The year 2022 - Czech interest rates are going up

On May 5th, 2022, the Czech National Bank increased its benchmark two-week repo rate by 75 basis points to 5.75%, the highest level since 1999 and above market estimates of a 50 basis point hike. Since the tightening cycle began in June 2021, the central bank has lifted the rate by 550 basis points (5.5%), one of the quickest paces in Europe, in a bid to slow the rise in consumer prices.

The Czech Republic's annual inflation rate increased to 16% in May 2022, up from 14.2% the previous month and exceeding market predictions of 15.5%. It was the greatest rate of inflation since December 1993, owing to rising energy and food costs as a result of the Ukraine conflict. In the meanwhile, the CNB raised the discount rate and the Lombard rate by 75 basis points, to 4.75% and 6.75%, respectively.

Performance

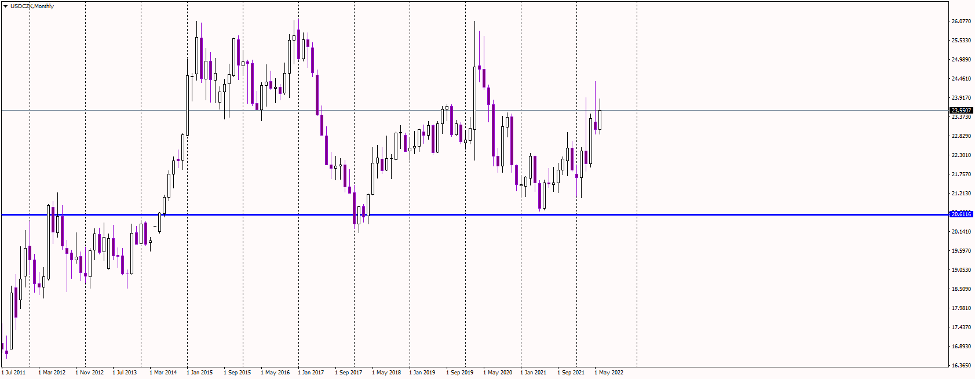

As you can see from the monthly chart, the USDCZK rate has not moved much since 2012. The price looks cyclic, reacting to either domestic or foreign news, but overall, the long-term trend is only slightly bullish, indicating the slow depreciation of the Czech Crown.

On the other hand, the weekly/quarterly cycles could offer enough volatility and momentum to be suitable for swing traders.

Source: Purple Trading Metatrader 4

USDCZK - quotes and trading

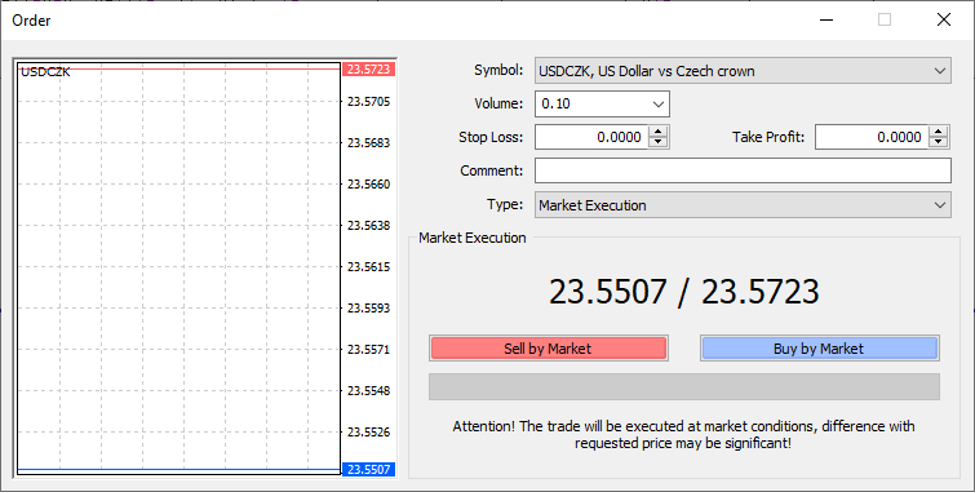

You can trade the USDCZK currency pair in our Purple Trading Metatrader 4 platform. First, find the ticker USDCZK in the MetaTrader 4 platform and press the new order button. The following window will pop up.

Source: Purple Trading Metatrader 4

Lot value calculation

When you open our MetaTrader 4 platform and click on the USDCZK ticker, you'll observe that during moments of strong liquidity, the difference between the Ask and Bid price is roughly 2 pips (usually when London and New York are open for trading).

The minimal volume for trading USDCZK is one micro lot (0.01). If you trade a mini lot (0.1), you will gain or lose 40 USD for each 10 cents USDCZK makes. Every 10 cents of USDCZK movement will yield 200 USD of profit/loss when trading half a lot. For example, you buy half a lot at 23.70, and USDCZK goes to 24.00. Your total profit will be 600 USD (calculated as 30 cents movement * 200 USD profit per 10 cents of the move). When entering a short position, the same principle determines your profit or loss.

Keep in mind that USDCZK is priced in Czech Crowns. Therefore, your profit or loss must be exchanged for EUR at the current exchange rate if your account is in EUR or another currency.

You have the option of trading at market price (market execution) or using pending orders (limit and stop orders). In addition, you can start trading without the stop-loss and take-profit orders and add them later.