Positions of large speculators according to the COT report as at 19/2/2021

The total net positions of speculators in the USD index fell by 400 contracts last week. This change is the result of a decrease in net long positions by 100 contracts and an increase in short positions by 300 contracts. The total net positions of speculators in the USD index have been negative for 15 weeks in a row.

According to the COT index, the positions of large speculators are at extreme values, however, from the point of view of price action analysis, the reversal of the trend has not yet been confirmed. Therefore the US dollar might continue to weaken.

Total net positions increased in the British pound, the New Zealand dollar and the Japanese yen. By contrast, total net positions fell in the euro, the Australian dollar, the Canadian dollar and the Swiss franc.

The positions of speculators in individual currencies

|

|

19/2/2021

|

12/2/2021

|

5/2/2021

|

29/1/2021

|

22/1/2021

|

15/1/2021

|

|

USD index

|

- 14 300

|

-13 900

|

-14 800

|

-14 700

|

-14 300

|

-13 900

|

|

EUR

|

140 000

|

140 200

|

137 000

|

165 300

|

163 500

|

155 900

|

|

GBP

|

22 200

|

21 100

|

9 700

|

8 000

|

13 700

|

12 900

|

|

AUD

|

- 2 800

|

-200

|

-1 500

|

800

|

4 900

|

5 500

|

|

NZD

|

13 700

|

11 500

|

11 600

|

14 800

|

16 000

|

14 700

|

|

CAD

|

8 200

|

9 500

|

16 100

|

13 800

|

10 300

|

12 100

|

|

CHF

|

8 400

|

11 400

|

14 600

|

10 100

|

9 400

|

12 000

|

|

JPY

|

37 200

|

34 600

|

44 600

|

45 000

|

50 000

|

50 500

|

Table 1: Total net positions of large speculators

Notes:

Large speculators are traders who trade large volumes of futures contracts, which, if the required limits are met, must be reported to the Commodity Futures Trading Commission. Typically, this includes traders such as funds or large banks. These traders mostly focus on trading of long-term trends.

Total net positions are the difference between the number of bullish long contracts and the number of bearish short contracts. The data is published every Friday and is delayed because it shows the status on Tuesday of the week.

The sentiment of large speculators will allow you to see what position this group occupies in the market. It is important to monitor the overall trend of total net positions, but also separately the trend of bearish short positions and the trend of bullish long positions. Extreme values of total net positions are also important as they often serve as signals of a trend reversal.

It is also important to monitor the turning points, when the total net positions change from bullish sentiment to bearish and vice versa. These inflection points are indicated in the graphs in section 3.

The chart compares the current value of the total net positions of large speculators with the value 3 years ago. A score of 0% means that speculators are at their lowest levels in 3 years. A score of 100% means that speculators are at the highest values in the last 3 years. A value of 80% or more means that speculators are extremely bullish, and a value of 20% or less means that speculators are extremely bearish.

Detailed analysis of selected currencies

Explanations:

-

Purple line and histogram in the chart window: this is information on the overall net position of large speculators.

-

Green linein the indicator window: these are the bullish positions of large speculators.

-

Red line in the indicator window: indicates the bearish positions of large speculators.

If there is a green line above the red line in the indicator window, then it means that the overall net positions are positive, i.e. that bullish sentiment prevails. If, on the other hand, the green line is below the red line, then bearish sentiment prevails and the overall net positions of the big speculators are negative.

Charts are made with the use of www.tradingview.com.

Euro

|

Date

|

Weekly change in open interest

|

Weekly change in total net positions of speculators

|

Weekly change in total long positions of speculators

|

Weekly change in total short positions of speculators

|

Sentiment

|

|

19/2/2021

|

2 600

|

-200

|

2 000

|

2 200

|

Bullish

|

|

12/2/2021

|

-2 400

|

3 200

|

4 000

|

800

|

Bullish

|

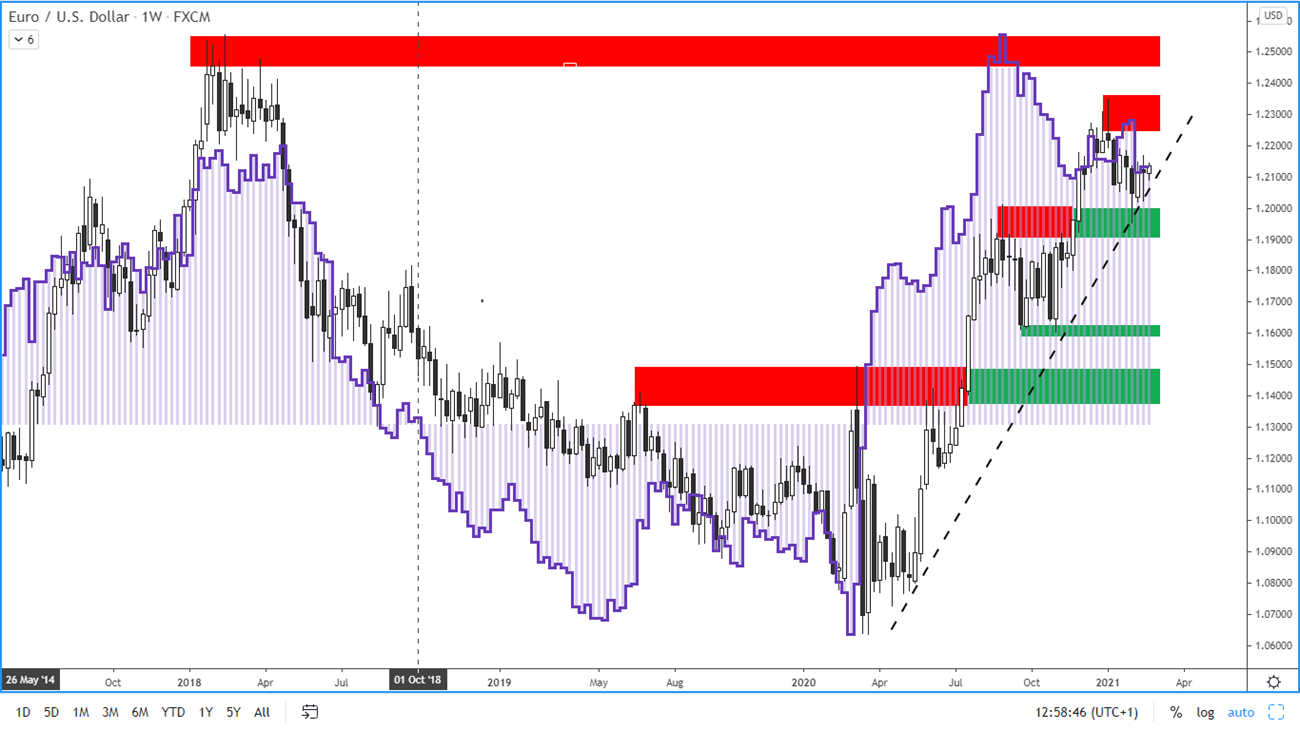

Figure1: The euro and COT positions of large speculators on a weekly chart

Total net positions fell by 200 contracts last week. This change is due to an increase in net long positions by 2,000 contracts and an increase in net short positions by 2,200 contracts.

The euro price opened and closed at about the same level last week. From the point of view of technical analysis, the euro continues to be in a rising trend.

Long-term resistance: 1.2250 - 1.2340

Long-term support: 1.1940 - 1.2000

The British Pound

|

Date

|

Weekly change in open interest

|

Weekly change in total net positions of speculators

|

Weekly change in total long positions of speculators

|

Weekly change in total short positions of speculators

|

Sentiment

|

|

19/2/2021

|

1 100

|

1 100

|

-200

|

-1 300 |

Bullish

|

|

12/2/2021

|

9 100

|

11 400

|

6 800

|

-4 600

|

Bullish

|

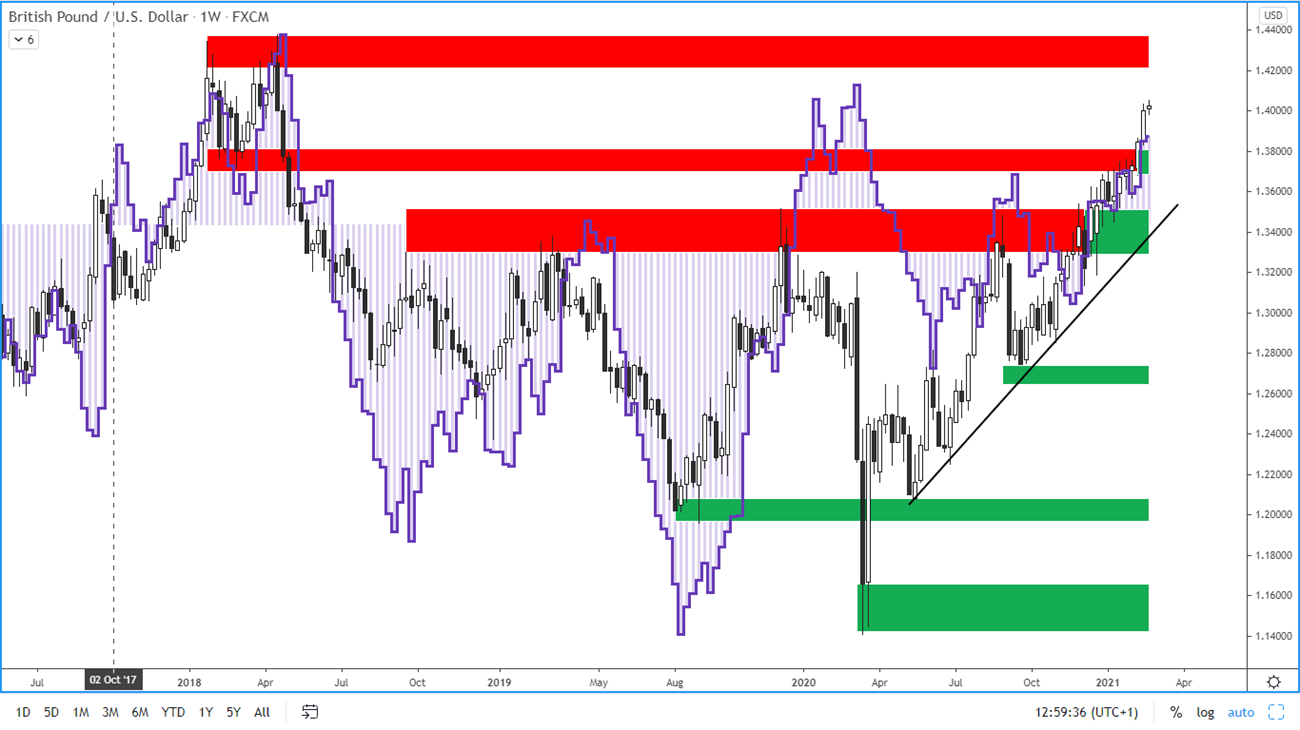

Figure 2: The GBP and COT positions of large speculators on a weekly chart

Last week, total net positions rose by 1,100 contracts. This change is the result of an increase in net long positions by 200 contracts, while net short positions decreased by 1,300 contracts. Open interest in futures contracts is growing, confirming a strong growing trend.

The pound continued to strengthen last week, breaking the resistance level at around 1.38 and it is continuing to grow.

Long-term resistance: 1.42-1.4350

Long-term support: 1.37-1.38200

The Australlian Dollar

|

Date

|

Weekly change in open interest

|

Weekly change in total net positions of speculators

|

Weekly change in total long positions of speculators

|

Weekly change in total short positions of speculators

|

Sentiment

|

|

19/2/2021

|

500

|

-2 600

|

-1 300

|

1 300

|

Bearish

|

|

12/2/2021

|

-2 150

|

1 300

|

200

|

-1 100

|

Weak bearish

|

Figure 3: The AUD and COT positions of large speculators on a weekly chart

Last week, total net positions fell by 2,600 contracts. This change is due to a decrease in long positions by 1,300 and an increase in short positions by 1,300 contracts.

The Australian dollar strengthened sharply last week, surpassing the resistance level, which has now become a new support level.

Long-term resistance: 0.810-0.8200

Long-term support: 0.7750-0.7810

The New Zealand Dollar

|

Date

|

Weekly change in open interest

|

Weekly change in total net positions of speculators

|

Weekly change in total long positions of speculators

|

Weekly change in total short positions of speculators

|

Sentiment

|

|

19/2/2021

|

-600

|

2 200

|

1 100

|

-1 100

|

Bullish

|

|

12/2/2021

|

-2 030

|

-100

|

1 400

|

-1 200

|

Bullish

|

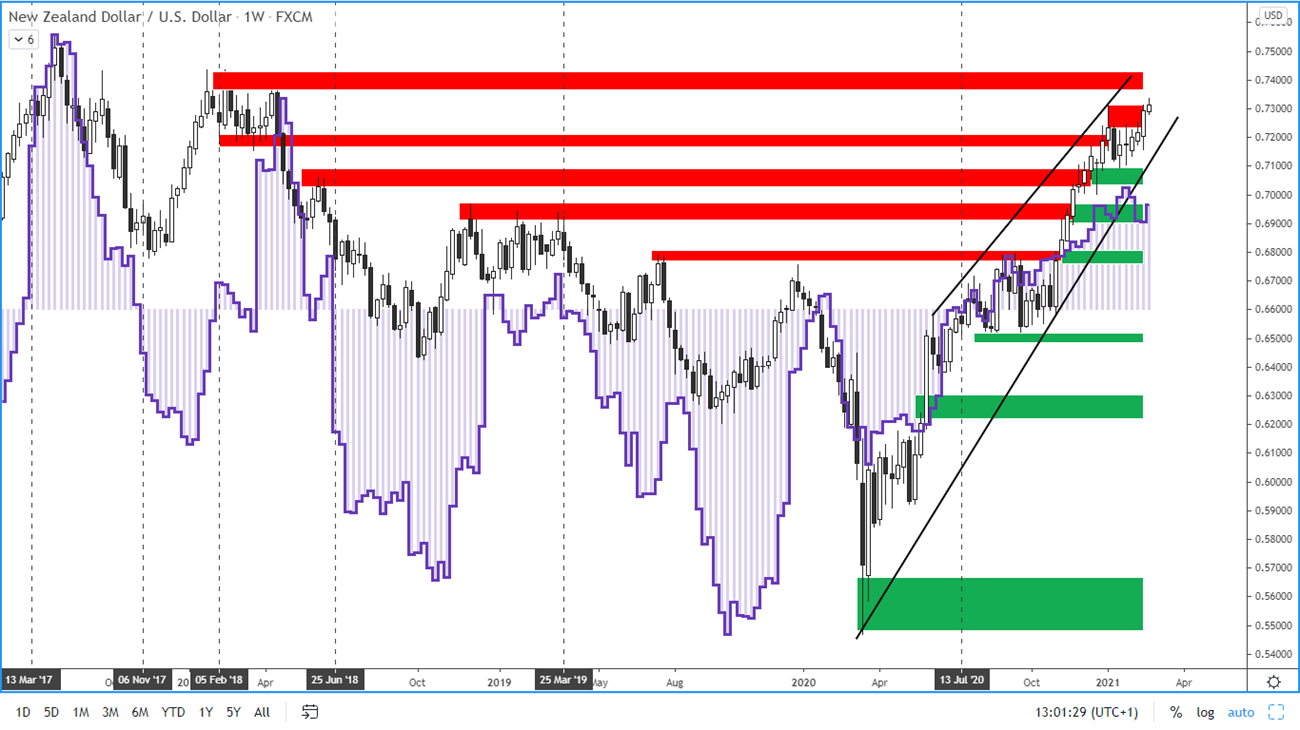

Figure 4: The NZD and the position of large speculators on a weekly chart

Last week, total net positions grew by 2,200 contracts. This change is the result of an increase in net long contracts by 1,100 and a decrease in net short contracts by 1,100.

The NZDUSD price strengthened strongly last week and closed at the top of the current resistance band. If a breakthrough occurs, then the next resistance is in the range 0.7370 - 0.7420.

Resistance: 0.7230-0.7320

The nearest support: 0.7050-0.7100