsequent financial results, which showed a

loss of USD 2.8 billion for the quarter. Within a couple of months, Lehman Brothers went completely bankrupt. David Einhorn then

made hundreds of millions of dollars on his shorts.

Chart 2: Evolution of Lehman Brothers shares since 2006. Source.

Chart 2: Evolution of Lehman Brothers shares since 2006. Source.

But David Einhorn wasn't the only one who made a fortune from the mortgage crisis. Each of you has probably seen the

movie The Big Short or maybe even read the book by the same title. The main characters are a group of traders who predicted the bursting of the mortgage market bubble. To speculate on the market decline, however, they did not short stocks themselves, but CDOs (collateralized debt obligations). The founders of

Cornwall Capital, Charlie Ledley and Jamie Mai, were already quite successful "shorters" before the mortgage crisis itself. Their analysis and instinct told them that the

mortgage bubble was about to burst, so they decided to short CDOs by buying credit default swaps. Both

made over $80 million on their speculation.

Even more successful was

Michael Burry, who is the founder of Scion Capital and one of the main characters in The Big Short. Burry was probably the first investor to realise that the US was facing an

economic crisis caused by mortgage defaults. So Burry got the big banks to sell him credit swaps on the mortgages he thought were most vulnerable. The bet eventually paid off and

Burry made a profit of over $700 million for his fund.