Brexit in a week from 21/10 – 28/10/2019

Last week, the GBP slightly depreciated as markets absorbed a new situation when it became probable that Brexit does not occur on October 31, 2019. This week it will be decided what the next Brexit deadline will be and whether and when the early elections to the British Parliament will be held. A very significant impulse for the GBP may come from America, where further interest rate cuts are expected. More detailed information on it is provided below.

Fundamental analysis

After failing to vote on Brexit withdrawal agreement on October 19, 2019, Boris Johnson tried to push through the Brexit Withdrawal Agreement Bill in the British Parliament on October 22, 2019. However, this was rejected by the Parliament on the grounds that the deadline for discussing and studying the bill was set at only 3 days, whereas the standard period is several weeks. It is now very probable that Brexit will not occur on October 31, 2019.

On October 28, 2019 the EU proposed an extension of Brexit with a flexible deadline until January 31, 2020 and the UK is expected to comment on this.

From UK macroeconomic data, CBI Industrial Trend Orders were first reported on Tuesday last week, reaching -37 (previous period - 28), indicating a deterioration in economic conditions in the manufacturing sector. On Thursday, data on the number of newly approved mortgages (the so-called U.K. Gross Mortgage Approval) were presented, which amounted to 42,300 mortgages (compared to 42,600 in the previous period).

From the US data affecting the GBPUSD currency pair, the U.S. property sales data, (Existing Home Sales), were reported and which amounted to 5.38 million properties (5.50 million properties for the previous period).

On Thursday, the order data in the manufacturing sector, (the U.S. Durable Goods Orders), were released, which reached - 0.3% (versus 0.3%). Also, PMI (Purchasing Managers' Index) data for the manufacturing sector, which was 51.5 (compared to 51.1) and for the service sector, which reached 51 (previous period 50.9) were presented.

Technical analysis as at October 27, 2019

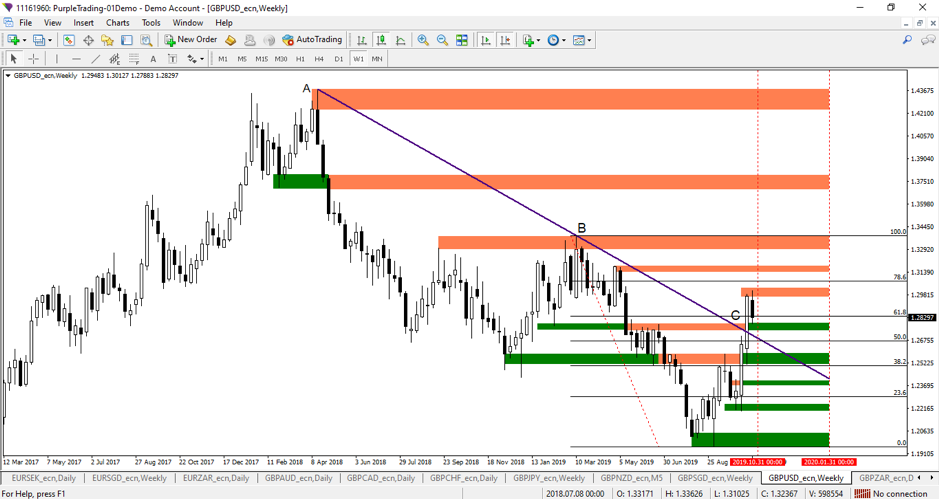

After two weeks of strong growth, the GBPUSD made a minor correction last week. The price opened at 1.2948 and closed at 1.2829. High reached 1.3012. In the weekly chart, see Figure 1, we can see that the price formed a bearish candlestick and halted on the first support zone.

Figure 1: The GBPUSD on weekly chart

Figure 1: The GBPUSD on weekly chart

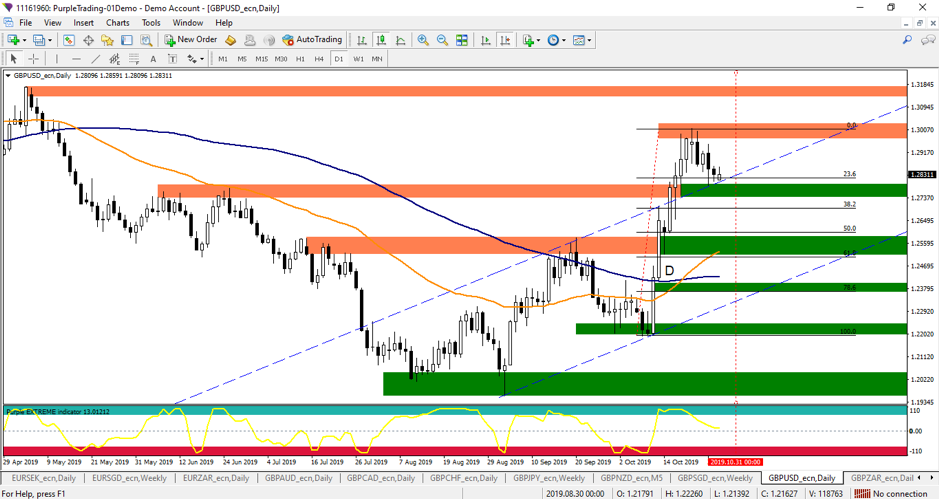

In the daily chart, see Figure 2, we can that in the past week the price did not create a higher high and remained at the 1.2780 support level. At the same time, the price stopped at the upper line of the raising channel.

Higher highs and higher lows in terms of price action means that the previous downward trend has reversed, and crossing of moving average EMA 50 (orange line) above the SMA 100 (blue line) at point D also indicates an upward trend.

Figure 2: The GBPUSD on daily chart

Figure 2: The GBPUSD on daily chart

For potential speculation in the long direction, it would be appropriate to wait for the correction and the price to fall to some significant level of support. The level of 1.2500 - 1.2600 seems ideal for these purposes. First, it is 50% Fibonacci retracement, and it is also the level where previous significant resistance was broken. For the correction speaks the fact that the delay of Brexit basically does not solve anything as it just prolongs the existing uncertainty.

Resistance 1 is at a level of about 1.3000 - 1.3050. From Figure 1, it is around 78.6% of Fibonacci retracement and it is the area from which the previous significant price decrease was triggered.

Resistance 2 is at a level around 1.3150 - 1.3200.

Resistance 3 is approximately between 1.3300 - 1.3370.

Support 1 is now in a zone 1.2740-1.2780.

Support 2 is in the range around 1.2550 - 1.2600. This level is a confluence of the Fibonacci level 50.0%, see Figure 2, and the break of a previous resistance. Reactions may also occur at 1.2500, where 61.8% Fibonacci retracement is.

Support 3 is at 1.2350-1.2400, where the Fibonacci level 78.6% is.

Support 4 is at 1.2200-1.2250, where the last higher low was created. If the price falls below this level, the 1.20 level may be tested.

If there was a totally unexpected surprise and on 31. 10. 2019 there would be a hard brexit, the British pound would fall very sharply. However, this probability is minimal.

What awaits us this week?

Boris Johnson, on Monday, October 28, 2019, tried to push through early parliamentary elections. He needed 2/3 votes to succeed. But this step did not work out. Therefore, he will try to push through the law on early elections on December 12, 2019 in the Parliament again. To succeed in this, he only needs a parliamentary majority but he will have to rely on some opposition MPs.

Furthermore, the United Kingdom is expected to confirm the EU proposal for a further extension of Brexit until 31 January 2019. Besides that, the opposition may vote on no - confidence in government at any time.

From the UK's macroeconomic data, Nationwide HPI data will be first reported on Tuesday this week. Consumer confidence data will be announced on Thursday and important PMI data in the manufacturing sector will be reported on Friday.

The impact of the GBPUSD currency pair may also be affected by US data. And this week there will be a very important Wednesday's meeting of the Fed, where interest rates will be discussed. Analysts expect the Fed to decide to lower the rate from 2% to 1.75%. In addition, very important employment data (Non Farm Payrolls) will be presented on Friday.