How did we come up with this data?

This comparison is based on publicly available data on the percentage of retail CFD accounts that were in loss and was collected within a one year span (between 1st October 2021 - 30th September 2022). Publishing of this data is mandatory for brokerage companies operating in the EU and they have to include them as a part of so-called "disclaimers". These can be found on all marketing materials (online banners, emails, ebooks), but also in the footer on their website. One of the subchapters of this article focuses on how and where to find this data.

What does ESMA request?

Online Forex trading has come a long way since its wild unregulated beginnings, and while unregulated brokerage firms or those that are less tightly regulated can still be found,

Forex traders of today can rely on a much greater degree of protection than their counterparts from the past.

The European Securities and Markets Authority (ESMA) provides guidelines to regulators, for example, the Cypriot CySEC, and thereafter each regulator provides guidelines and restrictions to regulated firms. EU regulations are considered to be one of the strictest, caring for the protection of clients (retail traders) and guaranteeing them a

high standard of security and transparency compared to other (for example, off-shore) regulators.

And it’s precisely the CySEC regulations that we, in Purple Trading, are obliged to follow.

How regulation protects traders:

For example CySEC (regulatory authority under which Purple Trading operates) requires a number of guarantees and client protection mechanisms from brokerage companies, below are some of the main ones.

Negative balance protection:

If a trader loses more money than he had in his trading account due to an accident, adverse market fluctuations, or leverage, he/she does not have to worry about possible debt. Thanks to the new guidelines,

retail traders cannot lose more money than they put into their account, if they get into the red, the debt incurred must be paid by the broker.

Segregation of client bank accounts:

In the early days of online Forex trading, we could often witness many fraudulent brokerage companies using their clients’ funds to enrich themselves or pay for operating expenses. Brokerage companies operating in the EU must therefore

deposit all client funds in bank accounts, segregated from the company's funds, and insured against bankruptcy. This way, traders have fewer things to worry about.

Disclosure of profitability of client accounts:

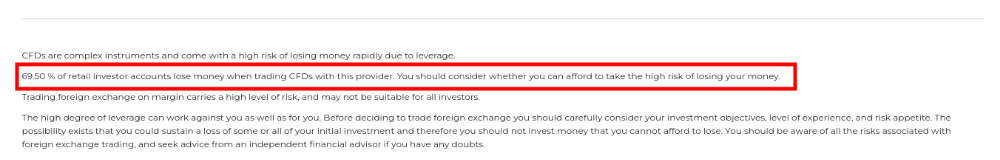

Every 3 months, brokerage companies must publish the profitability number of their clients' trading accounts. This is stated as a percentage and is placed in small print on each advertising banner, image, or other promotional material. You can also find it in the footer on the brokers' websites in the so-called "Disclaimer" (see picture).

Figure 1: Percentage of profitability of client accounts in the footer of Purple Trading websites

Figure 1: Percentage of profitability of client accounts in the footer of Purple Trading websites

Table comparing the profitability of clients of European brokers - how did we do?

Because the profitability of clients’ accounts is information that brokers are required to disclose publicly in the EU, we decided to venture to other broker’s websites in order to see how our competitors are doing. The result completely exceeded our expectations.

Table No.1: Comparison of the number of profitable client accounts of leading European brokers

*This number refers to CFD retail (client) accounts and is based on data for the period from 1st October 2021 to 30th September 2022)

|

BROKER

|

Number of profitable accounts of 2022*

|

|

30,50 % |

|

29 % |

|

27,28 % |

|

27 % |

|

25,72 % |

|

25 % |

|

24,8 % |

|

24,79 % |

|

23,73 % |

|

23,4 % |

|

23 % |

|

23 % |

|

22,26 % |

|

22,16 % |

|

21,21 % |

|

21 % |

|

21 % |

|

21 % |

|

19 % |

|

19 % |

|

19 % |

|

18,6 % |

|

17,94 % |

|

16,3 % |

|

12,64 % |

As you can see, Purple Trading is among the absolute top with more than 32,7% of client accounts ending up in profit. Which leaves behind a large part of the competition. To some, however, a third of profitable clients may seem like a low number. However, we must take this number in the overall context of the Forex industry.

Why a third of profitable clients are such a success?

It should be noted that Forex trading is one of the most challenging disciplines and as such has a very steep learning curve. In particular, beginning traders must initially go through a number of educational materials if they want to make money in this discipline. And even then, the task of the most difficult remains ahead of them - to deal with themselves and set strict rules of risk management and thus avoid the psychological pitfalls of trading.

What could be the secret behind the profitability of our clients?

Emphasis on education

Not only for our clients but for the entire trading public, we organize regular webinars, publish educational ebooks, and compile daily news from the markets. An informed trader is a successful trader. In addition, all webinars, ebooks, articles, and videos are

completely free, so why not learn something?

Ability to respond immediately to trading opportunities

Thanks to LD4 Equinix servers in London, our traders can count on lightning-fast executions and thus adequately respond to trading opportunities. In addition, add the possibility of immediate bank payments (within the Czech Republic, completely free of charge), which will allow you to send money to a trading account on a weekday morning and start trading with them the same day, and you have a clear idea of what it means to be able to respond to business opportunities.

Access to fresh information + quality business infrastructure = the key to success

Our traders have become accustomed to the fact that the information we serve them through regular articles or webinars and videos has the opportunity to trade on the markets that day. Which is perhaps one of the reasons why they are

one of the most profitable in Europe. If you also want to start trading with a fair Forex broker who takes his clients seriously and provides them with all the means to be truly profitable, Purple Trading is here for you.

Become part of one of the most profitable trading communities in Europe