What market sectors currently have high growth potential?

Rising yields have opened the gap between different sectors in the stock market, and investors are now wondering where the fundaments will send stock markets in the medium term and whether there is still room in the markets for more interesting returns. According to JP Morgan, the first months of this year indicated the current trend.

Cyclical and defensive sectors

Even before the growth of yields and before the beginning of the correction in technological stocks, we could notice that investors' expectations regarding the further development of the stock market are beginning to change slightly. Many of them have begun to turn their attention to stocks that will benefit from the gradual vaccination of the world's population and the consequent return of the economy to normal. Cyclical and more defensive stocks will thus continue to grow inthe medium term. These are companies that copy the economic cycle, both expansion and recession. The specific sectors on which we need to focus our attention are finance, energy, production. Regarding the defensive ones, these will be primary health care and consumer goods. These are sectors that offer consistent profitability and dividends under any stock market conditions.

Financial and consumer stocks can set the pace for the whole market

While the majority of markets are concerned about rising yields and higher rates in the economy, large financial institutions will benefit from higher rates. Therefore, more attention will need to be paid to the shares of banking houses and insurance companies. For the banking sector, this will be an opportunity to further increase the margins that have fallen since the beginning of the pandemic, when rates in the economy fell sharply. Given the expected increase in consumption, we should also pay attention to the consumer sector. Joe Biden's latest stimulus package of less than $ 2 trillion, which includes, among other things, direct $ 1,400 checks to American citizens, should play a big role there.

These sectors should drive stock market growth in the next few months. For example, airlines remain insignificant, for the time being. At this point, they are benefiting from the gradual easing of travel restrictions, but the situation in Europe, for example, is still relatively dramatic and travel will not be at pre-pandemic levels for a long time. However, in the long run, it also offers interesting valuations, but it will not be a sector that should determine the market trend.

What about technologies?

Higher rates have not been very beneficial for the technology sector yet, as the beginning of the year shows. Since the beginning of the pandemic, it was the most popular sector, where valuations simply got too high and the correction was about to fall. Rising revenue still threatens the continued performance of this sector, but certain stocks with interesting investment potential still can be found. From the main technological titles, money is gradually shifting to companies that tend to sell software and computer chips. As several leading carmakers have indicated, thereis still a great shortage of chips and the situation will not improve for several months to come. As there is a global shortage in all sectors, this will push the profitability of these companies and the growth of their shares.

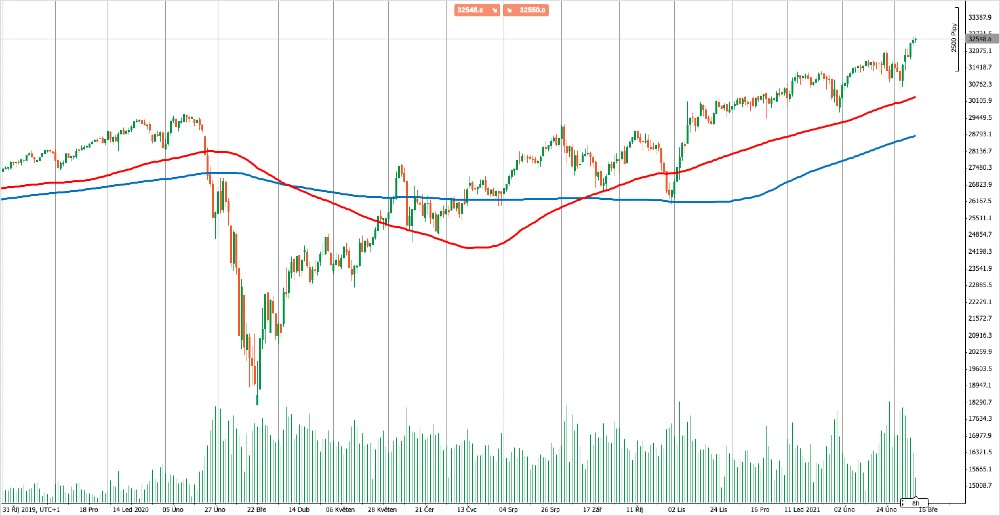

A more conservative approach could be chosen when investing in stock indices. So far, DOW Jones has been at its best since the beginning of the year, containing mainly cyclical and value stocks. The correction on the Nasdaq technology index, on the other hand, offers an interesting opportunity to accumulate longer-term positions.

Chart: Dow Jones Daily Chart (Source: cTrader PurpleTrading)