Technical analysis as at October 13, 2019

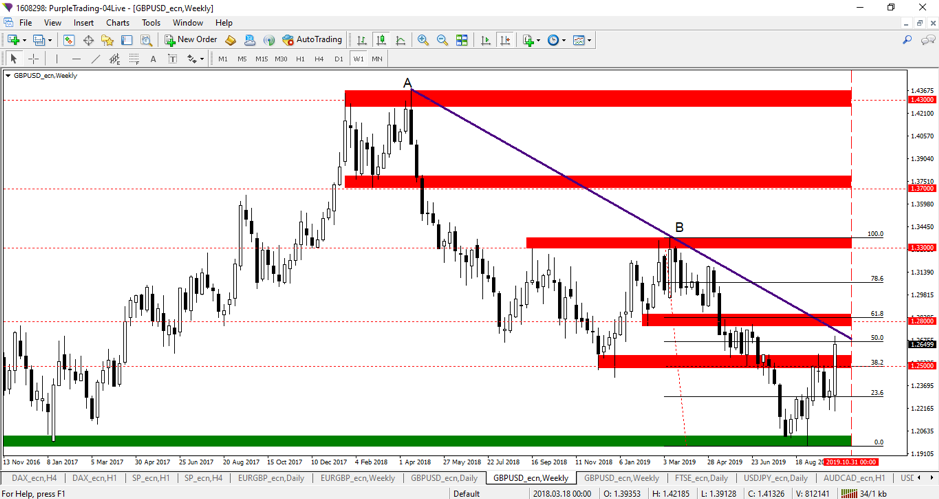

The GBPUSD currency pair offered us a really strong move over the past week. The price opened at 1.23 and closed at 1.265. The high was even 1.27. So, on the weekly chart, see Figure 1, a strong bullish candlestick was created last week that broke through the first resistance zone. This candlestick could indicate a further upward move.

Figure 1: The GBPUSD on weekly chart

Figure 1: The GBPUSD on weekly chart

At the same time, we can see that the price is close to the next resistance zone and also near to the downward trend line. In order to break these lines, a very strong impulse would have to come, which could be a definitive statement that the Brexit agreement was reached.

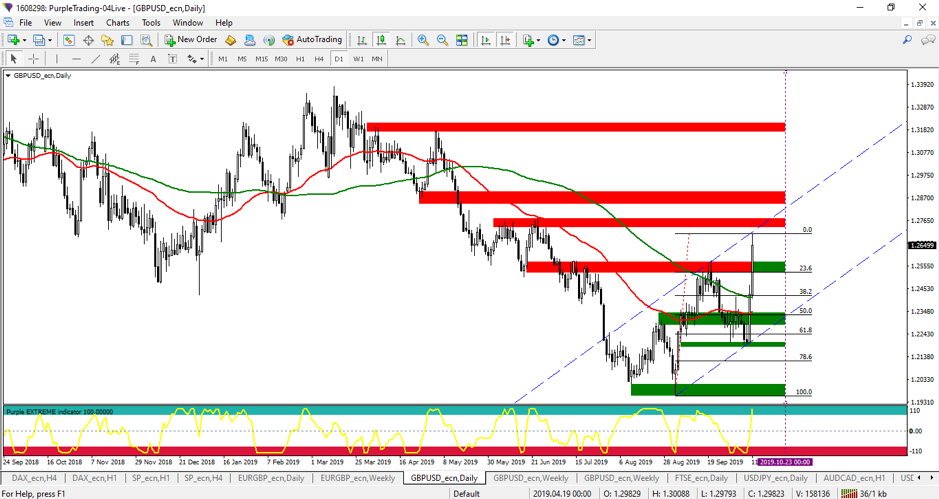

In the daily chart, see Figure 2, we can see that in the past week the price first dropped to support level 1.22, which we pointed out in the previous article. Then, on Thursday and Friday, the price rose sharply, breaking through the resistance, which was the moving average of the SMA 100, and the resistance, which was the last high at 1.257, which has now become a support.

We can also see that a higher high and a higher low formed, which in terms of price action means that the previous downward trend reversed. We have drawn the current growing channel into the chart and updated Fibonacci levels.

Figure 2: GBPUSD on daily chart

Figure 2: GBPUSD on daily chart

Since the price is close to the resistance levels, it will be appropriate now to wait for a price correction if we want to speculate long. For example, if the price fell to the bottom of the growing channel, there could be trade entries.

Resistance 1 is at the level around 1.270-1.2770.

Resistance 2 is approximately 1.2850 - 1.290. Here, there is a confluence with the Fibonacci level 61.8 and the resistance that was created on May 17, 2019 by breaking the previous support, see Figure 1.

Resistance 3 is at the level 1.3180-1.3200.

Support 1 is now in the zone 1.2530-1.2570.

Support 2 is in the band around the level 1.2330. This level is a confluence of the lower line of the growing channel and the Fibonacci level 50.0, see Figure 2.

Support 3 is at the level 1.22, where the last higher low was formed. Should the price fall below this level, it can be expected for the price to test the level 1.20 again. This scenario could happen in particular if the Brexit agreement is not concluded and if there is a risk of no-deal Brexit without the agreement.

Should it be announced that the United Kingdom has finally agreed with the EU on the new version of Brexit agreement, this currency pair can be expected to strengthen further.

What awaits us this ‘super’ week?

We can call this week as a ‘super week’, because there will be two major meetings based on which it will be definitely clear whether Brexit will be on October 31, 2019 or whether it will be postponed. The conclusions drawn from the meeting between prime ministers Johnson and Varadakar need to be further officially confirmed now.

First, the draft agreement submitted by the British Government must be approved at the European Council meeting on September 17 and 18, 2019.

After that, the British parliament will meet at the weekend. For the first time in this century, parliament meeting will take place on Saturday, namely October 19, 2019. At this meeting it will be decided whether the agreement that prime minister Johnson negotiated with the EU, will be approved or not

. If the agreement is approved, then Brexit could occur on October 31, 2019. If it is not approved, the prime minister is obliged by law to ask the EU to postpone Brexit until January 31, 2019.

If the agreement is not approved by the British Parliament, it is possible that the next step will be the vote of no confidence in Boris Johnson's government.

From the UK's macroeconomic data, employment data, namely the Unemployment Index, Claimant Count Change and Average Earnings will be reported on Tuesday. Inflation data (CPI Index) will be reported on Wednesday and data on Retail Sales will be released on Thursday.

The GBPUSD currency pair may also be affected by US data. Data on Retail Sales will be presented on Wednesday and further information will be provided on the development of demand on the property market (the so-called U.S. Building permits) on Thursday .

Important: depending on the decision of the British Parliament to approve or not to approve the Brexit agreement, a large gap on all GBP currency pairs can be expected when the market opens on 20 October 2019.