What drives the EURGBP cross?

The EURGBP’s price is essential for both the European Union and the United Kingdom, as both these blocs are trading in huge volumes between each other. Therefore, if one of the currencies weakens a lot (for example, the Pound after the Brexit referendum), one country will benefit from it greatly (due to exports being cheaper). The other country might suffer (due to exports being more expensive, thus, less competitive).

As always, the most crucial driver of the EURGBP cross is the difference in the monetary policies of the central banks. However, as previously mentioned, the Brexit had a significant impact on the price as well.

Short-term traders can rely on the technical analysis and its tools, but long-term traders and investors should closely track the difference between real rates. The political situation in the United Kingdom will most likely continue to influence the EURGBP cross as well.

Performance

One glance at the EURGBP cross can tell us everything necessary. As we said earlier,

the Pound fell sharply ahead of and after the Brexit referendum. The price rose from 0.70 to 0.90 in a matter of months. Afterward, the cross consolidated for three years and showed no clear trend. Some volatility came in 2019 and 2020, but the price always returned to the neutral zone at around 0.85. We can assume that this trendless trading could continue unless there are some new political or economic changes either in the UK or in the EU.

Source: Purple Trading Metatrader 4

EURGBP cross – quotes and trading

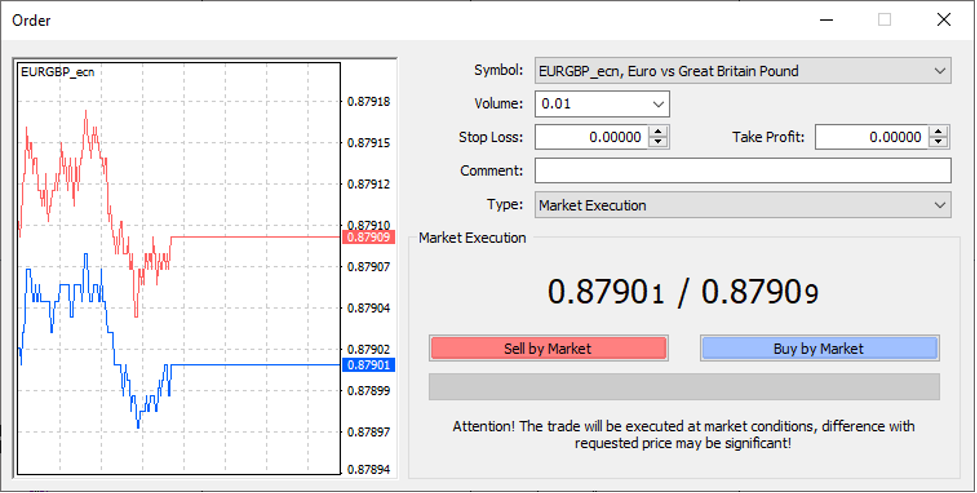

If you are interested in trading the EURGBP cross, open our Metatrader 4 platform and find the EURGBP cross in the symbols. When you click on the new order, the following window will appear.

Source: Purple Trading Metatrader 4

As you can see, the spread between the Ask and the Bid price is 0.8 pips, but the spread can fluctuate slightly, mainly during volatile times of the day.

Lot value calculation

The minimum amount to trade is 0.01 lot, while one lot represents 100,000 EUR. So, if you are trading 0.01 lot (or a micro lot), you will be trading 1,000 EUR. The 0.1 lot is also called a mini lot and represents 10,000 EUR. If you want to buy or sell half a lot, you will be trading 50,000 EUR. Two lots are 200,000 EUR and so on.

Please keep in mind that the Pound is one of the most volatile major currencies, so be careful when trading it.

Besides, you can open a market execution trade, which means that it will be done at the current market price, or you may use pending orders – limit and stop orders. Finally, it is possible to use the stop-loss and take-profit orders when opening the trade, or you can add them later when the deal is live.