Commodity-linked currency

Since Australia is the largest coal and iron ore exporter, the movement of its currency is heavily dependent on commodity prices. That is why the performance of the Australian dollar is tied mainly to China, as China is of the largest importer of Australian commodities.

Traders watch the current economic cycle, how the world's (and especially China's) economy is doing, and at what stage of the commodity cycle are we in. The Aussie follows.

For example, if the world's economy rises at a solid pace, demand for iron ore picks up, and the Aussie usually strengthens. On the other hand, if the world's economy slumps, demand for commodities decreases, and so does the Australian dollar. To sum it up, the Australian dollar is one of the best known cyclical currencies.

Performance

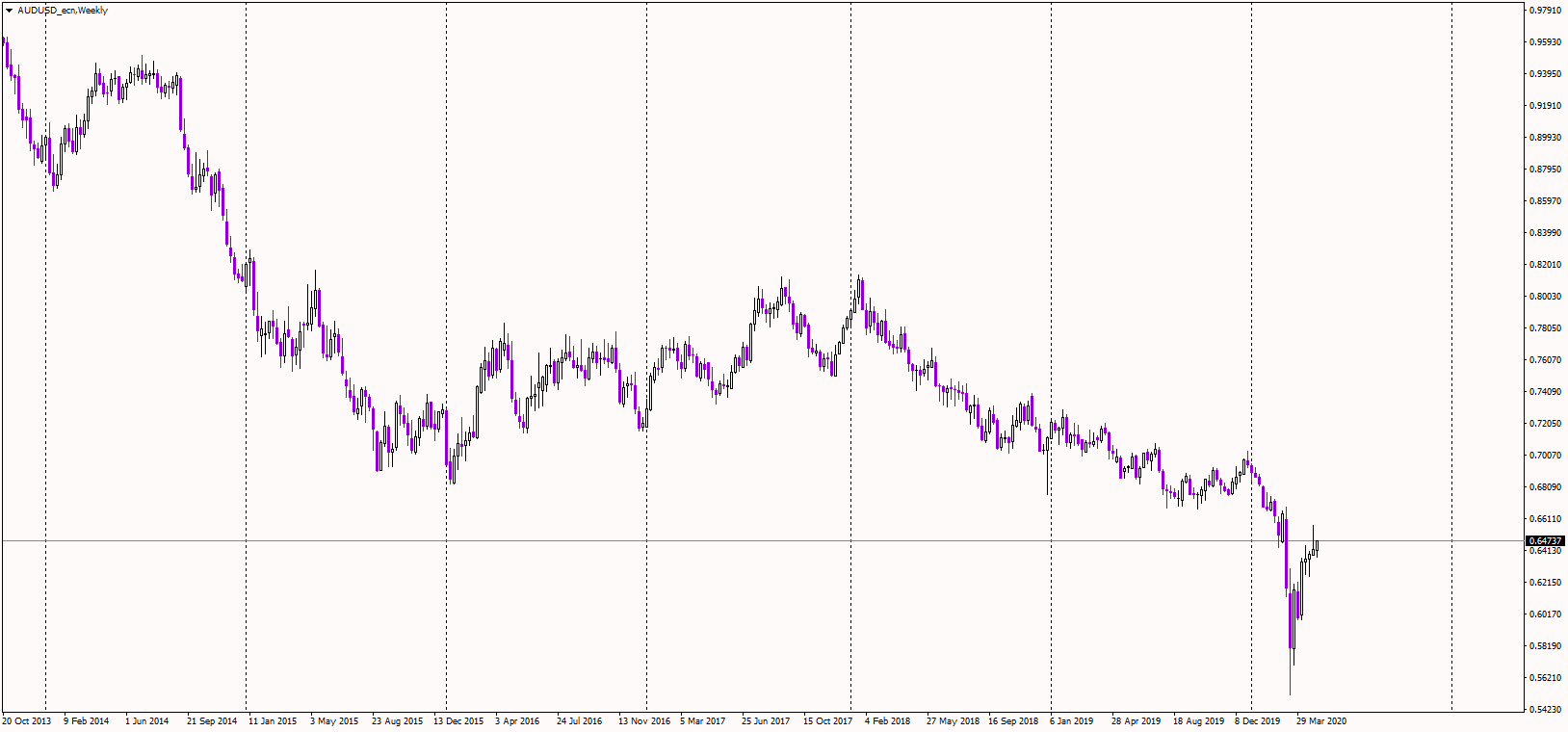

When we take a look at the history chart of the AUDUSD pair, there is an apparent bearish trend, starting in 2014. Back then, the Aussie was trading at around 0.95 against the US dollar, nearly reaching parity.

As the Fed raised rates, the interest rate differential evaporated from this pair, making the US dollar more attractive. Afterward, the global economy started to slow, which once again undermined the Australian dollar. In 2020, the sell-off began by the COVID 19 panic, and investors rushed into the greenback, as it is the safest currency in the world. In April 2020, the AUDUSD pair was seen hovering near the 0.60 handle, which is a 40% decline in 6 years, making it one of the best trending pairs in the world.

Source: Purple Trading Metatrader 4