Top events at financial market during Q3 2020

1. The split of Tesla and Apple shares drove the valuations too high

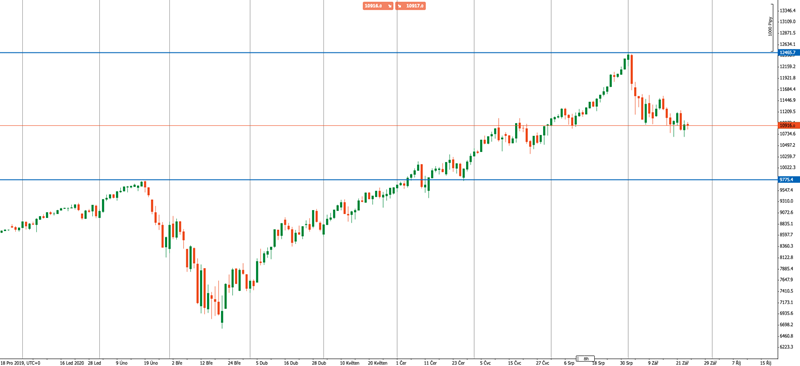

US stocks have experienced a quite wilder quarter, even though they have still moved in only one direction in recent months, determined by perhaps too much greed and confidence in the US Fed. The Fed has not yet backed down from its intention to support the economy at any cost, and it still supports the financial markets with the huge dose of liquidity, thus inflating the bubble. Even the big technology giants, for which the demand has been the greatest in the past, eventually managed to find their way to profits even in this difficult period, which only encouraged further interest of investors.

Some of the fastest growing companies even announced split shares, in response to their high valuation. Apple's 4: 1 split came first in August after the price of one share reached $ 400. Subsequent growth made no longer much sense, with the Apple stocks reaching over 20% in two weeks. Another interesting split was announced by the carmaker Tesla, 5: 1 at $ 2,000. Tesla shares made 80% after the split. The expected correction did not take long and the nervous sentiment about these stocks may actually persist until the November presidential election.

Chart: NASDAQ stock index

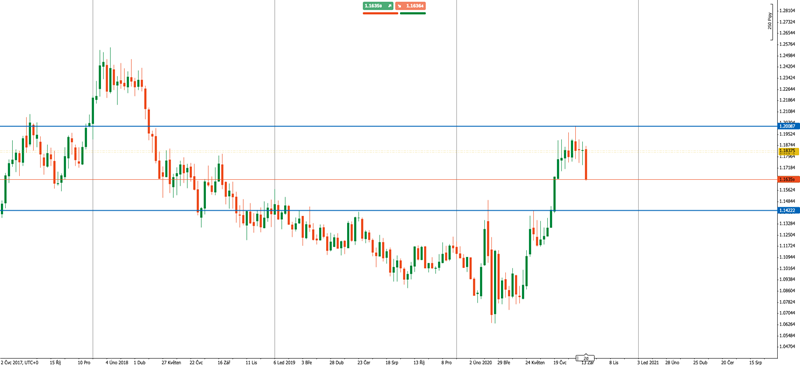

2. The dollar strikes back

The US dollar was losing its “safe haven” and “number one reserve” labels over the summer. The gradual conviction of investors that the dollar is losing its strength due to monetary stimuli and the continuing growth of risky stocks got the dollar to two-year lows. The weakening of the dollar was also partly due to declining yields on US government bonds. On the other hand, the weaker dollar helped the unprecedented growth of currencies such as the euro, the pound or the Australian dollar.

In September the dollar reminded itself again though, and it convinced investors that it should have a place in their portfolio, because it was the dollar where the money flowed after the stock indices began to correct their unsustainable valuations. At the end of September, the dollar is the strongest in 2 months and the continuing nervousness can push it even higher.

Chart: EURUSD weekly chart

3. The second wave of the pandemic threatens Europe

The second wave of the pandemic, which was to come with the autumn months, has been talked about since April. In the United States, the second wave arrived during the summer months already, due to higher testing. However, it did not appear in Europe until the arrival of September, when we can observe the breaking of records in numbers of infected in the Czech Republic, France, Britain and other countries. For the time being, governments are only introducing local restrictions on the movement and gatherings of people. However, the British Prime Minister Boris Johnson has already threatened to close the whole London if the situation worsens, which would be a huge intervention in the economic recovery. A similar trend can be observed in other countries if the situation worsens and there is no shortage of market volatility foreseen.

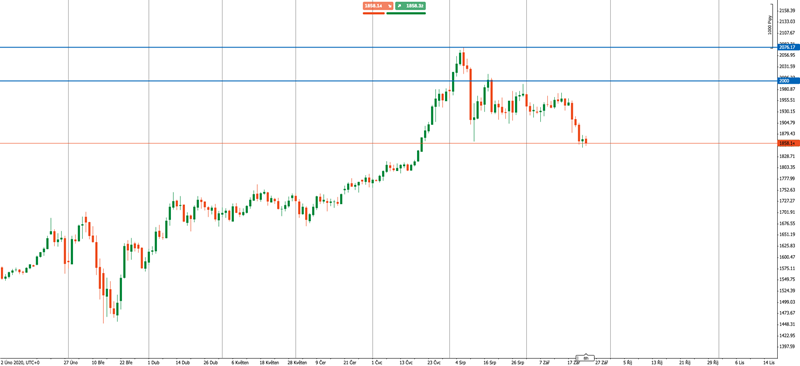

4. Gold sets a new record

A weaker US dollar, uncertainty about the future of inflation, a relentless drop in GDP, historically lowest interest rates, or record pace of money printing. This is the list of just a few factors that were behind the growth of gold above previous historical records. However, investors failed to keep the price of gold above $ 2,000, and we could see a quick return below $ 1,900 per troy ounce. The reason was the strengthening of the US dollar and the collection of profits, when gold set a new record. However, many investors still keep holding gold and the possibility of breaking the current highs is still possible. It would need the US dollar to play a major role, and it seems it will not weaken if the stock market situation continues to be nervous.

Chart: Gold

5. The Fed is changing the parameters of monetary policy

The US Fed remains its interest rates close to zero, and after deducting inflation, we can consider the real rates even negative. But the US economy needs such unprecedented monetary stimulus and especially the cheap credit, which gives it a chance to reach for a faster recovery. The bankers in the US Fed also know this very well and have devised a way to circumvent a possible faster increase in prices, to which they would have to respond by raising their rates. The bank will now target the "average inflation target" at 2%, which practically means that inflation can easily breach 2% and the Fed does not plan to intervene. Bad news for consumers, good news for stock investors, interest rates should remain at current levels until 2023.

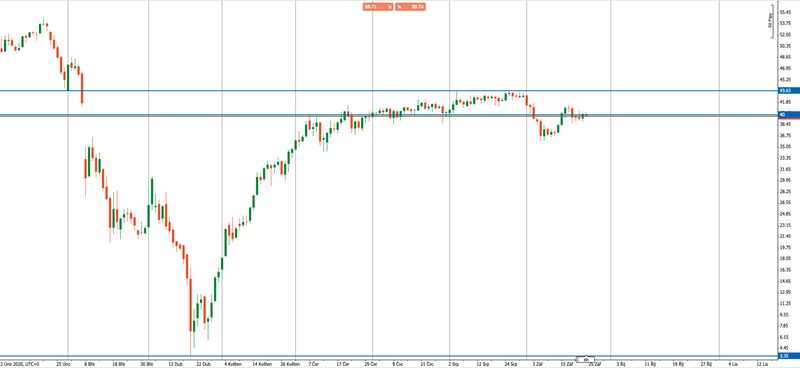

6. The oil fundamentals are weakening

Not much interesting has happened on the oil market over the summer, but it is not set for roses until the next few months. Fundamentally, the bulls have nothing to bounce back from, and the decline is hampered by massive production cuts by the OPEC cartel. The reason is the slowing resumption of demand for oil and its derivatives, which is again caused by the spread of coronavirus, or if you want by the government quarantine measures. Governments are restricting travel, closing borders, etc., and, for example, air transport is unlikely to help the oil demand much. Furthermore, companies start to recommend a “home office” to their employees, and some cities are closing schools again. All this has a huge impact on demand.

However, the offer is also not in very good condition. OPEC began to gradually reduce production cuts, and Iraq, for example, still failed to compensate for its previous violations of production quotas. Meanwhile, production from Libya is returning to the scene and the United States is also resuming production. American WTI oil will probably not peel off from $ 40 a barrel, and we will still refuel at gas stations for cheaper.

Chart: Daily WTI oil chart

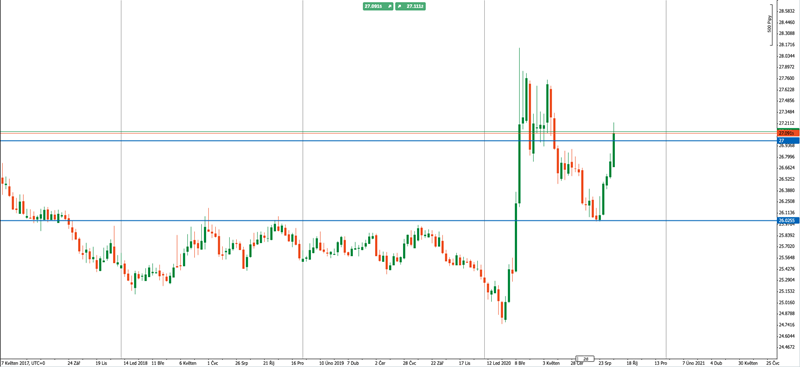

7. The Czech koruna weakens to 27 CZK / EUR

The koruna was very successful during the summer months and even wiped out all of its pandemic losses on the pair with the US dollar. On a pair with the euro, it strengthened to the level of 26 crowns / EUR, where a combination of technical resistance and the return of risk to the financial markets met. In the eyes of investors, the koruna is perceived as a riskier currency, which is why everyone started to get rid of it again and it subsequently weakened back above 27 CZK / EUR. The return of some restrictions on the economy in Czechia has not helped much either, and unemployment continues to rise. On the other hand, everything can be perceived as an opportunity, because the koruna is an interesting instrument that thrives in good times and the arrival of the vaccine together with the restart of the economy can bring the koruna closer to 26 CZK / EUR again.

Chart: EURCZK

You can read all the updates from the financial market in a special News section on our website. We are regularly preparing fresh articles, analysis and more.