Powell backed another weakening on the dollar

At the beginning of the week, the US dollar is currently deciding whether to side with the fundamentals, declining stock markets, or the comments of the FED governor, Jerome Powel. He reassured markets yesterday that higher rates were not on the agenda and delayed the possibility of ending quantitative easing. However, the dollar may still strengthen, as evidenced by the improving fundamentals in the US and still high yields on US bonds.

Powell confirmed that higher rates are not a threat

It was the faster growth in US bond yields, which reflected not only the worse situation on the bond market, but also expectations of a faster economic recovery and, above all, rising inflation, that convinced many investors that higher rates in the economy would not benefit stock markets much. Inflation expectations in the United States reached their highest levels since 2014 in January and February. This was achieved thanks to revenue growth from 30-year maturities to its highest levels in the past year. However, fears of faster inflation were eased by Jerome Powell yesterday before the US Senate. According to him, inflationary pressures have not yet materialized, and even if inflation rises above 2%, the Fed does not plan to raise rates. The Fed has therefore stopped focusing on inflation and is currently devoting all its attention to the labor market. There, it wants to use all possible tools to return employment to pre-pandemic levels. According to FED, the economic recovery is still not evenly distributed and complete.

Higher yields - a stronger dollar

Powel with his comments therefore singlehandedly added a bit of confidence to the stock markets while putting the US dollar under further pressure, showing investors that higher rates would not help its growth. However, the main discussion here is about short-term interbank rates, which the Fed sets. It is known that market rates in the economy partially affect government bond yields, which are at their highest levels in a year. However, bond yields are key to the US dollar, because the higher the yield they can offer, the more likely investors are to start withdrawing into bonds and the US dollar.

However, it depends on the context of other markets. If stock indices are all-time high and long-term yields are above 2%, many investors may begin to shift their attention toward bonds, where there is no risk of a major correction and where is, on the contrary, a promise of a stable yield. Moreover, these bonds are in US dollars, for which demand would, therefore, grow. This means that even though Powell has put the dollar under longer-term pressure, there would still be a certain degree of demand for the US currency.

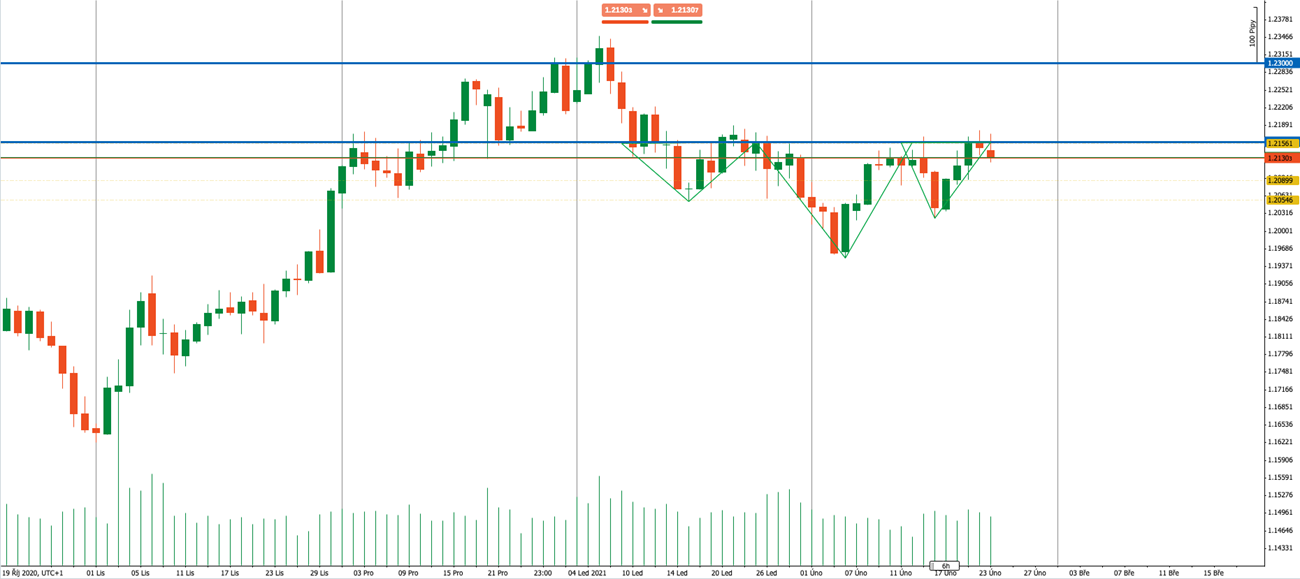

Chart: Daily chart of the EURUSD currency pair

The economy can save from the downturn

We must also not forget the foundation of the US economy, which will also be central to the development of the US dollar. So far, the data is clear. Retail sales in January grew by 5.3% compared to December which was the first growth since September last year. The PMI for the services sector rose to 58.7 points and unemployment is the lowest since the beginning of the pandemic. Economic data is thus clearly improving, and expectations of a $ 1.9 trillion fiscal package should give the economy an additional confidence boost.

So far, higher confidence in the markets could be seen through the gradual vaccination of the population. In the USA over 60 million people have already received at least the first dose of the vaccine. In itself, however, the economic recovery will be supported by tremendous stimuli. Even so, it should slow the US dollar from further weakening, but it is precisely those stimuli that will gradually devalue the dollar and bring it under pressure. This year, the outlook for the dollar will not change much. It should still weaken, but the pace of weakening should slow significantly compared to the last year and the dollar will have its bright moments.