The harsh winter in the US pumps up oil prices above $ 60

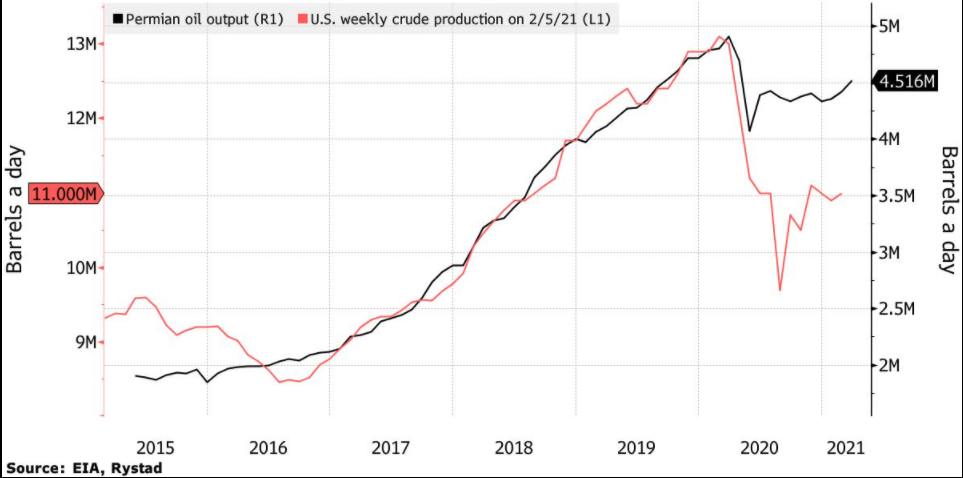

Oil production in the United States has been under very strong pressure in recent weeks, giving the price extra confidence for continuous growth. Production in some parts of Texas has fallen by as much as 70%. Paradoxically, this number still surpasses global demand, which is significantly lower than before the pandemic last year, but with production cuts by the OPEC + oil cartel, it shows us what is the current state of the oil market.

Oil production has declined by a third

Overall US production has witnessed the biggest plunge in recent history, by one-third of its original production. The reason is the unusual winter, which completely "frozen" the production and all the operations associated with it. Overall, production has fallen by approximately 3.5-4 million barrels or perhaps more. We will have to wait until next week for the official numbers. Before the cold front has hit the USA, the oil production was again close to pre-pandemic levels, at 11 million barrels per day. In the Perm Basin, a key area of oil and gas extraction, production fell by 65%.

Chart: Decline in US mining (Source: bloomberg.com)

An unprecedented rise in energy prices

Mining in Texas has stopped due to the extremely low temperatures which freeze oil and gas both in the wellhead and in the pipelines above ground. The question now remains how quickly temperatures will return back to normal and production can be resumed. The production outage could last for several weeks, which would further exacerbate the already tense situation on the oil market. However, due to the supply outage in Texas, other energy prices are also rising. The price of electricity in one day rose from $ 1,490 to $ 8,800 per MWh. Gas prices rose by more than 10% in a few days. Some parts of Texas were even completely without electricity. Up to 3,000,000 households were affected.

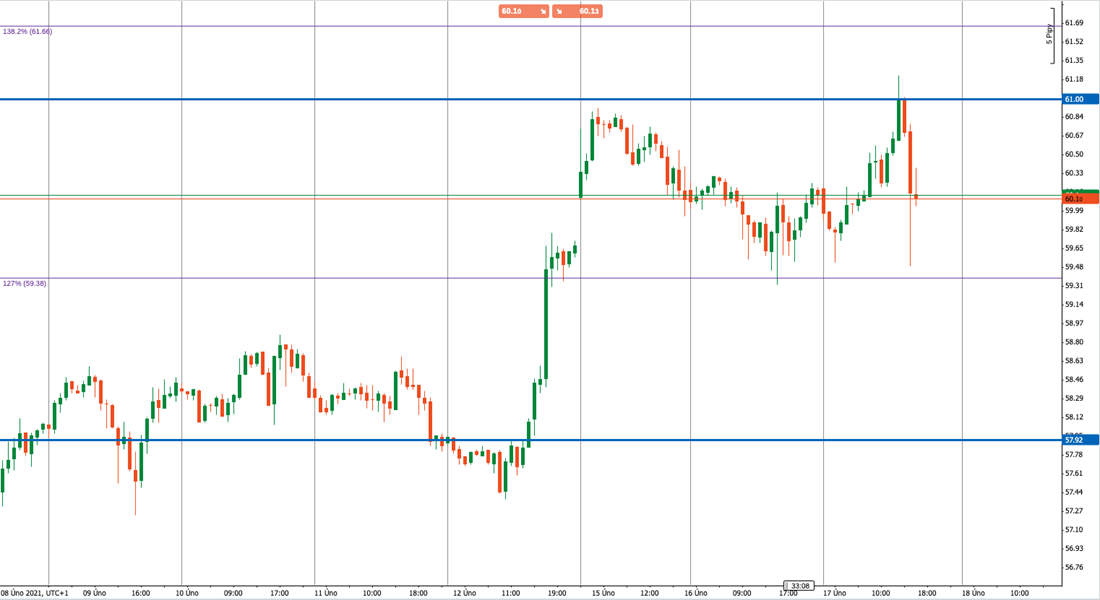

The short end of the stick now belongs to the oil supply. The OPEC + oil cartel agreed in January to extend production cuts, and Saudi Arabia promised a further reduction in production by another million barrels per day in February and March. With the current production outage in the US, which can last several days to several weeks, oil can very quickly get over $ 61 a barrel and maybe even higher. Oil exceeded $ 61 a barrel this afternoon, yet failed to make profits above that level. The situation on the supply side might show us the endgame in the form of lower oil supplies in the US. This would support the price of oil to a new high this year.

Chart: 1H graph of WTI oil