The IEA lowers the outlook for demand in 2021

The price of American WTI oil managed to rise above $ 50 per barrel, a long unsurpassed milestone, especially for American producers. However, this was mainly due to an additional reduction in production from Saudi Arabia, meanwhile, demand still remains under pressure. The International Energy Agency (IEA) today published its estimate for the further development of demand and worsened it again compared to the last forecast. The price of oil remains above $ 52, but the bulls are starting to weaken.

Demand for oil will recover more slowly

Global oil demand will be lower than originally expected in 2021, the International Energy Agency (IEA) said on Tuesday that oil demand would be 600,000 barrels a day lower in the first quarter of 2021 than previously predicted, and for the whole year, it will be lower by 300,000 barrels, although it still expects a strong recovery in the second half of the year. According to the agency, it will take longer for oil demand to fully recover, mainly due to renewed restrictions in a number of countries, which is having an impact on fuel sales. The agency hopes for a faster recovery in demand after the gradual introduction of vaccines in the world.

Demand for a pandemic of 100 million barrels a day will not be reached until 2022, as in 2021 it should be around 96.6 million barrels. According to the agency, global oil reserves could also fall this year, but OPEC has been pumping less to the market since the beginning of the year than originally agreed, which will maintain higher reserves. It was the policy of the OPEC cartel that was marked by an increase in the price of WTI oil above $ 50 per barrel, but further growth above $ 55 failed to be established.

The reason will be mainly low demand from European countries and perhaps hastened price growth once it’s above the 50-point limit. Thus, the market can technically come for a correction in the order of several units of dollars, or move to the consolidation in which the current is located. According to the latest report from the IEA, it could easily take several weeks until the countries gradually begin to relax restrictions.

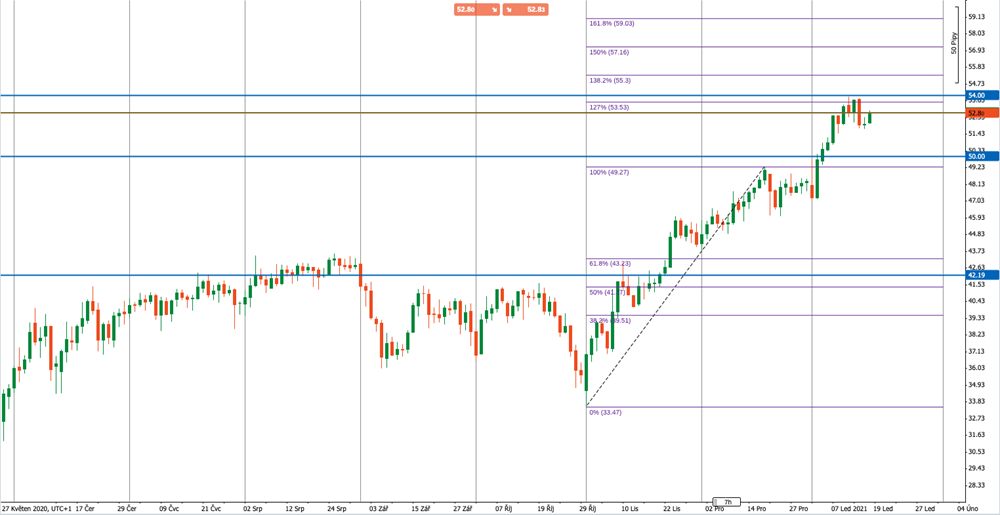

Chart: WTI Daily Oil Chart (Source: PurpleTrading)

Chart: WTI Daily Oil Chart (Source: PurpleTrading)