Two Nasdaq indices

The other Nasdaq index, although less known, is the Nasdaq Financial 100, which consists of banking companies, insurance firms, brokerage firms, and Mortgage loan companies.

The technology Nasdaq 100 index is often confused with the Nasdaq Composite Index. The latter index (frequently referred to as "The Nasdaq") includes the stock of every company that is listed on the NASDAQ exchange (more than 3,000 companies) and therefore is not that sector dominant, such as the technology or the finance Nasdaq indices.

Nasdaq 100 calculation

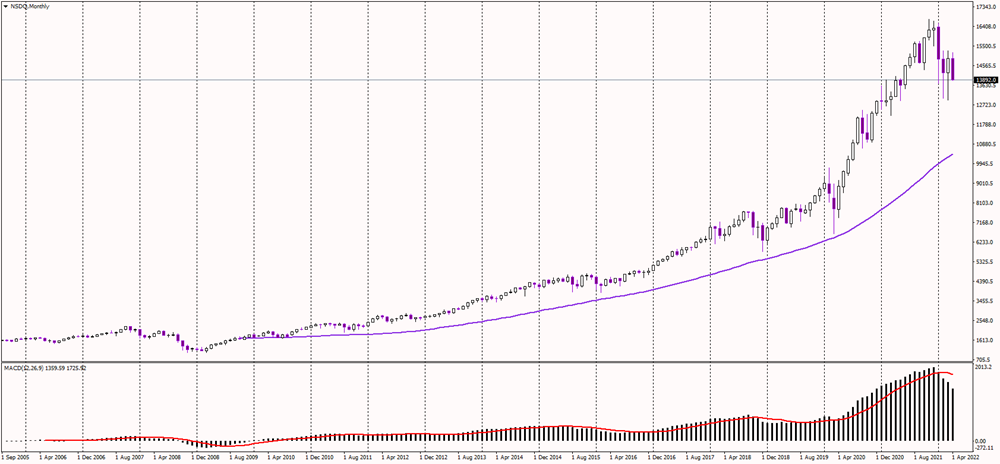

The index is calculated by taking the total value of the share weights of all the stocks in the index, multiplied by each security's closing price. It is then divided by an index divisor to determine the current index value. As of April 2022, the Nasdaq 100 index oscillates in the 14,000 USD area.

The technology sector is usually more volatile than other sectors, thus making the Nasdaq 100 index a more risky play among investors. However, the returns tend to exceed the SP500 index.

Performance

As shown on the monthly chart of the Nasdaq 100 index, the long-term bull market has remained intact since the Financial crisis in 2008, and the index is up circa 1,250% from its post-financial crisis lows, making it the best performing index out of the US major benchmark indices. Over the years, there have been some corrections, but investors always “bought the dip,” pushing the index to new all-time highs. In early 2022, the index fell 10% amid rising inflation, US yields, and the war in Ukraine, and it is yet to see whether it is a start of a more significant correction or the bull market will continue.

Source: Purple Trading Metatrader 4